Trump win, How a 33 Year Old Mechanic from Montreal executed a BRRRR in Memphis, TN

Trump election win, implications on investing in Canada and US, proud dad moment, how a mechanic from Montreal bought a BRRRR: buy, renovate, rent, refinance, repeat property in Memphis, Tennessee from home. All this and more and the truth about real estate investing!

As always, I won’t comment on politics because like arguments, there are no 100% winners because even if you win an argument or who you voted for wins, you have likely damaged the relationships with the person you’re arguing with or those who voted for the other party.

While I do believe both Trump and Harris had positives to their policies, both have negatives and I feel really sorry for those who feel really hurt by the election outcome.

Where I do choose to focus my attention and energy is on how I may help my community of Canadian real estate investors and many have asked my opinion on the election results and their implications on Canadians investing in the USA.

The overall investment landscape for the Canadian, everyday real estate investor has not changed. The US economy is the envy of the world in it’s productivity and growth. If anything, that will accelerate under a business friendly environment vs raising taxes as the Democrats promised.

We at SHARE, the easiest way to build a portfolio of fully managed US rental properties focus on business and landlord friendly States, some of them were Democrat and have flipped to Republican so our investments should perform even better.

Trump has promised to bring back to America even more jobs and manufacturing by applying tariffs to imports which will only increase demand for our rental properties already located near domestic manufacturing.

For example, SHARE recently expanded to North Carolina, specifically Greensboro where Toyota is investing a historic $13.9 billion to create 5,000 manufacturing jobs, the first ever Toyota battery plant in America for hybrids and EVs. One of the biggest if not the biggest investments in North Carolina’s state history.

The deal? A seller leaseback deal as in the seller will stay to rent the property so no upfront vacancy and the investor can defer some initial renovations while locking in today’s price, a win since the market is expected to go up with further interest rate cuts expected. The investment property is a single family, detached house: 4 bedrooms, 2.5 bath, 2,300 sq.ft, built in 2012 for $252,000. Expected renovations $38,000, projected rent $2,190 plus utilities. Estimated annual appreciation 4% and 5.6% cap rate plus all the benefits of landlord friendly rules and regulations: no rent control, non-paying tenants can be evicted in 30-60 days.

For full property details go to iwin.sharesfr.com. In my 20 year experience of being a landlord, I do believe it is in every Canadians best interest to be real estate investor and diversify to the USA for all the cash flow and landlord friendly benefits. SHARE deals to me should be every Canadians’ baseline to compare their future investments against.

Whoever decides to own this deal in North Carolina is likely a winner based on a Trump victory.

Unfortunately a Trump government is not good for the Canadian economy or dollar but we will fare better than Europe, Mexico, China, basically the rest of the world since we’re already major trading partners.

For the Canadian real estate investor, yes the decline of the Canadian dollar hurts but again, we’re investing in red Republican states, our mortgages and rents are in US dollars and earning US$ cash flow, when cash flow is non-existent in Canada still makes a US investment better than a Canadian investment.

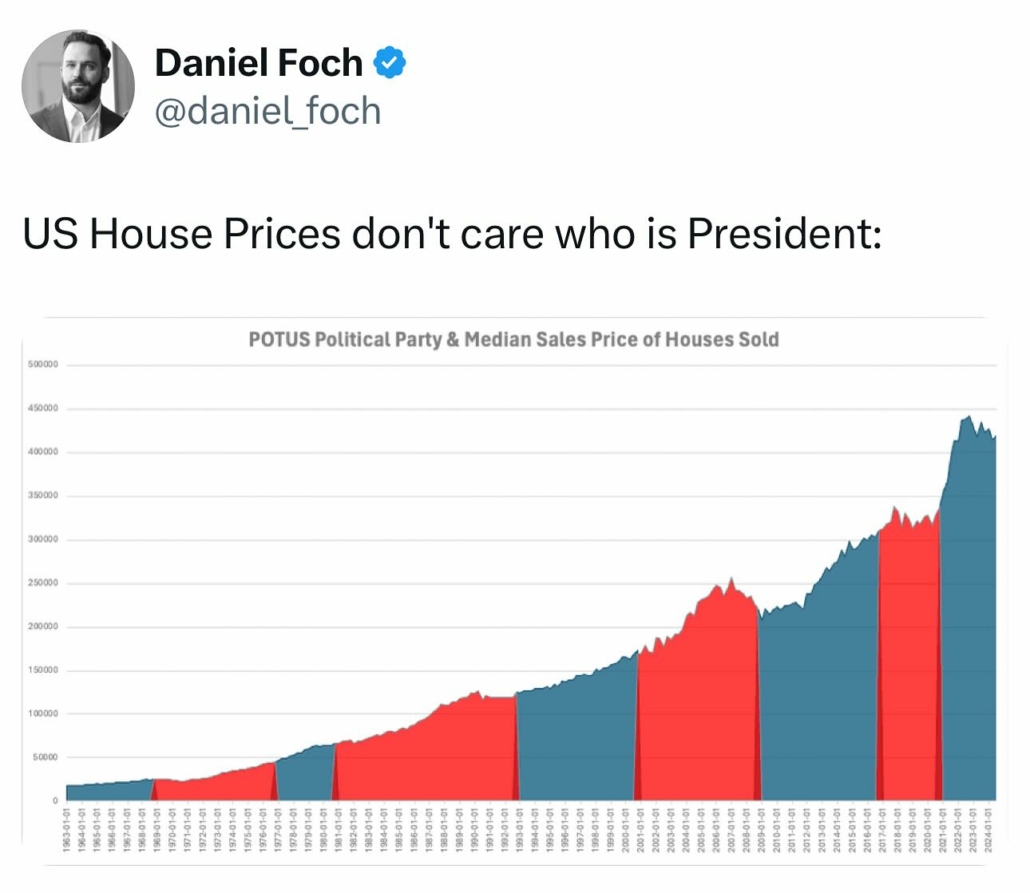

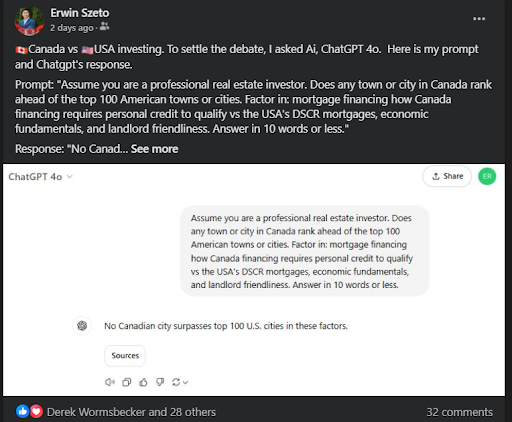

Please don’t take my word for it. Do your own research. Here is a nice summary of my research using the latest version of ChatGPT:

I asked Google’s Gemini as well and they’re pro Democrat:

If you’re interested in learning more about US investing and where to get started, I’m offering a free training, hybrid format for the first time as in we’ll have folks here in my office in person and online via Zoom Webinar in the evening of Thursday Nov 28th, doors at 7:30pm for refreshments and networking, my presentation begins at 8pm.

As always I believe in giving value and investment education should be as accessible as possible so again this event is FREE and accessible in person or online. Every attendee will have factual, tangible, actionable information and takeaways like every episode of this show.

There’s nothing I enjoy better than helping out the underdog become rich. Helping rich people get richer is great too but helping young, lower or middle class, hard working people who aren’t rich yet, that’s what gets me out of bed.

Along with sticking it to the governments here in Canada who don’t want us here. How better to send a message that we landlords won’t take it anymore than to exit and pay less tax to our municipal, provincial and federal governments who’ve all made it known that we’re not wanted here.

Just look at New Brunswick who sent their Conservative Government walking after six balanced budgets to be replaced by a Liberal Government who will implement rent control of 3% next year. We in Ontario haven’t had a balanced budget since 2018 and are projecting $419.7 billion. We are one of the most indebted subnations in the world.

If you want to get in life, real estate investing is the way to go and on Nov 28th, I’ll be teaching How Canadians Can Leverage U.S. Real Estate for Passive, Scalable, and Tax-Efficient Income Streams

This is not selling coaching, mentorship, courses, joint ventures, OPM, creating a 2nd job for yourself and taking time away from your family nor is it getting rich quick. In my experience, this is about getting rich slowly with as high a probability of success as passively as possible. I’ve helped over 45 of my clients make a million or more investing in real estate and can’t wait to help even more Canadians from all over Canada do the same.

I hope to see you there!

Please allow me a proud parent moment I’d like to share with you my 17 listeners. Cherry and I invest heavily into our kids to ensure they’re happy, well rounded and prepared for the real world. They work hard and my son’s standardised tests came back and like his older sister, he scored 99th percentile and will be tested to see if he’s gifted like his older sister. Something extremely rare.

I know many see how Cherry and I raise our kids is not normal but these results give me great joy and vindication that our parenting is working and we’re not going to rest on our laurels. We teach our kids everyday that hard work trumps talent when talent doesn’t work hard and will continue to do so.

My fellow parents know and for those who don’t yet have kids, I don’t know what it is but my kids have bought me more joy than anything else in life and I’d like to keep that going which I can by pacifying my real estate portfolio. By investing in better cash flowing properties in the USA, I can afford quality property management vs. its waaaaaay more challenging in Canada.

A long long time client of mine shared with me she called the cops on her property manager in small town Canada who is ghosting her and they have her rent money. Yes cap rates are higher in small, tertiary and beyond towns but find quality property management and trades is way harder than major centres.

Enough about me on this week’s show!!

Trump win, How a 33 Year Old Mechanic from Montreal executed a BRRRR in Memphis, TN

This week we have an everyday, blue collar Canadian, 33 year old Shayne from Montreal who just bought his first investment property and he has executed a BRRRR in suburban Memphis, Tennessee. The ARV is substantially higher than projected, rent came in almost 10% higher.

Shayne is the youngest client of mine by far for years and years so I’m of course excited to have been part of Shayne’s journey to become a successful investor and mentor him in scaling up to not just have a large portfolio but for financial peace of mind.

This is his story, if you enjoy the show, please share this episode with your fellow Canadians who want to invest in real estate, especially those who can’t afford to get into the Canadian market or want diversification. Please enjoy the show.

To Listen:

** Transcript Auto-Generated**

(00:00) a trump election win implications on investing in Canada and the US proud dad moment how a mechanic from Montreal 30 years 33 years old bought a burr buy renovate rent refinance repeat property in Memphis Tennessee from a home all list and more on this week’s truth about real estate investing show how are y’all this is Win CTO here your H podcast host and producer since 2016 there’s been over 300 past episodes of the show and you wouldn’t believe it my gu today’s guest has listened to every one of those episodes um anyways uh uh as always I

(00:36) won’t comment on politics because uh I believe politics talking about politics are like arguments there are no 100% winners because even if you win an argument or who you voted for wins you have likely damaged the relationship with a person you’re arguing with or those who voted for the other party while I do believe both Trump and Harris had positives in their policies both had absolute negatives and I feel really sorry for those who feel hurt by the by the election outcome uh where I do choose to focus my attention to energy

(01:07) is how I may help my community of Canadian Real Estate Investors uh including especially my clients and how uh and many have asked me my opinion onction on the election results and there of course implications on Canadians investing in the USA the overall investment landscape for for the Canadian everyday real estate invester has not changed the US economy is the Envy in of the world in its productivity and growth if anything that will accelerate under a business friendly environment versus the raising taxes policy that was heavily

(01:37) featured heavily in the Democrats uh election promises uh we yet share uh the easiest way to build a portfolio of fully managed us rental properties we focus on business and landl friendly States so those are generally red States some of them are actually under Democratic control and actually uh they’ve all pretty much all flipped uh there are yeah uh there’s a lot more of them that are now red States um so some were borderline now they’ve actually gone more red more Republican so our investments should actually

(02:10) perform better uh Trump has promised to bring back uh to America even more jobs in manufacturing by applying tariffs to Imports which will only see increased demand uh for our rental properties already that are already located near domestic manufacturing uh because they’re in business in landl Friendly states which is pretty much where all the manufacturing all the growth of manufacturing new investment exists for example share recently expanded to a GE geography to North Carolina specifically a deal in Greensborough North Carolina

(02:42) where Toyota is investing a historic $ 13.9 billion to create 5,000 manufacturing jobs this is the world’s largest automotive manufacturer the first ever Toyota battery plant in America for hybrids and eeve this is the first ever for Toyota so again this is one of the biggest if not the biggest investment in North Carolina state’s history now speaking to the real estate deal this is a seller leas back deal as in the seller will not well sorry the seller will be staying to rent the property so for the landlord there’s no

(03:14) upfront vacancy uh and the investor can defer some of the initial renov Renovations while locking in today’s price a when since the market is expected to go up as interest rates are expected to be cut further and possibly more accelerated under this new government regime uh the investment property is a single family detached house four bedroom 2 and a half bathroom it’s over 2300 square ft built in 2012 for $252,000 I haven’t done the math yet so I’m actually going to break open my calculator is I use calculators because

(03:47) I’m not that good at math so that’s $252,000 divided by 23 uh 2,349 ft that’s $17 per square foot for a house that comes with land yes that’s American dollars uh now there are expected Renovations of $38,000 this is a bur project the projected rent is 2,190 plus utilities estimated appreciation on this property now I don’t know why people say this but one of the objections I always hear about America is that there’s no appreciation well again this properties located in somewhere business friendly landlord friendly with historic amounts of

(04:29) investment going nearby to createit 5,000 new manufacturing jobs so the estimated appreciation for this property is 4% and if for those who know cap rates so those who are at least an intermediate level of real estate investor you know what a cap rate is the uh net operating income divided by the price of the property plus capex 5.

(04:52) 6% now find me something like this 5.6% with uh with all the benefits of being in a landlord friendly area so that so landlord friendly rules and regulations rank control where non-paying tenants can be evicted in 30 to 60 days find me that in Canada right and also we got appreciation and upside uh so I got the full details in in the show notes uh and if you’re interested in seeing the numbers on this deal just simply go to I win.

(05:20) Shar sfr.fr dcom in my 20-year experience of being a landlord I do believe it is in every Canadian’s best interest to be a real estate investor first of all because it’s uh I’ve never seen uh so many people who weren’t Rich become rich in in this asset class in any asset class other than real estate at the same rate of success and to diversify to the us as uh as because there’s cash flow and landl friendly benefits uh shared deals to me should be every Canadian’s Baseline to compare against their future Investments whoever to whoever owns this

(05:55) property in North Carolina is likely to be a winner and again um that only improves with a trump Victory again it’s not an endorsement of President Trump it’s this is just what this again I’m just talking about implications to Real Estate Investors uh unfortunately a trump government is not good for the Canadian economy uh I know somebody disagree with that if you want to disagree like go ahead go argue with the uh the way that that our Canadian dollar is going right now uh but fortunately for us our dollar is fairing better than

(06:26) than the Euro so um we’re doing better than Mexico China uh basically rest basically better we’re doing better than the rest of the world since we’re already major trading partners and we’re so intertwined with the Americans uh for the Canadian real estate investor um yes the decline in the Canadian dollar hurts but again we’re investing in red Republican states our mortgages and rents and expenses uh our cash flow are on all US dollars so again earning US dollar cash flow beats not earning cash flow which is common

(06:59) for Canan investors Canan local Canadian real local Canadians investing in local real estate uh or significant negative cash flow and uh still a US investment property is better than a Canadian investment property please don’t take my word for it do your own research I’ve actually included a nice summary of mine research using the latest version of chat gbt 4.

(07:26) 0 whatever that letter is anyways I have a screen capture of it in my um in my show notes and I posted it on my Facebook I simply asked chat jbt assume you are a real estate professional um does any town or city in Canada rank ahead of the top 100 American towns or cities factor in mortgage financing how Canadians have to have to personally qualify versus Americans they use debt service coverage ratio mortgages include economic fundamentals and landlord friendliness because AI can be a bit a little bit verbose I asked it to answer in 10 words or less

(08:00) chat gbt’s response no Canadian city surpasses the top 100 US cities in these factors can we can we can we stop the debate now I asked Google’s Gemini uh as well for those who know and follow uh Google was a was a major donor of the Democrats anyways so I asked the exact same question of Google’s chat gbt sorry Google’s Gemini hopefully Google didn’t hear that get mad at me anyways uh so Google Gemini’s response no Canadian C cities generally lag behind top US cities and investment potential so again can we end the debate

(08:42) which is a better investment USA versus Canadian real estate now if you’re interested in learning more about us investing and where to get started I’m offering a free training hybrid format for the first time ever as in we’ll have folks here in person in my office we only have room for about 40 people 20 40 people in person and we’re in Oakville and also will be online uh via Zoom webinar the evening of Thursday November 28th doors at 7:30 uh and for refreshments and networking and my presentation will begin at 800m sharp

(09:13) this will last for probably just over an hour um I’ll probably present for about 1550 minutes and then take questions for 10 20 minutes uh networking will likely continue on in person afterwards as always I believe in giving value and investment education uh because the world needs more of it um and I believe investment education should be as accessible as possible hence this event is free and accessible in person or online so if you can’t be here in person obviously in person is better uh because you’ll be able to speak to me in person

(09:42) live uh and again but if you’re not close by or your schedule doesn’t permit we’re available online so if you have internet you can join uh every 10d will have factual tangible actionable information and takeaways like every episode of the show uh but obviously obviously we’re going to get a lot more more specific there’s nothing that I enjoy better than helping out the underdog become rich helping rich people get richer is great I love my rich clients they do a lot more volume and they’re easy to work with but helping

(10:14) young lower or middle class hardworking people who aren’t yet Rich become rich that’s honestly what gets me out of bed along with sticking to the government here in Canada uh because they’ve honestly they’ve honestly been pretty rude to us uh they’ve been let it pretty known they’ve let it be pretty well known they don’t want us here and how better way than to send a message that we landlords won’t take it anymore than to exit here in Canada and pay less tax to our Municipal provincial and federal governments who’ve made it again they’ve

(10:43) made it all known they don’t want us here at least in my experience in the markets that I operate in now uh just look at New Brunswick they just had a provincial election I generally don’t follow provincial politics uh outside of Ontario uh but they just sent their conservative government walking after six balance budgets out of eight they’re being replaced by liberal government who will be implementing rent control of 3% next year uh apologies to the new to all those who ran up to new Bruns recently for in Chase of cash flow uh we in

(11:15) Ontario haven’t had a balanced budget since 2018 and we’re projecting a a debt of in the world in Ontario again if you want to get ahead in life real estate investing is still the way to go and on November 28th I’ll be teaching Canadians how to leverage us real estate investing for Passive scalable and tax efficient income streams again this will be highly tactical uh it won’t be that funny I’m not it won’t be emotional we won’t talk about like how to 10x whatever in your life or setting goal setting we’re going

(11:53) to talk about hard facts this is not selling coaching mentorship courses joint ventures raising other people’s money or creating a second job for yourself and taking time away from your family nor is this getting rich quick and my experience this is about getting rich slowly with the highest probability of success as possible and passively as possible I’ve helped over 45 clients of mine already make a million more investing in real estate and can’t wait to help even more Canadians especially from canans all over the world

(12:23) previously all pretty much all my clients are from the GTA so I’m really excited to be able to help out more Canadians uh link to register is in the show notes so and I hope to see you there um now please allow me a proud parent moment as i’ like to share with you my 17 listeners uh who I consider my friends and again every time if each of you see me in public and say hello um it’s it’s an honor it is an honor to meet you all and it’s an honor that you’re listening to the show um Cherry I uh you probably all know uh we invest heavily into our

(12:55) kids both our time and money and time uh to to ensure that they’re happy well-rounded and prepared for the real world uh they work hard and my son’s uh standardized test came just came back and like his older sister he scored in the 99th percentile and so he’s going to be tested to see if he’s gft gifted like his older sister is uh now already the test results are extremely rare and to have two gifted children which is not confirmed yet but if we do this is something extremely rare um I know many people uh see how cherry and I

(13:30) raise our kids and and think it’s not normal uh but these results give me great joy and Vindication that our parenting is working uh but we’re not resting on our Laurels and we’re not letting our kids Le rest on their Laurels either we teach our kids every day that hard work Trump’s Talent when talent doesn’t work hard and we’ll continue to do so uh my fellow parents know uh and for those who don’t have kids yet this is my experience um but I don’t know what it is but kids the kids have brought me more joy than anything

(13:59) else in life and I like to keep that going uh which is why I don’t want my real estate to take more time time of my own away from from them from them because selfishly I enjoy being around them hence uh my efforts to pacify my real estate portfolio by selling off close to half of it half of our local local real estate uh portfolio here in Southwestern Ontario and trading it for um honestly better cash flow properties in the states uh where I can afford quality High quality institutional grade Property Management versus it’s way more

(14:33) challenging to cash flow here locally uh and the reality is uh way more Canan investors are their own property managers and they even do their own bookkeeping which is something I don’t want to do in the states uh a long long time client of mine just shared with me last week that she has called the cops on her property manager in small town Canada the property manager is ghosting her and they have her rent money uh so my point is yes cap rates yields cash flow they are better and higher and small in in small town Canada uh but to

(15:06) find Quality Property Management And Trades is way harder than major centers so if things go sideways and the property is far from you I I I I feel bad for these investors but enough about me on to this week’s show this week we have an everyday blue collor Canadian real estate investor He’s 33 years old his name is Shane he’s from Montreal Quebec Canada and he just bought his first investment property and he’s executed beautifully on a burr in Suburban Memphis Tennessee without leaving home the arv the after repair

(15:40) value is substantially higher than projected and the rent came in almost 10% higher than projected as well so his numbers are phenomenal he’s actually he’s actually uh for those who know cap rates he’s a 7.9 on a single family home single family detached home uh Shane is the youngest client of mine by far for for the past years I don’t know how long I have to go back to find a client of this age and I cannot wait to have even younger clients um so I’m personally excited to be part of Shane’s journey to become a successful investor and for him

(16:12) to become a successful investor and to Mentor him in scaling up not just so that he has a large portfolio but to have Financial Peace of Mind this is his story uh again uh Shane’s listened to all 350 episodes or so of the show and if you do enjoy the show like Shane did and would like to you know see more your friends fellow Canadians who who want to invest in real estate be successful like Shane especially those who can’t afford to get into the Canadian Market or want diversification please share this show

(16:41) with them and uh please enjoy the [Music] show hi Shan what’s keeping you busy these days uh the usual you know um usual day today now I’m getting prepared for the winter so Riz the house and stuff like that but just your average Joe stuff you know yeah so for the for context for listener you are an average everyday investor is that fair yeah that’s correct on the younger side especially for canadi you’re on the definitely on the younger site um so Shane I didn’t know until until we got on this call so you’ve apparently

(17:24) you’ve listened to every episode of this podcast yes I I know that might sound crazy but like yeah so this so how it went down is I uh got introduced I was looking doing some research right and how I can invest um in Canada how I can build up wealth and stuff like that and then I looked into towards the real estate aspect right so I’m like thinking okay what are the tax implications right so I stumbled on your wife’s uh YouTube channel and then you came along on whenever ch one of their episodes right so oh this is interesting guy you know

(18:03) and then after I I found out he had a podcast I I started to be really interested in podcast so on my daily drives I would listen to your podcast but like your pocket was so Advanced that I couldn’t start it in the middle right I so in my head I was like let me start at the beginning maybe there there’s some gems I could catch up on and then yeah that’s how I stumble on some other of your co-workers or F so that’s well over 300 hours of content yeah yeah you got a lot of time but to you know when you’re driving back

(18:40) and forth from work and it’s like 30 40 minutes so that’s almost a podcast right there you know uh so Shane um as I mentioned again for the context with listener you are uh my first Canadian uh client to invest with share uh and purchase of property in the states and just to shake things up as well I’ve had I’ve had requests from listeners to have an everyday person on the show because we do you know you’ve listened to the show we’ve had some like serious Heavy Hitters on the show oh yeah folks doing like hot building

(19:09) high-rise buildings or you know uh folks with like a hundred Airbnb Properties or 50 Airbnb properties right this massive scale um but but you are young can you share how old you how old you are yeah so I’m 33 right now actually yeah 33 uh start starting to feel the AES Cains but uh you know but that’s I guess that’s T somewhat with my job and uh this life in general I guess wait till you’re my age so uh what what sparked your interest in in real estate investing yeah so um look I was listening to a lot of people’s like

(19:50) podcasts or like audio books or whatever and a lot of them started like um well the first they make the first Millions through real estate right so that’s where really spark my interest and then okay I was like okay let me look at the Canadian Market try to understand try to make see if the numbers make sense right and as as it was going on I’m like wow uh it’s really difficult to make you know either Break Even or make just a little bit of profit cash flow you know then so I had to find different ways a different way to make that drun happen

(20:30) and then uh what what made you decide on buying in the US and that’s and that’s your first investment property right the your yeah so states exactly so this is my first purchase my my personal purchase but um my mother right um I technically I I lived in the states briefly when I was a young kid so um Florida Florida was the main State I lived in um my mom uh purchased a property there in like 2008 2009 at the crash so she got a really good deal in Florida right and so I understand a bit of the market and understand that it’s

(21:11) cheaper cheaper entry level right so when I stumbl on your podcast with Andrew Kim and them I was like oh yeah this is great so I already know the prices compared to Canada it’s cheaper it’s just that like how can I do it pH like not can’t do it physically but how try to get in there and have someone manage it and uh look after it for me so so definitely it shook my Intrigue it was intriguing for me how much research did you do besides listening to over 300 hours of my podcast um it’s hard to say I do I do like randomly maybe I’m just like if I

(21:52) have some extra time is Rite on Google try to make the numbers work um you know um it’s hard to say but I would say quite a bit um right but like like I said uh share made it made more simple for me to uh to uh proceed what did the deals look like locally so local to you is Montreal K back yeah so Montreal yeah so depends um in Montreal there it’s it’s coming up in prices so like for example if you’re looking for uh let’s say a duplex and stuff like that we’re talking about now currently now we’re talking about $800 to maybe a

(22:33) million dollars now uh for a duplex um that’s a lot that’s that’s more than yeah now now yeah now it’s caught up like crazy before you used to be more affordable maybe I I would say back in 2011 you could get like a duplex triplex in the 500s and you can make it work right but um yeah everything skyrocketed with the you know the co and all that the interest rate being low a lot of people um felt like they had more purchasing power so definitely uh shot up the prices right how much would a do do you know how much a duplex would rent

(23:14) for that that sells for oh great question yeah so I would say a duplex currently now you could probably get uh maybe 1,800 to maybe 2200 deping on the side yeah depending on the size yeah that’s not very good yeah it depends it really depend also the location probably would also be a factor right so yeah it’s it’s kind of tough and as you know yourself at the increases annually it’s not that great as well so oh what’s your um you’re limited in your increases yeah definitely so uh increase I believe it’s like 3% 5% or something

(23:59) like that 5% so it’s not that great is it really oh I had no idea honestly our conservative government proudly announces that the that at 2.5 rent rent increase allowed in Ontario is the lowest across Ontario Oh my God so I’m just Google R oh Google rent Quebec rent increase oh gee you can read French right yeah yeah yeah speak friends yeah hang on I’m trying to find it no problem 4% 4% is the suggestion from tribunal administer lalal yeah 4% that’s that beats the pants off a two and a half yeah now you bought in Memphis Tennessee

(24:56) so what’s what’s the What’s the allowable renting increase in Tennessee uh up up to your discre basically you you’re not really not really capped right wherever makes sense right so that’s that’s amazing so it makes sense how he chose Tennessee so why why did you choose Memphis Tennessee the location of your first investment property um we did just a bunch of research and stuff of that and uh as you know share has different categories of of like properties right so for my first one I want to just try out and get more

(25:32) cash flow so that’s like a SE type property so what we did is we just did a global search and we found an off Market deal that matched Aline with M my cres and uh it happened to be Memphis Tennessee uh which is pretty cool because I’m a basketball fan I’m a fan of Memphis uh Grizzlies so I’m like why not man that that’s a perfect place why not let’s start there uh so your your your property is on the company website oh fantastic I think you know that right oh it’s hard to including the address do you mind to share it yeah sure no

(26:14) problem I’m literally so for folks who are watching on on YouTube I’m literally showing it on the screen now now what was the pro what was the process like so uh how are you inform how you informed that this property was available for for purchase by you yeah so basically I was going back and forth with tmri um he he was like looking through my crer and whatnot and this uh this property actually was uh off market so uh so off Market at I believe the price was 90k which is fantastic you know fantastic deal so I’m like okay yeah let’s let’s

(26:54) do that and uh all in all with titles and fees and all that stuff it came up to 105 said and done and then uh we decided to do some renovations to Spruce it up a little bit and then put it back on the market yeah so like you’re handy U because you are a mechanic by trade so are you flying down there to do the renovations no no no sir no yeah they all took care for me everything was in a detail list um some stuff that we didn’t have to do right away so that’s why the renovation costs were lower than expect but um yeah everything turned out pretty

(27:36) well it didn’t take that too long it took maybe within a month or two everything was ready to go what was the scope of the renovation yeah so Bas yeah basically um like painting cabinets uh fixing like mailboxes um dry F cracks filling the cracks minor stuff like cosme stuff like that okay and then what was the budget for that yeah originally the budget was we were spending about 12K 15K but in the end we we only spend about $9,000 which is fantastic I think you can do that over here in can for that yeah because on the productive Financial it

(28:18) was actually 25 is there is there more Renovations planned after the tenant moves out for example or probably yeah probably in theut or was it just conservative estimate well maybe in future we’ll do some stuff to uh to to update it uplift it even more but yeah I’m pretty sure that those numbers were conservative um just in case any major um you find anything major you know once you open a wall or once you do something you never know right so you need 105,000 to close because you yeah that’s not including a That’s not including a

(28:55) mortgage uh 9,000 for your renovation and then the projected rent was originally 1,00 I believe yeah so the so that was the projected rent but uh we have fantastic uh management so we actually got additional $100 on the rent which is fantastic right so I was happy about that happy to hear that so all in the house was 105,000 including closing costs plus another of $9,000 for renovation so gee my my math is really bad 114,000 yeah yeah 114,000 yeah 114,000 uh is includes your closing costs and your capital expenditure with

(29:36) your renovation and your rent is 1,200 a month correct right so how you feeling I’m pretty ecstatic man really happy feel blessed man your cash flow is very significant then especially for for 114,000 investment yeah I surprised I was not expecting that but hey I’m not going to complain and and now what’s the plan now post renovation you have the tenant what’s the plan now yeah so um we’re looking to refinance right uh well some of the equity in the house and then move on to another potential property um hopefully maybe in the b b type class to

(30:25) just diversify a little bit um in a different state most likely yeah oh okay do do you have your eyes set on any particular Market uh not in particular we’re we’re looking at different places like Alabama Kansas um North Carolina Georgia maybe so I’m open to whatever makes sense basically and that’s what I found as my initial challenge with the States was uh you know me right I I like economics and you know job growth and all those things that drive real estate prices uh in migration immigration all sort things and there’s just so many

(31:05) markets that fit a buy criteria like a yes to buying in that area definely and and yeah so actually before we’re recording we’re discussing I was showing you what that query I did on Chach chbt I’ll just show it quickly on on here as well so yeah you’ve done a fair amount of research as well so for the listeners benefit I’ll read out the query I asked chat gbt which provinces or territory in Canada would you rank ahead of the top 10 US states for long-term residential real estate investing question question mark factor

(31:39) in how income properties in Canada must be personally qualified for versus in the US it’s that service coverage ratio mortgages and then there’s a respon there long response again that’s on my screen but if we go down to skip it right to the conclusion in short while Ontario BC and Alberta offer unique benefits they don’t hold up as effect itively against the top US states when facturing and debt service coverage ratio financing and other Pro investor advantages so like I was joking around before like that’s let mic drop yeah the

(32:11) debate’s over were the best place to Canada versus us for long-term residential real estate investing yeah so so you you’re you’ve now had a taste for it you ever going to buy a local investment property again ever most likely not most thing Chang it but I highly doubt it yeah have you told your friends and family about what you’re doing in the states what do they think yes I spoke to my aunt my aunt is more into this kind of stuff and she she lived in the states uh for 10 years in La so she’s familiar with the what goes on over there so I

(32:48) spoke to my aunt and a few of my friends as well I’m trying to get them on trying to bring them with me which I think is Noble because I I made the joke before like friends don’t let friends invest in substandard Investments correct yeah definitely actually do you know how how long say say a tenant in Montreal doesn’t pay you how long until you can resolve that issue yeah so I think it’s similar to Ontario I was reading into the forums and the Facebook groups I think some of them are like up to a year or bit more than a year to get

(33:24) a resolve from the government or the the agencies that are place for that so that’s crazy imagine someone not paying you for a year or more that has to hurt well just think about yourself could you survive no uh yeah definitely wouldn’t be able to survive I definitely have to get like two three jobs just to support that probably yeah when when people get into investment that’s a side hustle for it to be passive and then you’re saying you have to get several their jobs in order to support their tenant not paying your

(34:00) rent that sounds an awful alternative yeah definitely something you don’t want you worse enemies for sure uh and then how did you set up so you’re Canadian right you have right right so how did you how did you how were you able to own a US property Yeah so basically with the the share team we set up um my LC LLC and also we set up a lip so um that was pretty pretty much hands off I talked with Sher and they sent me over the documents and I just filled it out and Bam I had my business uh LC and LP ready to go and uh to purchase uh properties

(34:47) in the states pretty simless what kind of financing options are you seeing to refinance your Memphis property yeah so uh currently right now it’s kind of um we’re looking at just like 7 7% or maybe High sixes to refinance um some are able to you could buy down with a certain amount of money that’s that’s one of your options um yeah so that’s pretty much what we’re seeing right now maybe it will change I know that uh us is breaking down the rates as well so hopefully later on it comes down but that’s what we’re seeing currently yeah

(35:25) because we’re in the middle of a rate cutting cycle in the states as well just like Canada right so are you just are you just going to be patient and wait it out or just G to bite the and take one of these rates oh yeah definitely uh definitely we’re GNA see because right um the right it’s the right opportunity come it’s better to be in than to wait and for the right opportunity and then you know it’s better to be in like like you said Real Estate is like a long-term game right so once you better to get in early wait you you have

(35:59) another chance to refinance to go down to another lower rate so as long as the deal makes sense now what was was there a piece of advice or moment from the podcast that you found especially valuable that you know like was a catalyst for you to start investing a good question um I this a majority of your like your your guest speakers or whatever just say um basically just just take a chance you know basically take a chance and and see where it’s going to lead you because like you don’t won’t be like 20 years later and figure out oh man that the

(36:41) property I looked at you know 20 years ago look how much had it has grown and I had the opportunity to jump in and you know have a regret you know sometimes the biggest reward it’s the biggest chances you take in life right so that’s that’s what that’s why I gain a lot from your guest speakers and and I said why not I’m young let me try it if it works it works if it doesn’t I still have time to Pivot right I remember 10 years ago I was at a real estate networking dinner and I was sitting between two gentlemen that were

(37:15) one was probably high in his upper 60s one was in his 70s and they’re like they’re they’re chatting we’re on a conversation together and he there one was saying I wish I started 5 years earlier the other guy said I wish I started 10 years earlier and then they both look at each other and they look at me I wish I started when I was your age and they pointed at me for sure I would been close to your age at that time so I don’t know if you realize but there’s a whole bunch of Real Estate Investors who would love to have been

(37:43) your age when they got started for sure I believe you had somewh younger than me too I me personally I wish I started at his age too so you know the cycle continues well that’s the thing it’s Jo you’re probably referring to jok stanza because I think he was 26 when we started working with him and and then I’ll even I even poke him as well and I said if you were getting into the market today how would you do it because it’s so much more expensive than it was five years ago even yes right so for for listeners looking to

(38:20) start their Journey especially Canan eyeing at us Investments what would you be your what would you be your biggest piece of advice to them good question um just do it man like like Nik says just do it just get into it um do all your research yeah see if it makes sense for you at first reach out to people uh like your your guest guest um guest speakers and uh ask some questions you know ask questions figure out see alliance with you and then go from there that’s that’s that’s what I’ll tell your your speakers what was it like for you to be

(39:04) you know living in Montreal and there’s a renovation going on at your property in Memphis how how how are you made aware of updates yeah so uh basically you it’s pretty s simple they send me emails progress photos um before and afters um it be constant in the loop So within a week or so every week or two weeks I get update where we at um if there’s any hiccups or anything like that MH and then uh destimated time now all the renovations be done so it was pretty relaxed I didn’t feel any stress pretty seamless yeah uh question have you run the

(39:48) numbers after you refinance the property what your cash flow would be good question actually I haven’t no I actually haven’t uh actually haven’t I’ll run it later and I’ll and I’ll actually I’ll ask Demitri for it and then I’ll present I’ll share I’ll share it in the show notes folks as long as you’re okay with that I’ll send it to you first how’s that that’s right k j the right guy to go to I’m not the I’m not the so that’s better yeah so for the listeners benefit Demitri is the chief investment officer of share uh like

(40:18) Shane how did you know again you’re in Montreal right uh Dimitri you’ve never met him in person how did you how did you feel comfortable with this purchase just just having like talks with him on the phone uh you know it’s very very easy to talk to like um he asked me my input what what am I looking for what’s my future what’s my plans in the future and stuff like that and like from that conversation I felt really comfortable and then uh we went you know week by week we talk on the phone and uh talk about strategies talk

(40:54) about different uh Avenues we could go and then over that time it Fel it felt he so I had 100% confidence in Demetri and what he’s going to provide for me fabulous and you could understand what he’s talking about because because when I first met Demitri like he thought you know I have some real estate experience right right but he’s used to working with like pension plans so folks with like massive like you know lots of letters behind their names they have NBAs they have cfas some of them probably CPAs as well like like he’s

(41:28) used to talking to folks who you know have millions upon millions of or even billions to place so but you felt comfortable talking to him yeah I Fel I felt comfortable talking to him but for sure if there was like some uh some terms I didn’t understand cat GPT was there to rescue me or or uh I have to do my own research and like try to retain the information you know fais when he sends me the your pro fer I’m going to stick it in the chat gbt as well there you go you know D it down to like a you know fiveyear

(42:01) old to be like that because I’m pretty sure most everyday Canadians would be would like your deal I would like your deal sure for sure oh have you had it praed yet you haven’t but like sh Shar can run the numbers they can take a good guess what your property is worth now do you actually know yeah I think uh on the website it said about it’s probably worth 136,000 maybe now with the renovations estimate okay 136,000 that’s an improvement of $22,000 that’s it’s funny because I was having a conversation with a friend I have lots

(42:44) of friends I don’t have a lot of friends I lie he was chirping me like saying you you like as much as you know what’s going on in the world I don’t see why you’re adding more Bitcoin to your portfolio and like yes I’d love to have more Bitcoin but I can’t get these equity uplifts in gold or Bitcoin like I can in real estate just like you did from the comfort of your home in Montreal you got an equity uplift of $22,000 yeah that’s fantastic did it and you’re definitely and like on the website your property is a seven cap but

(43:23) which is not which is understated because you got more rent and your renovation was smaller so again I can’t wait to see what the what the what the uh the updated financials look like but holy cow what a deal especially in her first property yeah pretty much struck gold right now it’s pretty awesome appreciate so we just had our us investing Workshop a weekend or two ago and literally I had a gentleman in my office he paid $900,000 for a two-bedroom condo uh it’s it’s facing the lake on it’s it’s GTA West and he originally and uh he

(44:02) originally priced it r at 2900 he couldn’t get it so it kept coming down for two-bedroom he got like 2400 2400 rent on a brand new condo that was Lake facing that he paid $900,000 for and he’s not a chump either he’s a realtor I believe he’s a realtor he’s not a chump so he’s negative on hard cost he’s negative 2,000 a month right so if he has a vacancy or repair it’s way worse than 2,000 a month right yeah definitely oh I wouldn’t want to be in those shoes man that that that would hurt me that oh man Depression was

(44:35) set on me on that point yeah like you have to put up like to put up money that much capital for a $900,000 condo and then have it take money from your pocket every month 2,000 bucks yeah the wife w’t be happy for sure that’s for sure brother you have a wife no no not yet not yet at least not yet not yet not yet so looking five 10 years out where do you see your portfolio in your financial goals and how does Real Estate fit into your overall Vision yeah definitely so uh my my my plan is to grow at least maybe try to

(45:13) get at least one or two a year um ideally probably set up to 10 and see how how how it goes from there um definitely the more the better mhm I won’t complain about that but definitely my goal is to uh to get a good amount to cover my expenses and uh have my primary job being my secondary job you know what I mean so that’s that’s the goal and and do you get a pension at your work yeah I get a pension I work for the federal so we have a government pension you got a decent one it’s pretty it’s pretty good I kind of come complain it’s uh the F

(45:52) benefit so it’s pretty good fantastic fantastic just because I had previous guess who’s RCMP and I don’t I don’t for federal pensions that’s I think it’s on the on the lower end of quality so really I’m no expert but it doesn’t for for people in the line of business who get shot at can’t believe aention yeah from that aspect okay yeah you’re right you’re right their life is on the line yeah I’m not in those shoes but yeah even if they don’t get shot at I if you if I compare it to like a teacher pension or like a federal

(46:26) employee like someone who works for federal government like like CR CMP I don’t think they they don’t get the same pension as like a someone I know with a desk job in Ottawa you know what I mean but uh yeah I’m no expert but it doesn’t seem fair oh they’re deserv more they’re definitely deserving it more for sure I would say that too you know and and then when you Vision your portfolio um what cities and states do you think you’re in yeah so hopefully a little bit everywhere so um like Kansas uh Alabama Georgia maybe Texas like like yourself

(47:05) we’ll see how that goes um yeah those maybe those main those areas and see uh there’s any opportunity elsewhere as well yeah so why do you choose the the geographic diversification because when if you were if you invested locally right would you do the same would you have like one in Montreal one in Toronto one in I don’t know ashaa one in bernabe British Columbia why why why do you envision why do you envision uh economic sorry Geographic diversity well just uh for protection right you don’t even know what what’s in

(47:44) store for in the future right so just having um properties in different states it’s kind of like a shelter just in case one is performing well one isn’t performing as well there’s Renovations here there’s a big issue here you just have overall a good comfort zone and then how would you execute this you’re going to fly down to each of these markets and you know meet wholesalers meet property managers Realtors you know oh that’s that’s why I got share man they they got my back you know so that they’re they very verse in multiple

(48:18) Estates so if anything Lins with my uh idea or my uh criteria just shoot me a an email and uh go from there you’re a young guy once you once and you’re handy too want to just fly down and uh be your own investor uh that’s that’s a lot of work that’s a lot of work uh a lot of times you know I don’t think I have that much time on my hands unfortunately but um yeah why why why why would I do that if I have share on my team they they got my back they proven to me for my first property that they’re capable doing what

(48:58) they say they’re they’re able to do and I have M confidence in them right and so when you’re when you’re talking to your friends and family like you’re you’re telling to telling them to go share or you’re telling them to go book a plane ticket and interview a bunch of Realtors and wholesalers and proper managers or no I’m definitely telling them if hey you want a peace of mind you want have your my IDs hey share is the way to go man share is the way to go you’ll sleep easy at night yeah like when you mentioned earlier

(49:33) like even in Montreal it can take you a year to to deal with the non-payment of rent issue with a tenant like that’s I think people lose a lot of sleep oh definitely lot of sleep and they could go crazy you know you never know what could happen especially if it’s like a property that has maybe sentimental value people people could uh you know change change on you you know not it’s not good it’s not good you should be able to receive you know and if you’re providing you should be able to receive right at the same time so it’s just one

(50:09) for any plans to go visit any of these properties uh not necessarily but maybe I’ll go see the city myself and maybe pass by and say just to see how how it looks but no not not no uh no plans in the future currently right now so awesome yeah I’d like I’ve never been to graceand which is just outside Memphis so I’d like to one day yeah definitely all right Shane thanks so much for doing this do do you have any final thoughts you want to share with the listener again you listened to over 300 episodes of the show what what are

(50:44) some parting thoughts um I’ll leave the mic to you oh my gosh no pressure on me okay so basically um from all the episodes I like listen to the main one is this just just try it do your research first obviously do your du diligence but um just take the leap leap of faith and see how it goes because um it could be turn into an opportunity that changes your life and changes your family life and the the generations to come so that’s that’s my that’s my advice I will add I don’t know how much faith is needed when research is easier

(51:23) than ever that’s that’s for sure you have chat TP chat TPT uh it’s pretty easy just put whatever you you’re thinking yeah it gives you the your results what are some prompts you think people could use in chat GPT if they wanted to do research into real estate investing okay yeah so like probably some some of the terms like major terms like cap raate stuff like that something that Average Joe wouldn’t know right so like how I do it it’s like I say okay chat GPT explain this to me like a 5-year-old or a 10year old you know and

(52:00) they use maybe the piggy bank explanation and stuff like that so so for a common person like me it’s simpler to to understand and retain the information so stuff like that like it makes makes your life much easier to understand yeah I plan on uh like project Prof foras projected financials aren’t that available actually they’re somewhat available actually no they’re not for for uh again because I I’m on I’m on a lot of emails as well so I get I get projected financials for a lot of properties and then you’ve seen the way

(52:33) Shar does them they’re they’re incredibly detailed and transparent so I actually plan on having get to having to finish off a project proper projector Financial Prof fora for for like local properties and just feeding it to chbt and like you tell me what’s better I think I think the everyday investor can do that as well like you want an unbiased As Good As It Gets unbiased uh opinion on what the best investment is AI chat GPT is it exactly yeah exactly that’s how I did also um with the my refinancing options as well so like add one or two options

(53:12) I’m like okay let put this in chat and it breaks it down the comparison what is what is Advantage for this option and what is Advantage for this option and the dises between the two so yeah it’s pretty simple you just have to put it in and read read the what it gives you and you could go based off on that so definitely easier that’s super cool do you find any of your friends and family and people your age are they using are they using chat gbt um I’ll would say more people my age are younger are using ja gbt the older

(53:47) people some of they’re not tech savvy unfortunately but um oh yeah I I definitely see people around my age are younger definitely definitely younger they all they’re all over there you know the technology so they they probably know more than me I was actually planning on doing a chat an interview with chat gbt on Canada versus USA for investing if you want unbiased you know because list just need to understand like I’ve covered this before in one of my other talks like the chbt has passed the bar exam in the states it it passed

(54:24) uh I think it was Wharton’s NBA School so Wharton is a top five top five easily top five business school within the US right it’s it’s uh and it keeps getting better it’s it’s just scary how good it is and and uh and this is why I warn uh folks who who are have businesses in in anything especially on well for my show I talk to I’ll mention it for like real estate agents and and mortgage agents and Brokers and whatnot especially they’re focused on investors like technology is coming for everyone’s job right not your job your

(55:04) hands on but oh yeah for at least for now who knows the robots they have some robots out there that you know nah not not yet okay you know everything I’ve seen like anything to do with like repairs and maintenance like that’s so far down the line for robots that’s just way too hard right like robots can do new because it’s all it’s the same thing over and over again right we already see that in automotive manufacturing right it’s already it’s already largely robots but uh for for any sort of like maintenance yeah well you tell me you’re

(55:38) in the shop not me right but just just say can you see a robot like replacing your toilet at home you’re right not at least not yet maybe in the future who knows but currently no I it’s just so far down the line like so yeah all right Shane thanks so much for doing this oh man it’s been honor this is awesome to be on your podcast man I’m a fan I’ve been listening you know as you know from the beginning and I’m I’m really humbled to be on this podcast be one of your guest speakers thank you thank you very much and Shane

(56:15) just throw it back to you it’s it’s it’s always been my honor to host this show and help people especially the everyday investor especially younger folk like you who don’t come from a pile of money or they don’t have a pile of money right like uh like I I I tell friends and family if you want to get rich you need to be in real estate right and for and from my experience I’ve never seen an easier asset class or strategy for people who don’t have money to get money right obviously they have like you I’m guessing you worked and save worked

(56:53) and saved and that’s how you were able to afford the investment is that fair yeah so yeah majority is worked and Sav but also like um I have received money also from family so um from the most part yeah my blood heart blood Harden s tears all that stuff um I I work two three Jaws that’s nothing new to me I slow down a little bit but that that’s that’s that’s my that’s my how I get down you know so so yeah so trying to offset that with the real estate and in my experience I don’t see a better way to do it Jan again thanks for so much for

(57:37) doing this thanks for thanks for being my first US Canadian client by us that’s awesome man thank you very much for having me we’ll talk soon [Music] home all right friends that wraps up another episode of the truth about real estate investing show for Canadians hope you got as much out of this one as I did remember that whether you’re just starting out or a seasoned investor there’s always something new to learn and it’s always about building that practical knowledge base that gets you closer to Financial Freedom if you found

(58:06) value today please do us a favor and leave us a review or a rating share this episode with a friend or better yet join our community of Real Estate Investors who are taking action and making moves and hey if there’s a topic you want us to cover or have uh there’s a certain guest you’d like us to have on the show dropped me a line my DMs are open on social media reply to this email that this have arrived on I’m not hard to find uh you know we’re all about getting you the unfiltered truth to help you on your journey thanks again for tuning in

(58:33) and we’ll see you at in the next episode until then stay Smart Stay curious and keep building that future catch you later

On iTunes: https://itunes.apple.com/ca/podcast/truth-about-real-estate-investing…/id1100488294

On Spotify: https://open.spotify.com/show/6Z8yd37AQfQI5DK0J0Xwzz

Audible:https://www.audible.ca/podcast/The-Truth-About-Real-Estate-Investing-for-Canadians/B08JJS91WR

Youtube: https://youtu.be/Yq78oEIcwUM

HELP US OUT!

BEFORE YOU GO…

Before you go, if you’re interested in what kind of properties I am looking at in the landlord friendly states of the USA please go to iwin.sharesfr.com for what I consider the best investment for most Canadians, most of the time.

I’ve been investing in Ontario since 2005 and while it’s been a great, great run. I started out buying properties in the 100,000s and now it’s $800,000 to $1,000,000. How much higher can it go? I don’t know

To me, the remaining potential for appreciation does not match the risk hence I’m advising my clients to look to where one can find rental properties that are affordable range of $150,000 to $350,000 US$, with rents that range from $1,400 to 2,600/month plus utilities. As many Canadians recognize, these numbers will be positive cash flow and are night and day compared to anything locally. Plus the landlord has all of the rights, no rent control, and income is US dollars which are better than Canadian dollars.

If you don’t believe me, US dollars are better than Canadian dollars, go ask 100 non-Canadians which currency they prefer to be paid in.

So to regain control of your retirement planning. Go to iwin.sharesfr.com and check out what great cash flow properties are available in the USA.

The best part is, my US investments will be much more passive compared to by local investments as I’m hiring an asset manager called SHARE to hand hold me through the entire process. As their client and shareholder, Share will source me quality income properties, help me with legal structure and taxes, they manage the property manager and insurance provider while passing down to me preferred rates so I save both time and money.

Share will even tell me when to strategically refinance or sell. SHARE can even support investors all over the country for proper diversification hence my plan is to own in Tennessee, Georgia, and Texas. Share is like my joint venture partner but I only have to pay them fees while I keep 100% ownership and control.

If your goal in investing is to increase cash flow, I don’t know of a better strategy for most Canadians most of the time. One last time that’s iwin.sharesfr.com to see what boring, cash flowing real estate investing can look like on your path towards financial peace.

This is how I’m going to make real estate investing great again for my family and hope you choose the same. Till next time!

Sponsored by:

This episode is brought to you by me! We don’t have sponsors for this show. I only share with you services owned by my wife Cherry and me. Real estate investing is a staple in my life and allowed me to build wealth and, more importantly, achieve financial peace about the future, knowing our retirement is taken care of and my kids will be able to afford a home when they grow up. If you, too, are interested in my systematic strategy to implement the #1 investment strategy, the same one pretty much all my guests are doing themselves, then go visit www.infinitywealth.ca/events and register for our next event.

Till next time, just do it because I believe in you.

Erwin

W: erwinszeto.com

FB: https://www.facebook.com/erwin.szeto

IG: https://www.instagram.com/erwinszeto/

Leave a Reply

Want to join the discussion?Feel free to contribute!