Real Estate Titans: Tools, Tactics and Wisdom for Canadian Real Estate Wealth With Andrew & John

While our government has done nothing to alter the budget to remain competitive and keeping family doctors in Canada I’ve decided to focus more on being positive. Hello and welcome to the truth about real estate investing show for Canadians since 2016, over 300 episodes, ranking as high as #81 on ITunes in the Business Category.

My name is Erwin Szeto and as I’ve shared on past episodes, I made the decision to begin diversifying my portfolio by selling on local Ontario properties and I’m beginning the process to buy income properties in the USA.

My criteria is simple, direct, 100% ownership like I do here in Ontario but I want the best of the best managing my properties hence I’ll be buying via a company called SHARE who is an institutional asset manager. It’s like me being a Costco member, I benefit from their buying power: I get preferred pricing on property management, leasing fees, repairs and maintenance, and insurance.

In the news is a little company called Samsung, they’re actually not that little, they’re actually the largest company in Korea by market capitalization. Samsung reported earnings this week and said AI will drive technology demand after they absolutely crushed their earnings reporting a 10 fold increase in first quarter operating profit.

So if Samsung is 10X’ing their operating profits, where and how are they investing in AI? Samsung is investing $37 billion into building two microchip manufacturing facilities just outside Austin, Texas that will employ a projected 4,000 high paying manufacturing jobs. I’ve already done a site visit and my theory is I will earn above market returns by investing nearby. I’ve already given the names of the neighbourhoods I want to own into SHARE. That’s not advice, I’m just sharing what how I’m investing and I’m open to criticisms. Note my plan is to only buy one house in Austin as my plan is to own in three cities before circling back for diversification which SHARE can manage for me as well.

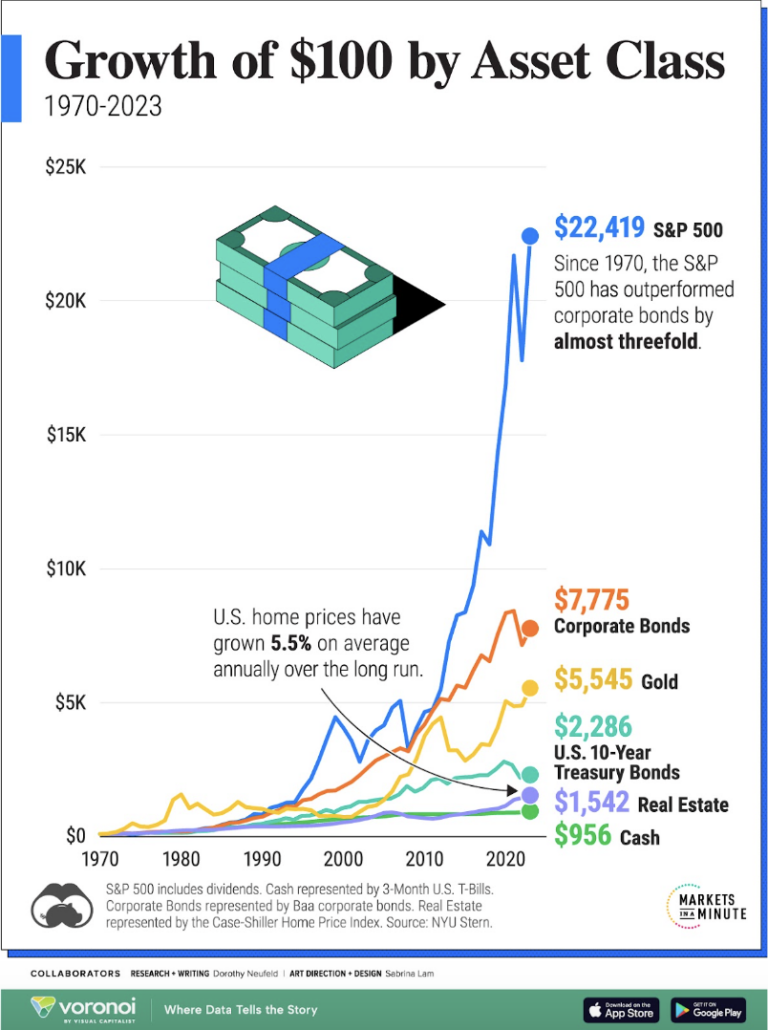

Keep in mind that historically real estate in the US between 1970 and 2023 increased on average 5.5% each year. I think I can beat that by investing in the best areas to invest. My clients and I were getting about 7% here in Ontario but I’m looking forward to being more passive, no rent control, more rights in my favour, and beating the average 🙂.

Source: https://www.visualcapitalist.com/growth-of-100-by-asset-class-1970-2023/

If you’re interested in learning more, I have virtual tours of US income properties coming up as well as a joint How to earn Six Figures Investing in the USA Workshop with my lovely wife Cherry Chan so make sure you’re on my free, weekly newsletter where we send a deal in the USA each week along with both free and for a fee events. Simply go to my website: www.truthaboutrealestateinvesting.ca and grab any one of my free reports on the right side by entering your name and email address. Easy peasy.

We’re going to make real estate investing great again, our friends in the USA have a bit of a housing crisis themselves so we can help them out as we’re welcome to unlike here in Canada.

Real Estate Titans: Tools, Tactics and Wisdom for Canadian Real Estate Wealth With Andrew & John

On to this week’s show!

We have my old friend Andrew Hines and his co-author of an all new book John Schwenker! Andrew needs no introduction and John is an everyday hero, a firefighter and recovering real estate investor.

Andrew has taken his turn sharing how he lost money investing in Ohio now it’s John’s turn to share how he made a bunch of money in Ontario, lost all his profits in the recent correction but it’s not all bad news, John’s short term rental property in the US is a winner. I’m confident you’ll agree when you hear his numbers especially when compared to his Niagara Fall, Ontario short-term rental.

In this episode, John and Andrew share their journey to writing this book so we may all learn from their mistakes and how to be successful in their book which is like Tim Ferriss’ “Tools of Titans” where other experts have contributed chapters to the book including yours truly.

To pick up a copy of the book:

“Real Estate Titans: Tools, Tactics and Wisdom for Canadian Real Estate Wealth.”

Link: https://www.amazon.ca/Real-Estate-Titans-Tactics-Canadian-ebook/dp/B0CZZZWP3Z/

To follow Andrew and John:

To Listen:

** Transcript Auto-Generated**

(00:00) the government’s made some updates to the budget but uh they haven’t done anything to for our family doctors to remain competitive and keep our family doctors and other medical practitioners in Canada so I’ve got nothing positive to say on that front and I’m deciding to stay more positive hello and welcome to the truth about real estate investing show for Canadians since 2016 that’s over 300 300 episodes probably about 350 by now we’ve ranked as high as number 81 on iTunes in the business category

(00:30) globally my name is urman cedo and as I’ve shared on past episodes I made the decision to begin diversifying my portfolio by selling local Ontario properties I have three closing I have one I closed one this past week and I have two more coming up uh this next week and I’m beginning the process of buying income properties in the USA my criteria for buying is simple it’s direct 100% ownership and control like I do here in Ontario but I want the best of the best managing my properties hence I’ll be buying via a company called

(01:01) share who is an Institutional asset manager it’s like being a Costco member I benefit from their buying power I get preferred pricing in this case under share I get preferred pricing on property management leasing fees repairs maintenance and insurance so while I had to pay share fees I save a lot on other in other areas in the news there’s this little company called Samsung they’re actually not that little I Googled and I found out they are the largest company in Korea in Korea South Korea by market capitalization as in if you

(01:32) add up all what all their stock shares are worth they are they are worth the most ssung recently reported earnings they actually reported earnings this week and they absolutely crushed it they tfold increased their first quarter operating profit now what they’re saying is AI will drive technology demand uh going into the future and going to the rest of this year so if Samsung is 10 Xing their operating profits where and how are they investing in AI I asked these questions that’s all I ever do all I ever do is ask questions which is like

(02:06) the nature of this show so I asked Google I read an article a couple articles Samsung is investing uh a combined $37 billion into building two merker chip manufacturing facilities just outside Austin Texas so um as many of you know I did site a site visit of one of them already only about three two three weeks ago did they announce the second uh the second record ship plant and they already have one already existing in anyways so the new investment will employ a projected 4,000 high paying manufacturing jobs uh and uh as my

(02:43) theory is well my investment goals is always to earn above market returns by investing and so my plan is to invest nearby where these plants are being built in Austin Texas uh I’ve already given the names of the neighborhoods I want to own uh via share the neighborhoods are called Hutto and Round Rock now that’s not advice I’m just sharing how I’m choosing to invest and as always I’m open to criticisms uh Noe my plan is to only buy one house in Austin as my plan is to own to buy in other cities proba at least

(03:14) three cities total before I ever Circle back and buy a second property in any one city uh my objective is diversification which and that’s not a problem for me because share is a n Nationwide organization that can cover me basically wherever landlording in the USA makes sense now keep in mind historically real estate in the US between 1970 and 2023 so that’s 53 years on average over that significantly large sample size real estate increased an average of 5.

(03:48) 5% each year and that’s compounding 5.5 compounded annual growth rate I personally think I have a shot at being that because of my very targeted areas for investment near historically historically levels of manufacturing investment into creating high paid jobs into largely Ai and Automotive manufacturing specifically EV anyways my clients and I were getting about 7% here in Ontario but I’m looking forward to being more passive uh with no rank control having the majority of Rights in my favor and of course beating the average I’ve got uh sources in the show

(04:24) notes of course as always so if you go onto my website truth about my email newsletter you will see the infographics from visual capitalist uh if you’re interested in learning more I have virtual tour tours of USA income properties coming up as well as a joint V uh a joint how to earn six figures investing in the USA workshop with my lovely wife Cherry CH Shan uh she will be presenting and I will be presenting as well along with uh members of the share team make sure you’re on my free Weekly Newsletter where we send a deal

(04:55) each week from the USA uh along with uh both free and for fee events simply go to my website www. truthout realestate investing.con the USA guide easy peasy just go to my website and enter your name and email we’re going to make real estate investing great again our friends in the USA have a bit of of a housing crisis themselves so we can help them out as we’re welcome to by the all levels of government there unlike here in Canada on to this week show we have my old friend Andrew Hines and his co-author of an allnew book John

(05:35) schinker Andrew needs Andrew Hines hopefully needs no introduction uh and John is an everyday hero a firefighter and recovering real estate investor uh Andrew has taken his sh turn sharing how he lost money investing in Ohio now it’s John’s turn to share how he made a bunch of money in Ontario and lost all of his profits in a re in the recent correction but it’s not all bad news John’s learned a lot he’s written a book in the meantime John’s short-term rental property in the USA is a winner and I’m confident you’ll

(06:05) agree especially when you hear his numbers on his uh on his vacation property in New York state when compared to his Niger Falls Ontario short-term rental the numbers are completely night and day as well as how he’s being regulated by that local government in this episode John and John and Andrew share their journey to writing this book so we may all learn from their mistakes and how to how to be successful in their book with in their book which is U similar to Tim Ferris tools of Titans where experts have contributed chapters

(06:37) to the book including yours truly the book is called real estate Titans tools tactics and wisdom for Canadian real estate wealth I’ve included a link in the show notes to Amazon so you can pick up the book and to follow John and Andrew they’re both available on Instagram and very active and uh I don’t know how howse to put it but I did chirp John he is a fireman he’s a young good-look guy he does appear in a calendar so he’s a good guy obviously because he’s taking a shirt off for charity who El what what other kind of

(07:12) good guy does that anyways please enjoy the [Music] show hello John hello Andrew uh what welcome to the first threeome we’ve ever done online for the podcast yeah we’re on to something here thanks for having us for the listeners benefit well the listeners who’ve been around for a long time no I’ve never had I’ve had two guests in person this is the first time we’ve done it online which makes sense since uh we’re all a little bit further apart uh but yeah let’s go what’s keeping you busy these

(07:49) days yeah who do you want to go first oh you spoke first Andre you you first all right well um when was I last on here on your show year ago 12 months yeah maybe a bit more than that um yeah so I got a two-year-old and uh I uh have been still busy in the US last time I was on we were talking about the new developments the builds um I’ve since sold all that off I did build three sold off the extra lots that I have sold those buildings and uh basically just decided that Kate Coral wasn’t going to work anymore given

(08:21) some of the changes in the market know you and I have chatted about this uh recently but uh basically things just got squeezed cost costs went up on building and then of course the market kind of came down slowly not as bad as it did in Ontario but it did come down in Southwest Florida too and um you know I just kind of decided that it wasn’t worth the risk for the P you know the perspective profit margin it uh you know just didn’t justify taking the risk so I I took a couple of small losses on some

(08:50) of the Lots just to liquidate them uh knowing that I was kind of getting a negative return on Equity at the moment with the stagnant market and then just you know paying property taxes on those slots so um shifted gears I’ve been doing some off-market acquisition right now uh making offers on land I was chatting with you a couple of weeks ago uh so we’re uh somewhere around 6,000 offers in 30 days and uh I got another 4,000 in change going out uh pretty much today so um yeah keep it rolling and that’s in Florida all in Florida right

(09:23) now yeah and I got the hospitality business up here we completed our second uh full season glamping uh we acquired a resort as well 9 Acres on the water in toore and uh so it’s all part of a you know the getaway group of companies sort of what we call it and um we do Luxury glamping and luxury stays in the area uh and we’re yeah like I said we’re expanding uh we we probably did a 75% increase in our sales year-over-year uh for 2023 and we’re looking to do a a similar growth again next year uh

(09:57) because we added a bunch of new inventory and you know new trailers T really awesome stuff um anyone wants to check that out they can check us out on Instagram at the gr getaway glamp and uh yeah that’s uh that’s the most of it writing a book we’re gonna talk about that today uh so John and I that’s why we’re here we’re talking about the book and uh yeah that’s had us both busy so uh both of our plates have been full and I will uh I’ll pass it back to you irn or John yeah before we just before we

(10:25) get to John just want to highlight for The Listener like I’ve known Andrew for quite a few years and it’s it’s good to see that you’re willing to share loss and also that you’re willing to Pivot when the market when the markets change yeah right because well how many people had losses right like I mean I had I had some wins too I I mean I I look at Florida and Southwest Florida in my first experience as as being um an okay Endeavor like I didn’t lose overall but it it didn’t justify the effort so

(10:53) that’s pretty much where I walked away from it like I apply when I’m doing Investments down there I apply my own internal rate of return if I can’t profit on top of that to me is effectively a loss because it could just put that money out in a passive investment yeah so that’s that’s in order to keep things equal I have to look at it that way right so for for those who don’t know like Andrew’s a smart guy so his money if his money is not working hard for him then it’s a loss essentially yeah if you know what

(11:18) you can Al invest in right like I know what I could I could go get 14% passively so if I if I’m not getting that actively why am I doing it you know I should be I should be able to do that and then some actively mhm MH and I was going to say like you made a lot of money in in Ontario investing as well I had some wins I’ve had some failures I shared both but uh yeah we we’ll all continue to have failures they’re only really failures if you don’t learn from them right y if you don’t cut them off and you when you need

(11:46) to so also we have John on the show so John this is your first time on the show first time on the show yes thank you what’s keeping you busy these days yeah the novel’s been one of the biggest things that Andrew and I are writing um we were fortunate enough to have you as one of our uh one of our interviewees in the chapter we really appreciate that your chapter is fantastic you gave a ton of insight and wisdom so we appreciate that but I actually approached Andrew for this idea about two years ago which

(12:16) I can’t believe that it’s already been two years already and uh I’ve told the story once or twice but I pretty much just sent Andrew a a DM video on Instagram it was just like hey man I’ve got this idea for a book I want to do this and this and we set up a meeting for a couple days later I pitched the idea to Andrew and he’s like yeah man that sounds awesome let’s go for it so it was a perfect match because I’ve written a book in the past so I have all of the publishing knowledge editing I’ve

(12:45) gone through the whole process before and Andrew’s knowledge it’s it’s uh you can’t really top that and his role aexs of guests he’s had on the show so it was pretty much a match made in heaven we both used our strengths and I just kind of brought Andrew a list of people I wanted in the book you were one of them and I had maybe 20 25 other people and Andrew was able to match us all together which was fantastic and that’s pretty much been the biggest project we’ve been working on but aside from that I guess your

(13:16) listeners wouldn’t know me my day-to-day work is a firefighter we just kind of talked a bit about that off camera and uh yeah that’s kind of what I do during the day I have a handful of airbnbs in Ontario and one in elville New York at Holiday Valley nice little ski area out there so that’s a lot of fun and over the last year it’s kind of just been stabilizing after everything that happened in the market kind of took a step back with everything and we’ve been stabilizing our Airbnb airbnbs and

(13:47) portfolio and that’s kind of the day-to-day right now so I asked before we start recording if anything’s if everything’s fair game he said yes you did can you share the story how you got introduced to my podcast yeah that was actually that was probably maybe four years ago now and uh my father was a big listener of Irwin and when I started learning about real estate that was probably four or five years ago as well and I was a big Andrew Hines fan and that’s why I actually approached him for the book I learned

(14:21) most of my stuff from from Andrew and then I was talking to my dad about his podcast and he’s like oh you got to listen to this Irwin guy he’s fantastic and you got to listen to him so yeah I started listening to Irwin’s podcast that I must have been 2019 or so maybe 20120 not quite sure but I’ve been one of your what is it 100 listeners or thousand listeners for 17 listeners okay I knew but yeah I’ve been one of The Originals I’d like to say thank you for listening and thank you to your father and uh I can’t let

(14:52) you off the hook for this either before we were recording we Andrew and I learned something very personal intimate about you that you do take your shirt off for a calendar yeah seeing as this is your first virtual threesome on a podcast I feel confident sharing that yeah I’m part of the firefighter calendar as a firefighter in the niagar region we do this for charity for pth stone mental health it’s a fantastic um it’s a fantastic organization so yes I’m willing to take my shirt off for a good

(15:22) cause sometimes and you get nothing for it this is all for charity all for charity yeah it’s a great time good char good time couple laughs are had and I think that’s a good segue into the book like people don’t write books to make money like there’s there’s not nearly enough money in it for for to cover all the time and effort that’s for sure it’s been oh it could be a thousand hours between Andrew and I at this point between all the interviews and storyboarding and the editing process

(15:51) and back and forth you know uh you know yourself know irn that we had to do kind of an update a couple months ago because so many things have changed in the market so it was almost like two full rewrites of the book and everything so yeah it’s a ton of time and effort but the reason I wanted to do this initially was when I got into real estate and flipping houses I really didn’t know much about it I kind of just jumped in because I knew real estate was a good investment but I I knew we were playing with some big numbers here some

(16:20) life-changing numbers but it’s also life ruining numbers at the end of the day and I didn’t know much about real estate other than what I’ve learned from Andrew and yourself irn so I wanted to kind of build a community of people I was able to speak to I think 20 or 21 investors and interview them for the novel and I just personally wanted to learn from the biggest names in the industry and that’s how it all got started so let’s start with what have you learned along in your own Journey because uh it’s it’s awesome you

(16:49) mentioned elville I need to hit you up later because uh we just got back from Huntsville and there was no snow right yeah El is a beautiful area but we can talk about that uh but the biggest thing in my real estate Journey was I started flipping houses about four years ago we were doing the nicer areas in St Catherine’s kind of the north end it was myself my father and sister we were flipping like higher end houses between the $600 and $900,000 Mark and we were making money hand over fist it was crazy it was all during that

(17:23) boom and that’s all I knew at the time I’ve heard about the 2008 scare whenever everything crashed but people weren’t talking about that two or three years ago very much there were people like both of you who understand it that would say that would reference it it’s not always going to be great but for someone like me that’s not been in this industry for very long I just did whatever I could to get more money make more money and get more properties so some of the basics of real estate investing went out

(17:52) the window but I ended up borrowing a lot of private money private financing private mortgages just to get more properties under my belt and then when everything crashed I think it was the start of Q2 2022 I was holding three properties with private mortgages private funds all between I think at that time $750 and $900,000 each of them between1 to $150,000 worth of Renovations into all of them and uh we ended up having to liquidate that at a huge loss for example I’ve told Andrew about the one house we purchased for

(18:30) 750,000 we put in anywhere between 100 and 120,000 and then um things got so bad we had to let it go for under 700,000 so major loss on that one we had a similar situation with the second house and then the third house we ended up turning into an Airbnb in niagar on the lake which is now doing wonderfully but that’s money we didn’t expect to have tied up in a property long term and yeah after a couple years of doing great uh it kind of all came to a halt at that point when the market crashed it was about a year

(19:02) of stabilization and yeah it was a very tough year and a lot of learning for sure and were you able to keep your lenders whole yep yeah at the end of the day everybody got paid back and everything but it was at a big personal expense unfortunately uh had to dip into the personal funds and everything but yeah everything worked out with the lenders and everything but pretty much all the pro the the progress we made kind of took a halt and but we were able to stabilize at the end of the day did you basically give back

(19:37) everything you made then yep yep in so many words yeah it’s too bad because we started I think we started in 2019 and like I said we were absolutely crushing it with a bunch of flips I still do have a handful of airbnbs which is great so I do have some of my portfolio left but pretty much well 100% of the flipping profit was G on and had to liquidate some more of the portfolio just to pay everybody back thank you for sharing John yeah for sure yeah who shares that e like yeah no problem you know keep on moving just usually go quiet like so

(20:16) many social media profiles have gone quiet yeah people just go quiet like they don’t share yeah for sure it’s been a hard time and I’ve been very open about it the whole time and my fiance has been incredible honestly would not have got through this without her we talked about it off camera she’s a social media manager and um she was doing very well before all this happened but when all this happened I didn’t have enough cash flow like our personal expenses were absolutely insane and we didn’t have enough money month by month

(20:45) even liquidating some of the portfolio just these private mortgages we were holding and paying back all these lenders and stuff we pretty much had to 3x her business overnight we did that in about two or three months just to just to to live just to cash be cash flow positive so thank you to Courtney for that shout out Courtney yeah no kidding think you owe her one I owe her lots I owe her everything that’s for sure and you kept your job through the whole process right I did yeah yeah that all went to uh private mortgages and stuff

(21:20) I’d get a paycheck itd go One Direction so yeah it’s been like I said it’s been tough but we’ve got through it we’re still paying for a little bit of it but yeah I think we’re kind of on the other side of it now so if you didn’t have your girlfriend in your great paying job where would you be um I would have had to sell all of our airbnbs for sure there would have been no question our oh well now that we’re sharing things our monthly expenses were about $22,000 that was between um just our personal house all

(21:54) the interest payments the private mortgages and stuff like that I’m only responsible for onethird of the flipping corporation that we had so for those three properties I was on the on the hook for onethird of all those properties but I also had my the private funds I I was borrowing so yeah it was lots of money going out every month and it was not going to principal that’s for sure so is that gross debt or is that total debt Andrew you had your mortgage license uh total debt service includes like yeah everything credit cards

(22:28) everything that’s not property related so anything directly related to 22,000 total debt a month yeah that was going out yeah okay did not the need for the plan A B andc uh yeah like you obviously on that one property you’re you you were able to turn it into a positive right of course like said you got money tied up in it but yeah but yeah like like I said at the start of this I wanted to write this book to avoid all unfortunately I started writing this book like as this was all happening so I thought I had a plan A B and C but I I

(23:07) didn’t know it could be that bad even my worst case scenario I didn’t know house prices were going to drop 20 25% overnight I didn’t know that no one was going to be buying homes everybody was selling off what they had and for that house I was talking about that we would have sold for 950 to a million and we had to sell it for 700,000 less than what we bought it for like I never expected it to be like that I thought minimally we could break even sell it in a timely fashion and but no it was definitely not like that well not

(23:38) everyone sold everything I’m still bag holding that’s because you probably used good uh investing principles like I did not so you were able to hold these assets could have been better I yeah of course that’s for another show but yeah John before we Sorry before we move on to the book can you talk to what were the relationships like because this was a family-run business the flipping business how about the relationships with your partners your your which you said was your sister and your father yep yeah um

(24:08) luckily for them they didn’t have to borrow private money like we all had to do the private mortgages of course but I needed private money for all the renovations and everything for my 3D so they were in a bit better of a spot than I was so everybody was stressed the whole time but luckily like yeah we’re family first and it’s hard with family sometimes investing and in life and everything but we got through it we figured it out and we still own that Niagara on the Lake property together as an Airbnb and it

(24:38) was figured out like we all had to help each other at different points but figured it out got through it and that worked so what would someone who read the book would they be able to avoid these Mist these these challenging times that you’ve had absolutely yeah so that was the goal so basically we used the book tools of Titans by uh Tim Ferris is kind of the guideline for the novel book the author yeah I see it in your background actually right there bottom left corner that nice little orange one um yeah F fantastic book but basically

(25:12) you can see four our work weeks on on my right I can see I can see the Spy but yeah go ahead sorry I can see it too yeah so there’s about 20 interviews with some of the top Real Estate Investors in Canada so people are able to start from the beginning with their story what they did to start their investing portfolios and then all the way up to who they are now so a lot of times it’s hard to look at someone like yourself Irwin and be like well how do I get to Irwin’s level so we wanted to give people everybody’s Inception story

(25:43) and then kind of the steps of how they built their wealth and their portfolio that’s kind of one section of the book is those 20 interviews but then the start of the book is a lot of Andrews knowledge being poured into the reader we have a couple chapters like Andrew’s golden rules of investing um how to F find your how to purchase your first investment property and things like that it’s very actionable chapters where you can even just print them out use them as guidelines and checklists and stuff like

(26:11) that so we’ve really broken it down to the base level for the newer investors and then we have those 20 chapters going into the expert stories sounds pretty awesome and something some everybody should probably consume at the beginning yeah the big thing like so we wanted to make sure that the process and methodology and and you know because it’s a buffet there’s all these different things you could do how do you synthesize like the different strategies and and pick what what works for you so a lot of it’s about finding that fit and

(26:42) then of course protecting your downside which of course is harder in Ontario now than it was before when cash flow is probably your biggest protector um which most people don’t have so uh we did you know focus and this is what created so much extra work is with the downturn and the the new interest rate environment and economic climate and and declining real estate values is you know how do you succeed now and and what’s going to work now because a lot of people can’t relate to how say you started or when

(27:10) all those years ago or how I started all those years ago um but they can get my two cents on now that I’ve seen 12 years of this like how would I start again if I had to start right now and I in a lot of ways I look at it as start starting again a lot a lot of what I’m doing although I’m coming in with a better better start than I came in last but you know I think that there’s a lot of opportunity right now it’s pretty exciting and I know you have your your ideas what you shared in the book too

(27:37) and uh I’m I’m super like this is probably the happiest I’ve been going into a new year from an optimism standpoint like yeah of course that nothing’s perfect but there’s there’s a lot of good stuff on the horizon yeah I like to agree especially where we are I know we’re we’re recording this January 2nd I know we’re releasing this in February but uh you know I think we’ve reached the bottom for both the US and the Canadian markets so yeah I I agree I’m I’m very

(28:02) optimistic oh so actually and question for Andrew Andrew John mentioned there’s uh what did he did you say golden rules of investing yeah the golden rules or Andrew’s golden R rules of investing can’t remember the exact title but yeah that’s one of the chapters Andrew can you share some of those golden rules maybe give me three oh put me on the spot um I’d have to see how we wrote it down but I mean obviously a big one is is cash flow don’t invest in Ontario no I’m kidding cashow FL number one um John

(28:32) what did we put in there I I we haven’t gone over that in a bit I share these things all the time but how how I exactly uh wrote it um you know for me I’m going to sound like a broken record you know if you if you listen to me uh you know have your plan A B and C be able to Pivot these are things that would be in those golden rules um invest in a way that fits with your own capabilities it fits with your why um there needs to be a there needs to be Synergy between what you can want and need to do and the in the strategy you

(29:00) picked so just because uh you want to do Airbnb Arbitrage or hospitality and you want to go full-time into real estate uh but you know at home you got kids and you got a full-time job like that’s just those those don’t fit you know you might be more uh set up to do more passive type of investing so um that would just be a little bit of a preview of some of the stuff we covered right let’s pick on John for example I think his story is actually a strong one in that um you know and you and I have talked about you

(29:29) know we talked about like what’s out there in terms of like social media marketing and whatnot all these programs that promise you uh if you take their course they can quit their job but you know we were just talking about John if he had quit his job he’d be financially ruined yeah for sure uh and that’s and that’s just reality of things and we all talked about and Andrew you mentioned cash flow and I was talking to an investor uh this morning about you know we’re talking about cash flow Ontario and my point was to him was

(29:57) you know we’ve never felt inflation as badly as we have the last two three years right and so a pro formula for a property a residential property say just use of something boring something very Vanilla single family home in Ontario anywhere right could be condo could be detached home your cash flow uh we all know your expenses are going to go up but we have rent control in Ontario so your cash flow is only ever going to get worse is this a good investment all for those who are listening like both John and Andrew are

(30:32) smiling I’ll let either you go what do you what do you think go ahead Andrew oh geez um yeah I’m here I’ll throw out something as an observation neither of you are investing in long-term Residential Properties that’s that’s a very easy observation right no we’re we’re not in I mean in Ontario for me to to me to invest in that kind of thing I got to get it out a price that makes sense for the headache right like that’s that’s the new reality you always had that risk but before we had compensation for that

(31:05) risk in the form of cash flow in the form of appreciation and 30% a year returns uh that was factoring in your leverage you know and a healthy cash flow like it was very protected it was very hedged it felt great uh and then we got into a place where you know returns as I can calculate them on my cash flow sheet are like looking like 12% which you can get more in private lending so now all of a sudden it’s like wait why would I do that for all the headaches that come with it you’re speculating at your appreciation right now I’d still I

(31:34) still uh would estimate that we’re going to get completely stagnant or 1% I mean of course in in 10 years time I expect real estate values to be up but I don’t want to bank on a big number there and uh knowing all that it doesn’t look great and especially when you don’t have cash flow you have no ability to Pivot so that’s why I’m not really um active in Ontario what I am open to in Ontario is the fact you’re not active in residential long residential in Ontario yeah I am open to a deal in Ontario like

(32:05) if it comes at the right price of course and I think people are sleeping on Ontario right now because everybody’s looking at the US so um I went I was in the US before most of the people who jumped on the bag vanwagon here but um I just acknowledge that that if if everybody’s looking South then I’m still going to pay attention to here um but yeah my activities are still South and uh for the time being will be I don’t think that the rules as they stand in the real estate uh you know uh so the

(32:34) landlord tenant board here in Ontario are going to stay the way they are I think that there will come a turning point once you know institutions own most of it uh where it’ll it’ll become much more landlord friendly but for now it is what it is I I hey I’ll still take a great deal and I still think there’s great opportunity here but yeah um just not my key Focus right now yeah and for me I’m not touching any long-term Buy holds or anything like that in Ontario I have a couple airbnbs in Ontario and they’re still cash

(33:04) flowing very well especially the ones that I purchased a couple years ago uh the one property we have a 2.7 interest rate and the cash flow is fantastic on that we have another similar one like that Niger on the lake but then the Niger on the lake property I mentioned earlier we have a we have a huge mortgage on it and I think our interest rat’s around 7% and even though it’s in on the lake renovated perfectly as a hot tub like it’s As Nice of an Airbnb as you can have and we’re barely cash flow

(33:35) positive so even at that point is it worth it not so much at 7% but the properties we bought a couple years ago yeah there’s still huge cash flow machines and everything but like Andrew said if you can find a great deal and maybe for me again I like the short-term rentals it’s a lot better for the cash flow but the biggest thing for that is just make sure you’re in a short-term rental municipality that’s favorable for it because a lot of municipalities are not so if they don’t have their

(34:05) established rules I would highly recommend not entering that area yeah mature you want mature bylaws they’ve been there a long time um one other thing I’ll add to that is now this is what I was getting at with people sleeping on on stuff like VBS and negotiating special terms and and all the things you can do in Ontario when sellers aren’t getting a thousand offers thrown at them that’s where you get to kind of create your deal and you can create sort of something that isn’t on surface level people wouldn’t

(34:31) necessarily see it but it could be a fantastic deal for you so not saying everybody needs to race to the US because I don’t think that’s the case um you might you know if you if you go that way you might have an easier time but not necessarily oh I just want to share with you both a Toronto realtor friend of mine tell was telling me he’s bus it’s insanely busy in downtown Toronto already yeah he was hoping for a quiet holidays nope with uh with fixed rates coming down uh they’re already seeing he

(34:58) shared with me a a tono semi semi detached home had 25 offers on it sold for 300,000 over asking so just with the just with the news that they’re going to come down obviously fixed rates have come down but they’ already had an effect of stimulating the real estate market which actually puts in Jeopardy the likelihood of the real estate rates coming down could be we’ll see in the short run anyway John question about your n [ __ ] on the lake property so um so when I see this kind of activity already happening

(35:28) in in downtown Toronto I gen that’s usually like kind of like our epicenter of real estate activity uh to me that’s the early indicator that’s the canaran the coal mine that we’re going to start seeing activity pick up uh slow it like Toronto be downtown Toronto will be the upper Center and it’ll Ripple out So eventually it’ll make it way up to Nag on the lake not not 25 offers but you’ll see buyer demand pick up probably very significantly over the next 2 years what would your plan be then with your nagon

(35:55) lake property you is that something you want to continue to hold or would you take the exit when you can we have it at a place where it’s cash flowing nicely now but it took a lot of work to get there but if they get back up to the prices we were seeing a year and a half ago i’ it definitely be worth looking at because that’s the one property that I I wouldn’t mind selling at some point just to get back the rest of the finances that I need to pay everybody back and then be completely whole again

(36:23) personally but yeah I think we would sell it just because again with the interest rates where are it’s not crazy cash flow positive it’s not in our slow season we’re cash flow negative in the main Seasons we are very positive but it’s almost not worth it kind of like Andrew said the return on investment just isn’t there on a property like that so if it does turn in a year or two I think we definitely look at selling so a question I’m I’m starting to ask folks is especially as we’re into

(36:51) this kind of like realate Market pivot is what is your next uh income property P purchase going to be so uh start with you John yeah for me I am liking over the Border definitely um elville New York uh they have Holiday Valley there and holmont the two ski resorts they have a casino right out there some amazing golf courses and some worldclass Trails it’s very big with like mountain biking out there I’ve got a property out there and my partners on that property I have a second one out there so it’s a

(37:24) good spot it’s just again interest rates are a little bit high right now so it might not be a terrible idea to pick one up before everybody starts buying again because you can always just refinance when the rates come down but I think the next place I’m going to go is somewhere like in elville because with our airbnbs we always want people to have a reason to go to these places all of my airbnbs in St Catherine’s and Niagara they’re right beside a beach or in Niagara on the Lake so it’s always going to be very

(37:53) touristy areas and people are going to keep coming to holid Valley like Blue Mountains blown up and it’s super crazy the real estate out there so I honestly believe that’s an area that’s going to pick up is Holiday Valley and elville so somewhere like that and I do like the 30-year mortgages out there as well so definitely looking over that way right so sorry just to uh just just from my own understanding you’re saying narland lake is kind of like seasonal versus elville is more the Four Season uh it’s

(38:24) not so much the Four Seasons in elville but it’s just so much cheaper there that we can make so much money in the High season that you can we cash flow very well there where Niger popular too though right it is absolutely yeah it’s kind of like kind of like the wet Seasons that aren’t great like early spring and and yeah exactly but yeah no it it is almost a Four Season place where in St Catherine’s and Niger on the lake it’s definitely more of a spring summer early fall type place can you

(38:52) walk us through some numbers what you think your next investment property would be like in elville yeah at bille so we bought this one almost 3 years ago now and we bought that one for 250,000 if we were to buy that same property same property today they haven’t gone up like crazy so we could probably pick up a comparable property for about 300,000 which is pretty nice there is not a big inventory out there which is something to note and also they don’t allow airbnbs right downtown in the core so we’re kind of like in

(39:25) Farmville we’re about 7 Minutes drive away from the uh ski hills and from the downtown but it’s nice quick drive so yeah if we buy that for 300,000 probably it cost anywhere between 40 and 50,000 to get everything to get it set up to how we like our Airbnb standards I’m talking like very minor Renovations all the furniture all the bedding linens towels all that get everything set up for our maids so we’re probably looking about 350 all to get set up for a for a middle of the road Airbnb in a nicer

(40:04) area Okay so I’ve been looking at Blue Mountain properties and this is this is this sounds much more affordable it is much much more sense doesn’t it and I had him on my podcast we were running through those numbers and and he did this incredible games room and I think you were at like 70,000 a year Revenue before John and now you’re thinking like I’m I’m thinking that games room could put you up to 100 oh yeah we’ve had it live for maybe a month now and we’ve already seen the bookings they’ve gone through the roof

(40:39) in both volume and price we’ve raised our prices about 15 20% and people are not having an issue paying for it so you’ll easily surpass a 100 then I think so and like I said we bought this house for 250 like couple years ago and uh I think our mortgage rates locked in at 2.

(41:00) 9% so for how many more years 30 27 years 20 yeah 27 years like I you can’t beat that so don’t sell that it’s incredible no we won’t ever that’s great does this can I find this property online uh yeah um what would be the easiest if I gave you the address or sure like can I uh yeah let’s shout at your property get it fully booked for the rest of this I appreciate that yeah 6365 Somerville so s o m m e r v i l l e so Somerville Valley Road yeah we’re booked up pretty good the next month or two um but shout yeah shout out to Pink wall designs they’re

(41:47) the ones that did our our garage they did the designs for our garage and then me and my partners on the pro project went down there and did all the work and it’s been amazing uh do you have a website or or Instagram for this property I might just no we don’t we’ve always talked about doing it we just haven’t done it but I could always just send you the link maybe could text it to you that would be the easiest I know in didn’t SEO running to the US but this sounds pretty awesome cuz I literally just got back

(42:19) from a ski trip where there was no snow but for my my research via chat PT is my understanding is elville even though it’s Sou Falls it gets more snow than Toronto which is crazy absolutely high elevation right it’s like 1500 feet I think if here in Burlington we’re around 600 feet above sea level so I think that that has something to do with it yeah definitely irn I’m just sending it to you right now sorry took me a second to get there oh good no for the listener’s benefit um under again so

(42:51) holid Valley which is the main which is the biggest ski resort uh in the area elville like definitely yeah it’s it’s huge and where like I’m in St Catherine so it’s an it’s about an hour and a half to get there where for me to get to Blue Mountain it’s two and a half three hours so it just makes sense quick quick ride over the border and you’re there and yeah I might place next year hopefully you allow me to book you direct US versus on Airbnb and absolutely of course that sounds great

(43:24) because I was on their Instagram and they were they were open for skiing like the first or second week of December just nuts yeah a couple weeks so it’s really nice yeah versus they had no snow and Whistler over Christmas right yeah for whatever reason lots of snow there I should stop talking about this so I don’t oversell the place for the next holiday I know that’s what I always do I talk about things too much and then everybody goes and does it yeah yeah that’s it yeah like I said with the

(43:52) interest rates being higher it is definitely harder to cash flow there um but it it’s still doable still someone could go with a bit of cash or even like if they use a helck at least is variable and then it’ll come down as rates come down right and it’s interesting they have a lot more land out there too so I’ve always had it in the back of my head of doing some sort of developing out there because you can get quite a bit of land for pretty good prices out there yeah because I found your property

(44:17) on Zillow and you have a huge Garage on it yeah you should see the garage now look up the listing there I just looking at it right I just sent it to you on Instagram irn I couldn’t get your phone number quick enough so here irn I’m putting it in the chat uh here on the on the zoom there you go oh you found it on B&B perfect oh wow okay I’m just gonna share screen so so folks on the YouTube will be able to see it awesome so would the gold would this fit the golden rules yeah absolutely would fit the

(44:55) golden rules yeah the big thing is your plan a b and c like you know what what would you do this is my biggest test is like what would you do if your plan a didn’t work out obviously their plan a here is go in run a Hospitality you know unit and be positive cash flow to some degree I’m sure you guys had a wealth building and goal in there as well um now as far as what happens if if things don’t go well well your first pivot might be to sell um would you necessarily uh make money that way I don’t know if Market values have changed

(45:27) enough that you would but then you so you could do that you might lose a little bit not a great plan B your plan C could be to rent it out just to families uh or do some sort of midterm stays uh if if for some reason Airbnb say was outlawed and you know this is this is type of stuff that that we talk about in the book is you know kind of examining what could happen and what you would do in each scenario and this one works out really well right now now would it work out well on a monthly um a monthly basis I feel like John if you guys could strip

(45:57) out the utilities and uh just do a simple monthly rent you might be okay and uh from what I hear New York state is actually not bad to be a landlord in as long as you’re not in New York City um so it does look like you have some um some uh contingencies but one thing to note about you know sort of the plan a b and c and having contingencies is that um it it becomes more and more important to have great contingencies the less Rock Solid your plan a is right if if you know that plan a is like you know 5050 shot of working then you know your

(46:29) contingencies need to be that much better if you know that you’re Rock Solid on your plan a it doesn’t mean don’t have contingencies but you know maybe you have to be okay with an outcome where you might lose a little bit if the worst happens like if we took John back to before he lost everything and said hey if if [ __ ] hits the fan you’re gonna lose 200 Grand per house are you cool with that he probably would have said no and picked a different um a different type of investing but if he was making a million on every house he

(46:54) might have said yeah that’s no problem John do you know what would this rent for this host rent for long is a long-term rental I haven’t looked it up in about three years uh to be honest with you I haven’t looked since we actually bought the property yeah and elal is pretty established with all their short short-term rental bylaws and everything like that they just said pretty much stay out of the main village and do whatever you want on the outside and we pay our our fees and and we’re laughing but no I haven’t looked at

(47:22) long-term rentals there for a long time and then our last plan that Andrew didn’t say is basically we could just use it as a vacation home at the end of the day if we wanted to because the prices are so low there and we love going there it’s beautiful and in the summer and the winter we love skiing and we actually don’t use it very much because it’s always booked but if we had to use it as a vacation home we’d love that too that’s the whole being okay with the other outcome right not every outcome

(47:49) has to be a profitable one um if you’re okay with it for sure how does the low season here compared to niag on the lake it’s want to draw a comparison uh basically a long a long analogy for the listeners benefit most of our listeners will understand Nag on the lake it’s kind of like it’s a what what’s what’s the equivalent in BC for our BC listeners the Napa no sorry it’s a oh it’s escaping the the line region in a VC ohok okag Valley Ok sorry yeah investor here apologies I’m

(48:23) an never getting kid all right all right so yeah John how how does this compare would low season like how would low season compare uh between the between the two low Seasons because they’re different right elville is busy abolutely ski season is it it is yeah so January February March we’re absolutely slammed every weekend every week is pretty much booked at our absolute premium prices and then like I mentioned there’s a season or two that’s pretty slow March and April are a little bit slower as it’s pretty wet but as it

(48:53) dries out May June July August are absolutely crazy and then September October what I didn’t know is they do all these festivals out out in elville way they do all these Halloween festivals and Beer Fest uh cider Fest all these different things so fall is absolutely crazy there too and then November December a little bit slower again and then picks right up again for winter and then how the rent rates compare between the two markets for short-term rentals yeah uh trying to think it’s not as expensive it’s it’s quite a bit cheaper to stay in

(49:31) elville it is a lot cheaper yeah and again 3.95 a night Canadian what’s your Nar on the lake property yeah it’s very different like again like I haven’t done the cash on cash in a long time but our cash on cash is exponentially better in elville than it is in Niger on the lake for us but again we bought the elville property a year and a half before we have that 2.

(49:57) 9 % mortgage rate versus a 7% in Niar on the lake if we had both properties at the same time it’d probably be pretty comparable yeah sorry I don’t have actual numbers for you right now that’s okay but just H like back of a napkin it sounds like you could probably afford two elate V Properties for the price of your nager on the lake property in gener more cash flow AB oh yeah two and a half times probably even yeah for sure so I I can understand why that’s that be your next investment property all right same

(50:25) question for Andrew think about like so let’s let’s just you know everybody talks about the 1% rule or they used to so what what if he does if he does 110,000 divided by 12 so that’s 9166 a month on average what is that out of the say you’re in for what 300 John on it yeah that’s pretty accurate I don’t know if we’re gonna hit 110 that might be a little aggressive but okay say I’m off by a bit you’re 3% rule you’re 3% rule if you hit 110 so right some simple math I mean to put it in perspective at a

(51:01) 2.9% mortgage rate that’s a Grand Slam in my opinion for sure yeah yeah I think we just create a whole bunch of competition for John let’s just push the air date back a little bit until we all uh pick up one as well that’s it yeah exactly uh now both of you guys are big on Research as well and Andrew you I know you’re big into the recreational uh stuff as well uh the question that comes to top of my head is how do you do research on these things in aird air DNA always seems to come up um how do you

(51:30) guys how do you guys do your market research for recreational use properties I mean I can speak like we will’ll try air DNA wherever we can like I’ll buy the subscription to the area um I haven’t done a lot of it like I’m not like the Airbnb master or anything um you know the hospitality when we when we got into toore it was it was pretty much a decision based on what we knew of the area we knew of the the offerings it had the popularity that was growing um and then the limited Hotel fac facilities

(51:57) but air air DNA was pretty useless for the area uh just didn’t have enough base of knowledge on the area to really be that helpful for us so um you know I I feel like we probably uh in hindsight could have picked even better markets but we like that market it was familiar and uh you know I’ve spent a lot of time up there and then sorry you mentioned as recent purchase can you share like high level numbers like how how did it make sense like how did you how that how were you able to come to the decision it was

(52:28) a buy uh Neptunes we were pretty optimistic about what we could do from a um from a a General Revenue standpoint and then also the ability to add units so nine acres there’s only five five cottages on that right now but the zoning allows so the as of right zoning allows for um pretty much as many as we can fit as long as we uh we respect the setbacks so we’re just in the process of doing that the development on that uh profitability uh is there uh we’re working through um those numbers to kind of refine them right now and a lot of

(53:06) it’s going to going to depend on the feedback we get from the municipality in terms of what they’re willing to allow uh but initially we we were quite hopeful that we could make the existing houses profitable but with the uh sort of like the post lockdown era um rates have come down quite a bit and made what would have worked say during lockdowns would have been very profitable less or so so um we actually were a little surprised that we were lower than we expected for season but we also came in low like we or came in late like we

(53:39) didn’t get into the market until we closed in mid end of May of 2023 so we didn’t really have any sort of runup with our U platforms Airbnb any of that like we we inherited some bookings from the previous owner uh but uh you know we’re optimistic that this coming year will will be a heck of a lot better but we’re also not waiting for that to happen we’re going hard on the uh on the development play because the zoning is there waterfront property uh so we’re pretty optimistic about what we can do

(54:08) there it’s just about finding uh one specific model from a construction standpoint that works really well and has a lot of character and you know getting kind of a volume building discount can you kind of paint us a visual picture with because I know you’re very eloquent you you mentioned de like what do these properties look like are they Cottages are they Yurts or so what what’s there right now um looks like you know little Bungalow style Cottages um and then there’s the main house which is

(54:40) you know distinctly not really a cottage it’s it’s on the the road front the previous owner lived in that building but we’ve converted it into one of the uh airbnbs that one is right now available for year round but we just haven’t done what it needs yet to really make it appealing for year round use um and toin Mar’s just like frigid and cold and you know desolate in the winter for the most part uh although we’re looking to change that uh can’t change the weather but we can change what to do um

(55:06) so that’s what’s there right now but we’re looking into a number of different things including like an A-frame um Cottage that we can kind of rinse and repeat um but we’re going to keep it interesting whatever we do uh make it Instagram worthy that you know big thing and then of course kidf friendly uh we do get a lot of families up at that particular location uh it works really well for families so it’s a key of being able to access all the the nearby amenities and then having a heck of a lot of stuff for the kids to

(55:32) do so I know I’m a lot older than both of you so when I went to friend’s Cottages they were usually very very basic I remember going to a friend’s Cottage where there was no ceiling it was just you know a peak roof and then there was yeah there was there was walls between rooms but there was no ceiling so there was no complete separation between bedrooms that’s what I’m saying so you had to be quiet anyone who snored you could hear it cuz again there’s no complete separation uh but Andrew you’re

(56:03) talking about like these had to be Instagram worthy where I stay was not Instagram worthy it was it was you know was Bare Bones no way it was for season you know I mean all the all the all the cutlery plate wear was you know they someone bought it from like the 1970s garage sale you know I mean and that’s what these look like like a lot of these hous the the existing ones like they’re not super great construction um they’re very basic they’re not like Instagram worthy in any way um but that’s that

(56:31) blends in in that market right you can do fine with that um but if we want to do better than fine which is what I always aim for right you never just aim for average um because if you aim for excellent and you hit average then I guess maybe you’ll be okay um but we we always want to go U you know the best we can go within reason and that’s the expansion this isn’t for your like your IG game I imagine there’s returns involved incremental that’s the big thing like we we’re we’re taking what

(56:58) works at the camp and and applying that at the cottages and people come to our camp and they literally want to do yoga po poses in front of the tents and take photos of it and then share it on their Instagram they do they do reals they do you know of them by the fire and and it’s it’s like a memorable Instagram worthy experience and we just want to make sure that we create that same thing because that drives our own marketing for us at no cost right like I mean yeah we invest in the experience but they

(57:23) they advertise Us for free and when we’ve done like on our camp for instance we’ve done it two years in a row where we got 177,000 or more comments of people entering for a free stay at our uh at our facility uh basically just tag somebody you know to to enter yourself for for um a chance to win a free stay and and 177,000 plus each time we did it so they went you know pretty viral explore Ontario we did like a a promo with them and like jointly posted and did the giveaway and it it worked out well so this is what we’re trying to do

(57:55) uh with the Cottages as well I’m laughing because I follow John on Instagram and I know how when you said people literally do yog poses in front of the where they’re staying John John for anyone doesn’t know John John is well traveled and goes to places just as nice as Andrew’s cam Crown just a disclaimer that’s because my girlfriend is in social media she’s a social media manager and influencer so most of this is against my will but uh yeah I have a couple photos are you looking right now Rowan yeah oh

(58:29) my goodness that’s where my eyes are diverted oh boy is this on Courtney’s uh Instagram no it’s on John’s like there like yeah there’s literally John shirtless I’m staring at somewhere really nice yeah I think that one’s Croatia yeah we’ve been on a few fun trips oh boy yeah but if firefighting and real estate don’t work out for me I’m a great photographer and video graer now all of Courtney’s Instagram is pretty much me doing all the videos and photos so I’ve got a another career

(59:03) there waiting for me at least there’s one of you in Bali and I don’t know it’s some sort of hollowed out palm tree that you’re sitting in this talking about John doinker inst on Instagram see maybe I’ll break a thousand followers now thanks everyn we should definitely have a Courtney up to the camp I’m sure shirtless photos of you up there John I’m sure people would love it perfect we’ll set it up that’s hilarious everybody just listening to this is probably uh really scratching their head right now yeah

(59:42) sorry everybody well that’s why I’m telling them where to find John’s Instagram so they’re let in on the joke oh boy so yeah so I guess that’s oh interesting it must be a kpi for Andrew’s business like how many times can they find their campground on someone’s Instagram it really is it’s a funny thing like how do you how do you not just be like if you’re if you’re trying to think about what’s your competitive advantage that somebody can’t copy sure they can’t copy your location but if if

(1:00:09) we’re like a cottage Resort there’s plenty of other Cottages around so how do we become distinctly different and like momentum and first mover advantage in that space is important like if you have a reputation people know you by name or they they know of what you stand for and your cool experience your brand precedes you then um I think that your your longevity is is much more protected and you’re getting free advertising for it and free advertising which is huge right because then that drives demand then your equilibrium

(1:00:40) price per night goes up just like John’s experiencing right now on his Airbnb all of a sudden you got a games room demand is up and your price went up because of it and that’s you know that’s the key longterm because average results like if you look at average results in Ontario for just about anything it doesn’t really make that much sense to go on to go in on it right now uh so it’s it’s doing better than average or getting a better than average price you know or combination of all all the above that’s

(1:01:06) why I need to book John’s Place in elville before before this episode gets out I want to see there yeah downward dog in the garage perfect so I I’m apologize because I think we’ve gotten away a bit from the from the subject the topic of the book uh but I’m guessing that both both of your Investments fall in line with what the book teaches cash flow first you know PL what interesting the the people we interview so many of them you see like the fundamentals coming out in what they’ve done right and some of them maybe maybe

(1:01:40) you would say hey for me I wouldn’t feel comfortable with that like because everybody’s going to apply those fundamentals in their own way right and some people have a different risk tolerance which is fine um you know not not every investment is for every person so yeah for sure I mean that was the point and you know when when I remember and John and I were doing the interview where we were talking about the my chapters and like my fundamentals like uh you know there was a pretty deep discussion there we talked a lot about

(1:02:05) it and I remember you really loving that discussion John so I did absolutely yeah it’s all most of your big principles compiled into I don’t know 20 pages into the like the first 20 pages of the book is all of your the basics of real estate investing and how everybody should approach it in my mind but then after that it’s more of a buffet of how everybody built their wealth so learn the fundamentals from Andrew read the chapters from all the interviewees like find what strategies you like take what

(1:02:37) you like discard the rest and then really Attack One Avenue of real estate and you’ll have a pretty good base from there and this show is kind of like a buffet as well like this episode specifically because Andrew’s Andrew’s recreational properties are significant scale like Andrew you have several Partners on them active Partners on am I correct yeah in in different different different departments like one for like daily operations like yeah you have like an Acquisitions team well the the the four of us uh we all kind of we take on

(1:03:07) different things we do have a significant employee base that works the sites for us so we had up to 10 employees at at the height of the summer at any given time um and that should probably grow this year between two facilities so lots to do lots to grow lots to do lots to grow versus John is you know we’re talking about 300 Grand American that’s that’s a very reasonable bite for most GTA people people that live in the GTA to afford that for sure there is still affordable real estate out there you just have to pick and

(1:03:39) choose what strategy is going to work for it and it just so happens that the Airbnb strategy Works fantastic for it moving forward in the future like I’ve done a lot of flipping of homes so maybe the next step for me is going there buying a cheaper property and do doing some Renovations there kind of combine my two skills we’ll see what happens out there MH and then like for we talked about like risks and plans B A and C um I think we just touch on the fact that you know if if John can get like a large a large summer

(1:04:10) um business then you really reduce the risk you really improve your cash flow as well right like f we talked about Blue Mountain for example like when I was growing up nobody went to Blue Mountain in the summer like almost nobody now it’s nuts right right no actually no sorry people tell me it’s busier in the summer than it is in the winter which is mountain biking too right a big it’s uh it’s like The Bachelorette capital of the of uh of Ontario and don’t don’t don’t ask me how I found

(1:04:39) out I’ve been to a bachelor party there that’s a good point yeah not Bachelor but uh again like there’s probably there’s probably still upside for John as well with with climate change and like I said there was no snow and anywhere almost anywhere in Ontario in the ski area versus elville hat snow right so John still has upside his Investments more protected than other people’s Investments and again Lower entry point really reduces risk for sure and they’re investing a lot of money into the town of el right

(1:05:12) now so I do believe it’s going to get more and more built up and prices have started creeping up but I think it’s going to really again I don’t want to make a prediction or anything but I only see it becoming more lucrative tone out there well the US economy is strong as well with a strong economy comes people wanting to spend more Recreation definitely yeah so less likely needs for plans B and C for sure all right gentlemen I have to go to hop to another interview it’s funny enough is I have to

(1:05:43) go have to drive to Andrew’s office now uh any final words where can people find the book yeah so it’s going to be released on Amazon and we are going to be doing an audible version as well we haven’t quite got there yet but that is one of our big goals um like we were saying we don’t have our official release date yet but we expect it to be out in mid February but uh we’ll definitely be releasing it on both of our platforms Andrew and mine on Instagram to release when the book’s actually coming out but

(1:06:13) as of right now we don’t have a date for it and what’s it called so it’s called Uh real estate Titans tools tactics and wisdom for Canadian real estate wealth I love it so a little bit of a play on tools of the Titans we we had the inspiration from that so we wanted to sort of build that into the title love it love Tim Ferris love for our work we love tools of Titans uh then I had something else but I totally forgot all right gentlemen thanks very much for doing this yeah yeah thanks for thank you for watching if you want

(1:06:45) to learn how to invest in real estate from scratch my team teaches beginners how to use the number one investment strategy that I personally use in a virtual free training class every month go to investor training.com CA /youtube to register for our next class that link is also in the description as well I publish at least two to three videos a week here so subscribe if you want to keep learning from seasoned investors like myself and my guests and if you’re just starting out feel free to ask questions and comment below and I do the

(1:07:11) best to answer each of those comments and questions myself again if you’re ready to learn the nitty-gritty about real estate investing from a professional investor register for our next virtual class that’s at investor training.com

HELP US OUT!

UPCOMING EVENTS

BEFORE YOU GO…

Before you go, if you’re interested in what kind of properties I am looking at in the landlord friendly states of the USA please go to iwin.sharesfr.com for what I consider the best investment for most Canadians, most of the time.

I’ve been investing in Ontario since 2005 and while it’s been a great, great run. I started out buying properties in the 100,000s and now it’s $800,000 to $1,000,000. How much higher can it go? I don’t know

To me, the remaining potential for appreciation does not match the risk hence I’m advising my clients to look to where one can find rental properties that are affordable range of $150,000 to $350,000 US$, with rents that range from $1,400 to 2,600/month plus utilities. As many Canadians recognize, these numbers will be positive cash flow and are night and day compared to anything locally. Plus the landlord has all of the rights, no rent control, and income is US dollars which are better than Canadian dollars.

If you don’t believe me, US dollars are better than Canadian dollars, go ask 100 non-Canadians which currency they prefer to be paid in.

So to regain control of your retirement planning. Go to iwin.sharesfr.com and check out what great cash flow properties are available in the USA.

The best part is, my US investments will be much more passive compared to by local investments as I’m hiring an asset manager called SHARE to hand hold me through the entire process. As their client and shareholder, Share will source me quality income properties, help me with legal structure and taxes, they manage the property manager and insurance provider while passing down to me preferred rates so I save both time and money.

Share will even tell me when to strategically refinance or sell. SHARE can even support investors all over the country for proper diversification hence my plan is to own in Tennessee, Georgia, and Texas. Share is like my joint venture partner but I only have to pay them fees while I keep 100% ownership and control.

If your goal in investing is to increase cash flow, I don’t know of a better strategy for most Canadians most of the time. One last time that’s iwin.sharesfr.com to see what boring, cash flowing real estate investing can look like on your path towards financial peace.

This is how I’m going to make real estate investing great again for my family and hope you choose the same. Till next time!

Sponsored by:

This episode is brought to you by me! We don’t have sponsors for this show. I only share with you services owned by my wife Cherry and me. Real estate investing is a staple in my life and allowed me to build wealth and, more importantly, achieve financial peace about the future, knowing our retirement is taken care of and my kids will be able to afford a home when they grow up. If you, too, are interested in my systematic strategy to implement the #1 investment strategy, the same one pretty much all my guests are doing themselves, then go visit www.infinitywealth.ca/events and register for our next event.

Till next time, just do it because I believe in you.

Erwin

W: erwinszeto.com

FB: https://www.facebook.com/erwin.szeto

IG: https://www.instagram.com/erwinszeto/

Leave a Reply

Want to join the discussion?Feel free to contribute!