Managing Six Figure AirBnBs in Canada & USA With Spencer & Ashley

New construction six plexes in Windsor, Ontario, tiny house communities, the status of real estate and investing in Canada, solving for happy, AirBnb investing: US vs. Canada, where is better, my show guest and I disagree. I’ll let you, my 17 listeners decide. All this and more on the Truth About Real Estate Investing for Canadians! What once was ranked #81 on all of iTunes in the Business category but much has changed.

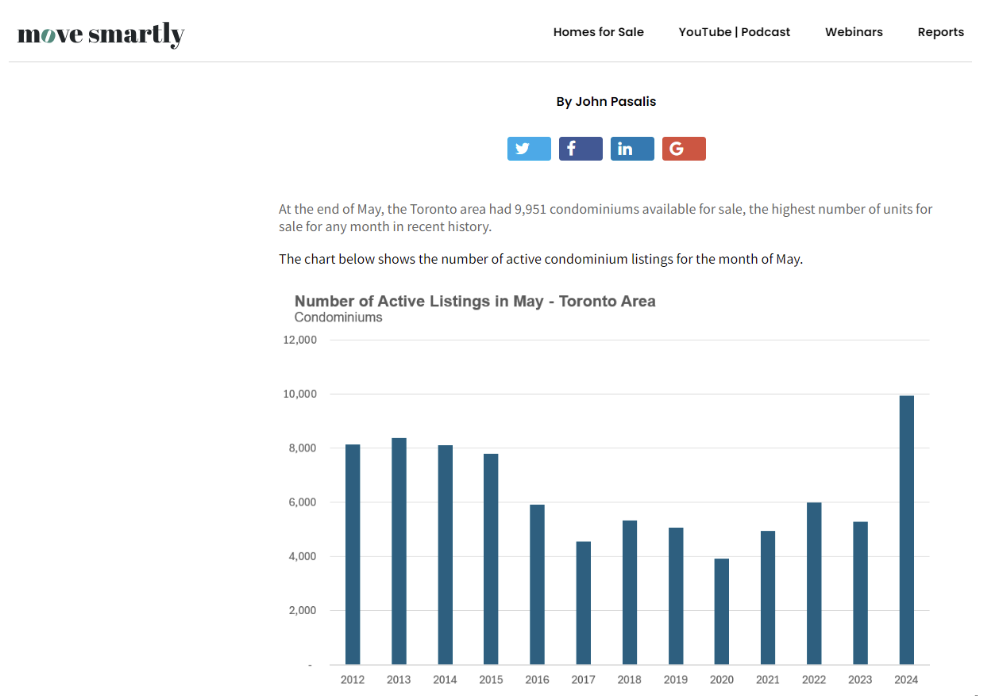

Real estate investing in Canada has really fallen out of favor. I see it at work, my own listings, on social media: all the condo bulls have gone either quiet or pivoted to coaching. I feel so bad for the agents I see paying for paid advertising of new construction condos while there are nearly 10,000 condos available for sale right now per John Pasalis of Move Smartly.

Condo investors are rushing for the exits, unfortunately if you bought a small condo, there’s lots of competition and very few buyers.

My friend in Toronto with a 1 plus den however immediately rented his condo AND had three offers to purchase. I’m not a condo investor but I’ve known for over a decade that the 1 plus den condo is the poor person’s two bedroom or the rich persons’ two bedroom so if you’re going to invest in one, make it a plus den as even in condo winter, the best practice is still working.

Housing inflation continues: my house insurance on my remaining portfolio in Hamilton, each one just went up $5-700/year. I’m not looking forward to rental licensing adding another $6-700. Our property tax is going up only 5.8% but they’re deferring a bunch of stuff so they only kicked the can down the road to be dealt with in the future.

This is why when a Canadian not from Alberta is pitching me a deal I ask them if their projected cash flow improves over time or gets worse? Between rent control and inflation.

But bless those who continue to create housing supply. I have an idea how difficult it is and we certainly need more of it. It’s the only way prices will come down like we’ll see in small condos in Ontario and BC.

I just returned from Windsor, while I was there the sale of my daughter’s house closed yay! Milena Simsic and her business partner Brandon Finn were kind enough to host me as their speaker. It was a pretty sweet event. $20 admission got you stone over pizza dinner and there was tons of leftovers as funny enough, Milena and I don’t eat pizza LOL

For the first time ever, I gave a presentation with no power point slides, just a white board I borrowed from my office and drew a T chart: Canada on one side, US on the other and categories such as mortgages, landlord rights, cash flow.

The feedback was excellent, that you to everyone for coming and saying hi: Cody, Louis, Kyle, Matt, Kevin, Jonathan, Savio, and Mike Seal. Thank you again to Milena and Brandon.

If you have not listened to my podcast interview of Milena Simsic: https://www.truthaboutrealestateinvesting.ca/how-a-nurse-became-a-millionaire-and-top-1-realtor-with-milena-simsic/

We really dug into her story and journey and if you want to be young and successful, she’s pretty much laid out hers on the show.

“Solving for Happy.” I just finished Mo Gawdat’s book. I can’t recommend it enough thought caution to parents, it’s tough to listen to at times. Mo reads the audio book himself so each time he revisits his son’s accidental death he gets choked up and coincidentally someone decides to cut onions wherever I happen to be when it happens.

Some of the nuggets include accepting death, no amount of money will make you happy, do more of what makes you happy, recognize what doesn’t make you happy and do less of if. In the absence of evidence based decision making, go with happiness.

I can’t tell you how much my work makes me happy I’m enjoying educating and sharing with Canadians about how much better and easier it is to be a US landlord and here locally while I get paid and have equity in SHARE.

Which reminds me, I’m hosting a free, virtual tour of USA income properties including the one I’ve conditionally purchased in Kansas City, MO for 1200 sq ft detached, 3 bed, 1.5 bath. Register here: https://us02web.zoom.us/webinar/register/5417189936607/WN_EQ_jWXpESF-r77oLzd28eg

Off market, BRRRR: $157,500 to buy, $25,000 renovation, equity uplift of hopefully 10k. $1,495 monthly rent. 5.9% capitalization rate which in other words is operating profit yield before financing costs. Cap rate is a must know for all sophisticated investors because no one can tell you what your cash flow is because everyone’s financing is different. Pros know cap rate, it’s the lingo of our industry.

Link for full definition: https://www.investopedia.com/terms/c/capitalizationrate.asp#:~:text=Understanding%20the%20Capitalization%20Rate,cash%20and%20not%20on%20loan.

Managing Six Figure AirBnBs in Canada & USA With Spencer & Ashley

On to this week’s show, as always, we try to focus on cash flow the young, lovely couple Spencer and Ashley Giles are Niagara- based real estate investors with a shared love of travel (they are literally vacationing in Nashville, TN right now, hopefully they find an AirBNB investment there as I hear Nashville is awesome), fitness, and dogs. They started investing in 2018 and have since expanded their portfolio to 13 units with a mix of short- term and long-term rentals. Spencer and Ashley co-founded Travelluxe Inc. in 2019, a short-term rental management company, which currently manages over 45 units across Canada and has expanded to the USA. We go into detail about that on the show including the numbers.

They were able to leave their corporate jobs in 2021 and 2022 to focus all their efforts on their businesses. Their love for travel has brought them all around the world where they are able to mix work and pleasure by creating systems that allow them to be location independent.

Instagram: https://www.instagram.com/spencerandashley/

Website: https://spencerandashley.com/

Ellicottville Airbnb: https://www.airbnb.ca/rooms/53721048?locale=en&_set_bev_on_new_domain=1719192849_EAMTU0NWYwZTcwNj&source_impression_id=p3_1719192850_P3OWaZ8QQzOrJpJd

To Listen:

** Transcript Auto-Generated**

On iTunes: https://itunes.apple.com/ca/podcast/truth-about-real-estate-investing…/id1100488294

On Spotify: https://open.spotify.com/show/6Z8yd37AQfQI5DK0J0Xwzz

Audible:https://www.audible.ca/podcast/The-Truth-About-Real-Estate-Investing-for-Canadians/B08JJS91WR

HELP US OUT!

UPCOMING EVENTS

BEFORE YOU GO…

Before you go, if you’re interested in what kind of properties I am looking at in the landlord friendly states of the USA please go to iwin.sharesfr.com for what I consider the best investment for most Canadians, most of the time.

I’ve been investing in Ontario since 2005 and while it’s been a great, great run. I started out buying properties in the 100,000s and now it’s $800,000 to $1,000,000. How much higher can it go? I don’t know

To me, the remaining potential for appreciation does not match the risk hence I’m advising my clients to look to where one can find rental properties that are affordable range of $150,000 to $350,000 US$, with rents that range from $1,400 to 2,600/month plus utilities. As many Canadians recognize, these numbers will be positive cash flow and are night and day compared to anything locally. Plus the landlord has all of the rights, no rent control, and income is US dollars which are better than Canadian dollars.

If you don’t believe me, US dollars are better than Canadian dollars, go ask 100 non-Canadians which currency they prefer to be paid in.

So to regain control of your retirement planning. Go to iwin.sharesfr.com and check out what great cash flow properties are available in the USA.

The best part is, my US investments will be much more passive compared to by local investments as I’m hiring an asset manager called SHARE to hand hold me through the entire process. As their client and shareholder, Share will source me quality income properties, help me with legal structure and taxes, they manage the property manager and insurance provider while passing down to me preferred rates so I save both time and money.

Share will even tell me when to strategically refinance or sell. SHARE can even support investors all over the country for proper diversification hence my plan is to own in Tennessee, Georgia, and Texas. Share is like my joint venture partner but I only have to pay them fees while I keep 100% ownership and control.

If your goal in investing is to increase cash flow, I don’t know of a better strategy for most Canadians most of the time. One last time that’s iwin.sharesfr.com to see what boring, cash flowing real estate investing can look like on your path towards financial peace.

This is how I’m going to make real estate investing great again for my family and hope you choose the same. Till next time!

Sponsored by:

This episode is brought to you by me! We don’t have sponsors for this show. I only share with you services owned by my wife Cherry and me. Real estate investing is a staple in my life and allowed me to build wealth and, more importantly, achieve financial peace about the future, knowing our retirement is taken care of and my kids will be able to afford a home when they grow up. If you, too, are interested in my systematic strategy to implement the #1 investment strategy, the same one pretty much all my guests are doing themselves, then go visit www.infinitywealth.ca/events and register for our next event.

Till next time, just do it because I believe in you.

Erwin

W: erwinszeto.com

FB: https://www.facebook.com/erwin.szeto

IG: https://www.instagram.com/erwinszeto/

Leave a Reply

Want to join the discussion?Feel free to contribute!