7 Figure, 20yr Appraiser From BC, To Real Estate Developer in Edm with Christine Traynor

Welcome to the Truth About Real Estate Investing Show for Canadians, my name is Erwin Szeto

The City of Toronto has passed the renoviction by-law which will come into effect next summer. While I’m all for protecting tenant rights and balance, friends of mine were in the news because they needed to upgrade all the plumbing in their apartment so ceilings had to come down in every unit on one floor as the building is 50 years old so of course much of the infrastructure does not support modern day living.

Speaking of modern day living, my friends were upgrading suites to have ensuite laundry and dish washers. Naturally, plumbing and electrical upgrades would be needed and this is a good investment as who doesn’t want a dishwasher and ensuite laundry and willing to pay more rent for it? Most do thus improving the value of the building.

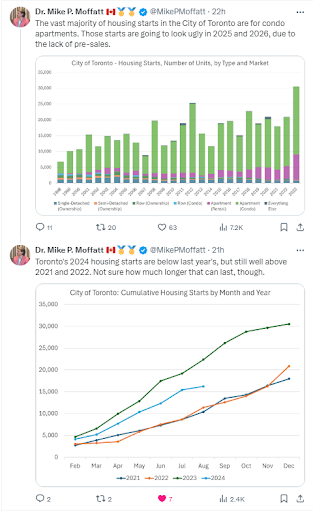

But because our immigration rates are faster than we can build, rents have skyrocketed and vacancy rates are at historic lows. Inflation has driven up build costs so new construction landlords are in a hard place as the rents they need to just break even on hard costs are hardly affordable to the average Canadian.

A friend of mine from the gym was just telling me his mortgage on his new construction, GTA, bachelor sized condo is over $2,200 plus $400 condo fee but his rent is $2,000. Not a good investment in most people’s books and $2k rent for a bachelor, 400 square foot apartment is a lot of money.

Now with anti-renoviction by-laws spreading across Ontario, first Hamilton, then London, now Toronto and I know Ottawa and Waterloo are considering it. The question begs, why would a landlord renovate? Say life safety systems need to be updated like fire safety systems: sprinklers, fire escapes, floor, wall ceiling fire rated separation. It’s complicated, expensive, disruptive to the tenant but life saving. How will a landlord get it done with renoviction by laws?

Keep in mind the onus is on the landlord to rehome the tenant in a similar unit at same rent or compensate any rent differential and if the landlord fails to do so, the fines are in the hundreds per day so an N13 eviction for renovation is really not financially feasible.

And the investment hypothesis only gets worse in Ontario IMHO.

On the positive, I recently became a member of SOLO: Small Landlord Owners of Ontario, a not for profit organization to lobby in support of small Ontario landlords, provide support to landlords with tenant issues beyond the scope of what Landlord Self Help Centre provides.

I’ve spoken to a couple of the board members and interacted with members of SOLO on the free Facebook group and folks are truly helpful. Check them out at www.solo.ca or on Facebook: https://www.facebook.com/groups/sololandlord

Just note they do verify members of the Facebook group, the most stringent I’ve seen in having to prove one is indeed a landlord.

SHARE and I are also a proud sponsor starting January 1st of SOLO and hope to support their efforts in supporting small landlords who honestly get the short end of the stick. I look forward to a mutually beneficial relationship in 2025.

7 Figure, 20yr Appraiser From BC, To Real Estate Developer in Edm with Christine Traynor

On to this week’s show!

In this episode, we sit down with Christine Traynor, from Victoria, BC, a seasoned real estate professional who has navigated the industry from multiple angles. She started as a paralegal in mortgage enforcement/foreclosures, became an appraiser in 2002, worked in for a high end real estate developer then buying a real estate appraisal firm, buying two more with creative financing and in 2024, sold those businesses for a seven figure exit.

What’s now keeping Christine busy is her current ventures as an Edmonton, Alberta real estate developer, multifamily investor, Christine shares a wealth of knowledge and insights that are sure to inspire.

For those looking to raise capital, specifically registered funds like RRSP’s and TFSA’s, Christine is involved with a Mutual Fund Trust as part of a 94 unit build so you’ll want to hear about that.

Christine shares how and why she chose not to invest in local, tenant friendly, unaffordable Victoria, BC for landlord friendly Edmonton which is something pretty much every BC, Ontario, Quebec investor from a tenant friendly jurisdiction is considering.

Christine is an advocate for empowering women around investing and finances, and is the host of She Builds Wealth, a (free) online community where she leads women in conversation around real estate investing, business, money and mindset. She is also the creator of She Builds Wealth: A Foundational Course for Women on Building Wealth in Real Estate.

To follow Christine:

Instagram: @Christine.traynor.reinvesting

Website: www.christinetraynor.com

Please enjoy the show

To Listen:

** Transcript Auto-Generated**

(00:01) welcome to the truth about real estate investing show for Canadians my name is Rano did you know that the city of Toronto has passed the renov eviction bylaw which comes to effect into effect next summer uh while I am all for protecting the rights of the vulnerable which means the tenants um I Still Believe In Balance uh friends of mine were in the news because they needed to upgrade all the plumbing in their apartment so ceilings had to come down in every unit on one particular floor as the buildings 50 years old so of course

(00:32) much of the infrastructure does not support modern day living or standards or code uh speaking of modern day living my friends were upgrading sweets to have on Suite laundry and dishwashers naturally plumbing and electrical upgrades would be needed and this is a good investment uh as who doesn’t want a dishwasher on sweet laundry and willing to pay for it most are uh when you increase the value uh and increase the rents of properties that improves the value of the building which is what every real estate investor

(01:04) wants to do uh but because of our immigration rates they’re growing faster than we can build uh housing rents have skyrocketed and vacancy rates are at historic lows uh inflation is driven of build costs uh so new construction landlords are in a really hard place as rents uh that they need to break even on hard costs are hardly affordable for the average Canadian uh a friend of mine from the gym was telling me how his mortgage on his new construction GTA located Bachelor siiz condo is is over $2,200 plus he has a $400 plus condo fee

(01:39) but his rent is only $2,000 not a good investment in most people’s books and 2,000 rent for a bachelor 400 foot apartment that’s a lot of money for the average Canadian uh now with anti- eviction bylaws spreading across Ontario first it was Hamilton yay my favorite then London Ontario now Toronto and I know Auto waterl are considering it and who else who else who knows who else is considering it the question begs why would a landlord renovate say Life Safety Systems need to be updated like fire safety systems such

(02:11) as sprinklers which would need Plumbing obviously fire escapes floor wall ceiling fire R of separation is complicated expensive disruptive uh you wouldn’t want to live when around in a unit when these things are being done uh Leen plaster is when Airborne is just nasty uh but they are life but these types of fire rated safety upgrades are indeed life saving so how will a l get these renov types of Renovations done without renov without with these renovation law bylaws in place now again I Believe In Balance I absolutely

(02:47) believe in protecting the vulnerable now keep in mind now with these renovation bylaws the onus is on the landlord to rehome the tenant during the renovations in a similar unit at similar rent or compensate any rent differential and if the landlord fails to do so the rents the the fines are in the hundreds per day uh so for an n11 eviction for renovation it’s really not financially feasible because in reality the landlord would have to put up the tenants in an Airbnb or hotel which again they can’t recoup that cost and so so and my

(03:24) opinion the investment hypothesis in Ontario only gets worse on the positive I just recently became a member of solo that’s an acronym for small landlords sorry small owners landlords small ownership landlords of Ontario it’s a not for-profit uh organization to lobby and support uh small Ontario landlords Provide support to landlords with tenant issues beyond the scope of what the landlord self-help center provides uh I’ve spoken to a couple of the board members interacted with members of solo on the free Facebook group and folks are

(03:55) truly helpful and there’s a lot of sad stories of LW um you can check them out at solo.com groups solo landlord just do note that they do verify their members uh there’s over 8,000 of them uh again it’s pretty helpful group it’s uh but they do have the most stringent screening I’ve seen in having to prove that one is indeed a landlord but it was pretty fast like you know I think I was approved within 12 hours no big deal now Shar and I like happy to announce that Shar and I are proud sponsor ERS starting January 1st of solo and Hope to

(04:33) support their efforts in supporting small landlords who honestly get the short end of the stick I look forward to a mutually beneficial relationship in 2025 uh and now in case you investors out there don’t want the short end of the stick uh for those interested and learning more about what I consider the best practice for investing in real estate I want to personally invite you to the to a free hybrid training event which means both in person and Via Zoom webinar I call it how Canadians can Leverage us real estate for Passive

(05:01) scalable and tax efficient income streams on Thursday November 28th towards at 7:30 p.m. for those in person 8m Eastern Standard Time For Those online here’s what you learn where to invest and capitalize on a trump government how are clients are making money on the buy executing perfect burs without leaving home diversifying to USA for better cash flow and returns in landlord rights links are in the show notes on to this show in this episode we sit down with Christine trainer from Victoria BC a seasoned real estate

(05:33) professional season is putting it lightly uh she’s navigated this industry from multiple angles she started as a pargal in mortgage enforcement SL forclosures she became an appraiser in 2002 yes ladies and gentlemen she has experiened Beyond five years like a lot of the gurus who are going bankrupt these days anyways we’re she worked for a high-end real estate developer then she bought a real estate appraisal firm bought two more with creative financing and in 2024 sold those businesses for a seven fig exit now with all this money

(06:07) and free time what’s keeping Christine busy well her current Venture is in Edmonton Alberta as a real estate developer multif family investor Christine shares a wealth of knowledge and insights so that so be be ready to be inspired for those looking to raise Capital specifically registered funds like the RSP rrsps and tfsas Christine is involved with a mutual fund trust as part of a 94 build so you want to hear her experience on that and the benefits of uh Christine shares how and why she chose to invest in how why she chose not

(06:38) to invest in tenant friendly unaffordable Victoria BC for landlord friendly Edmonton which is something pretty much every BC Ontario Quebec investor from a tenant friendly jurisdiction is considering Christina is an advocate for empowering women around investing in finances and she is the host of she builds wealth a free online community where she leads women in conversation around real estate investing uh business money and mindset she is also the creator of she builds wealth a foundational course for women in

(07:10) Building Wealth in real estate to follow Christine you can find her on Instagram at christine. trainer s trainer with a y t r a y n o r. re investing that’s one word or her website it’s a lot easier www. Christine trainer that’s CR oh that’s bad c h r i s t i n e t r a y n o r.com please enjoy the [Music] show hi Christine what’s keeping you busy these days hey irn um goodness what’s keeping me busy um besides two teenagers real estate obviously that was a one of the shortest answers ever on history of this [Laughter]

(08:04) show uh so I invited you on the show because you have a a sizable Edmonton build project going on but even before we get into that can you can you tell the listener a bit about yourself yeah absolutely so uh my background irn we won’t go too far back but um I my background was as a real estate appraiser for gosh over 20 years so I got into uh real estate appraisal and um I recently exited um so I eventually ended up buying real real estate appraisal firms and I recently exited those businesses this spring and um yeah

(08:41) so that sort of you know how I kind of got into real estate investing was just um yeah seeing all the deals coming through the office and what people were doing and what was working and what wasn’t working right and now it’s in your bio you had a seven figure exit so I imagine you did well yeah yeah yeah no I did it was it was actually really fun I um ended up buying the first company through creative Finance before I even knew what creative Finance was so I was approached by someone who was wanting to buy a company um and she wanted a

(09:11) partner um she wasn’t designated as an appraiser it was actually her mom’s company and um so she asked if I wanted to buy it and um after saying no the first time a couple years later I’d seen that something hadn’t sold and decided to jump into it and at the time you know didn’t have funds to purchase a company and um she’s like you don’t need any money and I was like how do you buy a company with no money like I never never even entered my my mind right and so end up buying it on a 0% interest um you know fiveyear term and then the company

(09:40) at the time was you know doing well enough to pay us both an awesome salary as well as pay this you know creative finance loan and that was kind of the the start of of kind of wrapping my head around okay there’s some interesting things we could do here and now again it’s from your bio so I’m not asking you anything that’s not public yeah yeah yeah so you bought out your partner you did you elaborate yeah yeah so about a year or a year and a half I can’t remember the exact time but into the purchase uh we just both kind

(10:09) of knew that it wasn’t the best fit like the working relationship wasn’t wasn’t just wasn’t really jelling I guess you could say there was nothing really negative going on but it was also just feel like okay we’re not we’re not really suited to be partners um and so we mutually agreed it was like okay who wants the company you know do you of course because it was her mom’s company it was like if you want the company awesome um um you know you can findy me out and if you want me to take over the company I’m happy to do that too so she

(10:34) had a chance to kind of mow that over and she was like yeah um I want you to take the company um and so I made her an offer and um bought her out and by that point we’d also purchased an office space so bought her out of the office space as well and um and yeah and so I was essentially on on my own and then shortly after that um someone else had approached me anaser who wanted to come work for me he was like youve got to meet my dad he’s got a company he need to sell it he needs to retire um you know I know you bought this company do

(11:03) you want to buy you that’s TR to connects you with him I was like oh sure I’ll have a conversation um and so I ended up connecting with him and um you know basically two months later um had bought his company also St of Finance um and so it was just like okay that that worked out really well and because I already had all the systems and processes in place um you know from the initial company you know it was really an easy transition to kind of just you know not close over to the other one um and then you know basically two years

(11:32) after buying that company um someone else had approached me about buying a third company and had kind of said hey I know you’ve bought these other two it was actually a group that had purchased um a company from Simon wanting to retire and um and they sort of thought it was going to be a really easy thing to run off the side of the desk kind of thing which everything else they had going on and realized there was a little bit more to it than than they wanted to take on and so they’d asked if I wanted to buy it and so I bought that third

(11:57) company so um yeah just so people hear in kind of what was going on it’s a pretty um intimate industry right like you know there’s not necessarily I mean there’s a lot of appraisers but in terms of firm owners and who’s doing what everyone kind of knows everyone so um yeah that’s kind of factory there now you living in Victoria BC uh were these all all these companies localish yeah they were all in Vancouver Island so um yeah one one was kind of Greer Victoria um all over the island and another one was in the CCH and

(12:26) Valley um sort of a pocket kind of the dunan area and then um the other one was also great Victoria so yeah all on the island amazing and then can you elaborate on creative financing like vendor takeback mortgages also 0% oh like on you mean like on the purchase of the businesses any of them even when you bought your partner out yeah so well so when I bought the first company essentially it was just um yeah vendor take back on on the purchase price um and it was a 0% interest and I think that um just came from probably

(12:59) the relation ship and um maybe not I mean I don’t really know but yeah so that was just sort of a fiveyear buyout of okay here’s the price and we’ll just pay this out monthly over five years um so that was pretty straightforward on that one and then when I bought my partner out it was basically the same thing it was like okay I’m going to pay you out and I think I paid that out over two years um so the the original yeah so again the companies were doing well right so there was enough cash flow in those businesses to pay them out so it

(13:25) was like let’s just get that done right so I agree we agreed that I would just keep paying her her regular monthly salary um until until it was paid off um so that worked out really well it was like I I still paying her but she was just wasn’t there um and that was while the initial loan was still going so I kind of had two St of Finance um bu a taxing at the same time um on the first one and then on the second one um it was so interesting so um the owner had wanted just had a specific number in mind and this is right before Co it was

(13:56) January of 2020 and when we so we were kind of negotiating like you know in the the late fall of 2019 but actually have purchased it January 1st 2020 and so he had a number in mind and you know with smaller companies it’s really like a lot of the order like the the value is attached to the work that’s coming in obviously right and if that person is no longer there you know you run the risk of those orders maybe not coming in right because that person’s going and so number mind yeah exactly right and so I was like if if it you know if you’re

(14:26) planning to he was still planning to work for a couple years and um essentially I said to him whatat about if you stay on for two years because that’s what you want to do anyways and I’ll pay you a percentage of each order that comes in right instead of your number I’ll pay a percentage if it ends up being more then then great for you um and if it ends up being less then that’s just what it is and so he agreed to that and we had a two-year um buyout and um so just every order that came through the office he got paid a percentage

(14:51) every month um and anyways in the end because things obviously went crazy during Co I ended up paying him double than what I would have paid him if I agreed to his first number um which is kind of crazy to think about but it was still a win-win right like it was still a win-win like I I would have been better off if I had taken um his number but I was like yeah I’m not sure like what if you just disappear so for me it was just that balance of of risk and um that’s what felt better to me at the time and you know hindsight who knew but

(15:20) um again you know because the work was coming in if if the real estate market hadn’t have gone crazy like it did during Co right he wouldn’t have you know he wouldn’t have been double we wouldn’t have known we couldn’t have known that market was going to go as crazy as it did right so have so many questions owners on this show uh just is a fun fact for the for the listeners benefit population of Vancouver Island is 864,000 sound right roughly yeah sounds yeah sounds about right I think VI Creator Victoria is like around under the

(15:51) 400,000 I think that’s the top my head so yeah but the island it’s pretty small sound that small but I mean compared to you know big cities now as an appraiser you know on onario was pretty Bonkers for appraisals for the last I don’t know how long it was only until we until things went sideways the last two years or so where appraisals we were having any sort of trouble with appraisals but for a good portion of my career being I’ve been I’ve been a I’ve been in a been a realtor since 2010 so almost my entire career of being

(16:25) a in real estate investing full-time with Investments is appraisal pretty much always came in whatever our clients PID for it and and with properties and at least well actually you probably you probably seen prices decline as well uh in the west as well prices have declined significantly here in the East and U so now people are ask asking this questions how come those properties are praised but anyways my bigger question is what are some of the what are some of the things you’ve seen in your career that are interest peaking yeah I mean I

(16:58) did I did see it in that sort of 070809 time period um as well because I started in the early 2000s um and so I definitely saw it with like that preconstruction uh stock where people bought property say in ‘ 06 um you know just like now people bought pre-construction property in the peak of of the market and then you know they’re not getting that appraisal done until two years later when the project is ready um and I mean the values you know depending on on price could be a CLE $100,000 um less right and of course do

(17:27) an appraise that you’re basing on current sales right and so um I think that’s always the challenge there is I will say for anyone doing pre construction um there’s only one lender um that I’ve ever seen that I know of and and I believe this to be true um and it’s RBC and they’re the only lender who um will actually so if you buy a preconstruction property say today they will order the appraisal today and they do not recheck appraisal income like you’re approved at the time’s purchase so you know I have to to sell

(17:58) preconstruction um projects as well I took a brief um break during break from appra but we would always say go to RBC right if you can get qualified with RBC because then you know you’re GNA you’re going to be good for that mortgage right if you change your job or if something happens or you know just to protect yourself so um but yeah definitely you know people and people always ask like you said how did how do they have praise because when the Market’s going up it’s easy to be kind of optimistic right things are moving prices are increasing

(18:25) um and so a lot of what we kind of saw in the 2022 and I don’t know if it the same in Ontario but the market kind of peak here in March of 2022 and you know people that bought property you know say February March during that time period and they were waiting to get those appraisals um you know and they might have gotten caught up in the hype I mean even on those two months later they were coming back to $100,000 left potentially in some cases where people had overpaid right so you know unless you’ve got that extra cash

(18:51) um people didn’t have the ability to close so definitely have seen a lot of that and the other thing we see a lot of is people you know on the appraisal side not properly plan their renovations right so people you know spending money on Bas and Suite are renovating um and you know cost overruns and then not being able to actually refine it so let’s just say you know you bought a property for a million dollars you’re spending 200,000 you know in their mind it’s going to be worth 1.

(19:18) 4 right and so that was their plan you know air close to refinance and pay off credit cards or line to credit um and and you know the biggest thing we all know is like you know crost doesn’t always equal values right so not properly mapping construction projects um is a big one too I’m guessing that’s from the more novice investors or can you can you paint broad brushes on who’s making those kind type of Errors H I wouldn’t say it’s novice or when as shocking as that sounds um yeah I mean even on new construction stuff too right I mean

(19:49) we’ve seen like people that have done you know probably built like you know 20 new 20 stuff builds you know they’re actually Builders um you know and and cost overruns not getting handled properly or not getting their financing sorted um you know I think people just a lot of people just don’t do their homework right it’s like I did this before it wasn’t a big deal right but markets change all the time lender requirements change all the time so just because something worked last year right with your financing doesn’t mean it’s

(20:14) going to work this year you know um so yeah I think it’s I wouldn’t say it’s notices you’d be surprised y yeah that’s that makes sense uh I have a friend good friend at uh one of the home builders associations in Ontario and it it it’s the medium it’s medium and the small size developers Builders who are are really hurting it’s the it’s the large absolutely large ones with deep Deep Pockets who can pull land for cash that are sitting pretty at least they not stressing yeah totally like they’re they’re fine right but if

(20:47) you’re relying on those um you know pre-sales or that that financing um to to move forward it can be definitely be a challenge this is why I’ve stayed out of it largely guess yeah I’m I’m very risk adversed with my with my real estate and uh portfolio but uh you are a developer it’s not a bad thing I think I think kind of the point of the show is also like I meant for this to be a buffet right yeah everyone can learn from people in all different walks of life specifically real estate investing this is real estate investing show yeah yeah

(21:18) and then people my intention is for people to take take a deep look at my guest and also themselves to understand who they are and what they’re capable of yeah and if they can do what what our guests do right so that’s why you’re on yeah I love you are developing and again you but you also have a wealth of what sorry you like you have like a 20y year career in appraisals yeah I did get my I think was a couple years ago got my 20 year like P or whatever they send you in certificate like how could it be 20 years I still

(21:48) feel like I’m 25 right like how like how is that even possible but um two major Cycles two major Cycles yeah 100% you’ve seen the worst have seen the worst for sure SE want be developer totally it’s like if that doesn’t mean but I think that’s a good thing right you need to see what can happen right abely The Bad The Good the Bad and the Ugly right and and be aware of the risks and and challenges that can can happen with whatever you’re getting into so I think that that you know having been on the real estate appraisal

(22:19) side you know seeing you know lots of foreclosures come through the office where people are having challenges um you know that’s also equi me to feel confident in in moving forward in the decision um that I’m making yes you are you have a much more you can make a much more educated decision than myself that’s too what’s a good investment what’s not well I wouldn’t go that far but it’s also just um yeah I think it’s and I also think too it’s not getting caught up in the hype right like I think that that’s what that’s the biggest

(22:47) thing that happens right is when you’re in a cycle where things are hot and everything’s moving and everything gets caught up in the hype and you know buying frenzies and you know paying for properties and you know you’ve got to be able to look at things I think with a longterm you right of you know are you going to be happy with this is this is this purchase going to make sense over the long term right um because you know if you’re in a situation where you need to refinance for some reason and you bought at the peak of the market you

(23:10) know you’re you’re not going to be able to right so it’s like does your plan make sense with with what you’re doing oh and by the way I checked RPC stock after what you mentioned and they’re doing just fine yeah so the market seems to be okay with what they’re doing totally and you know what’s funny like I’ve had a lot of mortgage brokers who I mean because obviously most of my clients were mortgage brokers right Banks mortgage brokers credit unions and they would all try to tell their clients like oh yeah you can actually um you you know you can

(23:39) qualify for this you can get you pre-qualified but they’re always running checks you know at at the end right and that’s so people run into trouble and so I’m honestly here doing anything preconstruction um talk to RBC a mortgage specialist there who does these types of deals I’ve got someone I can recommend um if if anyone needs and um it’s incredible right because you protect yourself so so yeah even with their lending practices they do seem to be doing okay which is a good thing all the condo P out there I’m

(24:05) surprised more people didn’t go to our BC I don’t know if it’s a thing that’s not well known I I honestly don’t know yeah it’s like like nobody knows no one’s heard of RBC before kind of right like that’s that’s where I would go we only have what five big Banks well yeah and I think the other thing too is they’re not accessible right to the broker town right they’re only like like Brokers can access RBC right so that’s probably one piece to yes thankfully a lot of my friends who are in the broker channel will tell you

(24:36) what’s best for you yeah yeah yeah and that’s not always true with all everyone that’s piding commissions all right so let’s talk about developments what what what spurred the interest into being a developer so so tell us about the journey to becoming a developer and yeah let’s start there yeah yeah yeah well I feel like I always knew that I wanted to shift into I mean I’ve always been invested in real estate um you know I bought my first condo when I was 19 um it was a foreclosure um you know I I bought a property that was a development

(25:07) site I think in my early 20s I didn’t hold it long enough but I still doubled my money like little little things that um but I always knew I want to shift into it in a bigger way and I think um it wasn’t really until things had kind of slowed down after the peak of of March of 2022 that I was like okay I think it’s time like I think I can actually create space in my life to uh really explore this a little bit further in the way that I want to because I was always really you know I was busy with appraisals right running free firms um I

(25:34) got a family as well and so it just felt like um I didn’t want to just jump jump into things without actually having the proper knowledge and education I I felt like I knew I knew you know I had a pretty good Baseline and knew a lot um but I knew I didn’t want to jump into uh doing developments on Vancouver Island um for a few different reasons I mean it’s an appreciation Market here and I do invest here and it’s an incredible place to live and invest um but I knew that I wanted to i’ always kind of had my eye in Alberta um and Edmonton

(26:00) specifically and so i’ kind of been following that market and so um when it kind of had this time and the space um yeah I just kind of started diving into it a little in a little bit of a bigger way and I ended up hiring a um a real estate Co so I end up sing someone to that knew Alberta and new new construction that I felt could fill in the Gap right like with the know I had could fill in the gaps and help me um kind of get get on my way so that was sort of the first thing that I did and that was really invaluable

(26:29) um in terms of getting getting the right information to feel comfortable moving ahead so and then also opening the doors to contact right contacts and assist to projects and and things like that um and so yeah so I yeah just sort of Dove Dove all in and um yeah here we are so I’ve got I think at the moment I’ve four yeah four projects actively under construction and then um I’m also working on a 94 unit equipment building project um as well that’s a mouthful and then you had so little to say when I asked what was keeping you

(27:03) busy well I said real estate investing I said real estate investing and teenagers I real estate investing three words yeah yeah real estate in they cover four projects in their construction and a 94 unit building all in three all in three words yeah I mean do you car a shout out your coach yeah I know I’d love to so I end up hiring Russell westcot um and I think he’s been on your show um and I think only three times he might be up there with the totally so I ended up doing some research just on sort of the market that

(27:39) I was looking at and who was kind of doing what and and um had kind of been doing it for a while right there’s a lot of coaches out there that I think are you know incredible and it’s just about finding the right fit so I did actually jump on quite a few calls and interviews of people and just to check but just just personality I think was a big thing too um and I just really jobed with with Russell and so got to work um and uh yeah was able to kind of fairly quickly after uh starting to work with him you know was able to kind of acquire my

(28:07) first deadening property and and just you know started building from there that’s amazing and before we’re recording I mentioned that how so many people don’t comparison shop yeah you did say that yeah I think it’s important I think I think you need to why not like we’re investors first of all which is partly about comparison shopping for Investments where will my money work work the hardest and no different or will get the greatest return on your investment for your coaching dollars your education dollars totally and I

(28:35) think it’s like if you’re if you’re considering on like it’s like learning anything right like you know if you want to learn I don’t know Spanish for example right or whatever you tennis like you’re going to you want to learn how do you learn who do you want to learn from what’s their experience do you je with that person right um you know and so those were all big things for me to consider and and I think you know the funds that you’re going to spend you know in working with a qualified coach to learn the specific

(28:58) thing that you’re wanting to learn is going to be you know it it’s going to come back to you like I don’t even know thousandfold right by investing in the right education for where you’re whether it’s investing or something else you know it just F TRS your your you know your end result I guess you could say can agree more um there’s all these newer organizations that are charging between 20 to 35,000 or more and but there’s some of the best coaches don’t work for an organization they have their own like the Elizabeth Kelly the Russell

(29:32) westcotts like Quinton dusa used to coach Julie broad from from the Nao used to coach and she in my opinion she was the best before she retired out of Nyo okay no I’ve never yeah but she since moved she I believe she’s mostly in La now but um okay yeah my point though is that for low five figures somewhere over 10 grand you could have pretty much any of these coaches on a one-on-one basis versus folks joining organizations that charge a lot more and the coach that you get will have nowhere near the experience of one of these folks that I

(30:05) just named well that’s exactly it and I think there’s a time and a place for everything right like I think some of the larger organizations do offer that like connection with other you know investors and like there’s other there’s other reasons maybe to join you know those types of groups but from a coaching perspective I mean I couldn’t agree more right like you’re going to get placed with a coach who you know may not have experience in what you’re trying to achieve and what you’re trying to invest in and also you know what is

(30:30) the training that that coach has gone through how long have they’ve been a coach how long have they’ve been a real estate investor right like a lot of the organizations you know they’re essentially if you’re in their Community you can become some coach right and and you might not necessarily have a lot of experience as an investor right so yeah I think it’s really important for you people to just kind of flush out what they’re looking to to learn and and see who’s out there right like you know until you start listening to podcasts

(30:53) and Googling and asking around who who’s doing what where um right then you come get a Vibe for who we might want to reach out to and then see if they’re a good fit you know I look at everything almost at an Roi perspective let me try a lower price thing first before I go after the biggest price thing yeah totally for sure I agree so tell me tell me about these projects you have um like for the listener benefit like paint me a picture what what what are these projects that that you have under construction yeah so um I’ve got so at

(31:27) the moment I’ve got two six units in filds um so those are essentially um you know older houses you know kind of like one level older Bungalows that were torn down sort of one previously one small single family home usually around a th000 square feet um and essentially what’s being built there now is a duplex if you picture a duplex uh twostory duplex with a basement and the basement have seat and then um a detached garage with two sleets above so in Edmonton everything’s got um rear Lane access so it’s really conducive

(32:00) to the detox garages the we right really unlik Victoria R Island right that model doesn’t really work because you don’t have access um to the back but um yeah so two projects like that one’s going to be complete actually next month um which is exciting and the other one is just starting construction and um yeah so that’s those two and then I’ve also got two 10un um construction projects as well happening yeah I can see a little bit of so that’s my latest 10 unit um what you thought there oh let’s PA you there folks I I’m

(32:36) I’m on Christine’s um Instagram page right now uh so let’s promote show your Instagram page christine. trer with a y. R investing we’re looking yeah this looks serious what what was on this property before did you tear something down or was this an empty lot on the one that we’re looking at right now win yeah so that’s my yeah okay so that’s a six units that’s the garage Suite um that you’re looking at right now um okay so on the six unit project that’s a garage enormous how many square feets this garage Suite uh the garage I think it’s

(33:24) about just under 600 yeah that’s the garage Suite that looks very nice nice yeah and the not the 10 unit that’s also under construction so um so I can break it down for you so the so the six units they typically have like older homes on them so like sort of a th000 foot two-bedroom Bungalow kind of thing right that hasn’t been modernized um and so they’re essentially replacing you know what was one unit with six units um and then I’ve got two 10 units under construction as well so the one that you saw of about the beginning of that video

(33:53) and the one that you paused on there now they two separate projects um that’s the site of our 94 units so I kind of just Little up a tour of of the stuff that we’re working on but um the 10 units so I’ve started investing in a neighborhood in Edmonton I don’t know if you’ve heard of it or when or if any of your listeners have but it’s called blackbord so essentially it’s um yeah it’s the site of the old municipal airport in Edmonton and um it’s basically the same size as Downtown Edmonton um it’s going to be home to

(34:23) 30,000 people on completion and it’s about 10 15% built out right now um it’s I think it’s 536 acres is the total site and um entally it’s owned by the city of Edmonton and um yeah it’s it’s one best new in Canada for 2023 and it’s all you know green and environmental and it’s a public bu community so upon completion it’s going to have all the schools um all of the you know spop Services Etc um yeah you can see it there youle photos that’s the original um air traffic control tower is it staying trffic control tower yeah staying isn’t that

(35:06) hilarious it’s part of the part of the development yeah but um yeah so all sustainable um you know geothermal heating and and like I said one best seing in Canada for 2023 so it’s it’s pretty neat and um it’s yeah like I said what 10 15% built out right now but um it’s sort of this upand coming incoming area and we’ll be home to 30,000 residents on completion so I kindy of equate it to it’s it’s kind of one of those areas there’s a couple areas that come to mind for anyone that knows in island or I don’t know if you do wi and

(35:36) and I can’t speak to anything in Ontario but there was these two developments in on V Island one was the old Gravel Pit in cwood um and is now Royal Bay and um the other one is is West Coast um and they’re both you know and they’re both sort of in the Westport area of of Victoria and when people started building in there and the development started happening this kind of back in 2006 everyone was like who would want to live there you know like it’s you know there’s nothing there yet and why would you want to invest there in places are

(36:06) expenses and you know kind of that that mentality and now it’s like you know those two areas are like one of the places to be right and so anyone that purchased there you know obviously years and years ago um now it’s like this is where everyone wants to be so it’s um I kind of feel like like blord has kind of the same vibe in terms of Remington um but I mean it’s got the new LRT station that just opened there um it’s Lally 10 minutes to downtown um no no no it’s it’s and it’s literally the same size if you look at what the

(36:38) size of the city of Edmonton is um this is literally you know the same size and so I brought um yeah two 10un buildings um under construction there right now and I’m and I’m yeah pretty excited about what this new um commic exp to the new communities are are usually a hit because then Community is kind of on the same level yeah as in there’s no like eyes sore properties yeah like everything around you is going to be brand new and and it attracts you know a specific type of person that wants to kind of live there

(37:12) right people with money yeah exactly who people with money want to live among right exactly right and so whether that’s you know you’re looking at that from a tenant perspective right I mean that’s the kind of tenant that you want right is is I love you know building sort of A1 Properties that are going to attract a really nice um Quality tenants you can see how big it is sorry the 94 unit project is is in is in blatchford or they all in blatchford or well no so my six unit info because info because this is the new community the

(37:44) infills aren’t in Blackford um but my two 10un buildings and the 94 unit Department building are in Blackford as well so yeah three of them are there and they’re essentially um you can kind of from where you’re if you’re standing there you can see them all um at the same time difficult yeah so it’s um it’s exciting and and they’ve got um some of the and it’s an area where you know because it’s owned by the city of Edon they’ve got sort of a builder list um where they release land right and um you got to be on that list to be able to

(38:15) acquire s um and some of the builders in there are selling them to investors as pages right where you can buy a specific um you know Pro multif family project and some of them are selling them off individually is that your plan are you’re planning for long-term rental hold yeah these ones are planned as long-term rental yeah so that actually is footage um a flashboard as well sorry are these yours no that’s um I B so the one the the 10 unit they saw this is the same Builder um but uh yeah know that was just some footage from

(38:53) when I was there cool yeah so it’s a cool thought I mean yeah I think k I love I love the new construction and the turnkey opportunities um I think they’re just yeah you really do get a nice Quality quality tenant for sure and and in great areas and and I’ve got an investing principal I think a lot of people have this but you know I won’t invest in anything that I wouldn’t live in myself so I don’t live in Edmonton I have no intentions in living in Edmonton but is it in an area and is it a product that I would be you know happy to move into

(39:24) with my family right if I was going to live there um and I know that that’s not everyone’s philosophy and it’s not necessarily the right philosophy but it is one of mine that I have to be able to um yeah have have a quality project that I feel good about right philosophies like that example I’ve had rentals well I’ve had student rentals right so My Philosophy is like at that age and if I was a student would I live there right okay okay you’ve got a on it right at that age when I live there yes okay yeah I that demographic and that

(39:55) income bracket when I live there yeah yeah yeah okay that’s good actually too I like that I feel like I could get behind that as well you you like Victoria I like Oakville like they’re they’re generally nicer areas but we can afford to be here that’s why we’re where we are yeah yeah totally right and um yeah I mean I love Edmonton I don’t have any reason to live there um and that’s the thing it’s like you know I think adminon seems to be I know there’s a lot of places in Canada but as far as sort of a bigger city in Canada it is kind of one

(40:28) of those places where you can you know it can be professionally managed um and the numbers still work right so it’s it’s not a situation where you know I mean I know someone who’s investing in edtion and they live here and they’re flying back and forth you know every couple weeks to deal with issues at properties and you know that’s not really how I rule right it’s got to be proportionally managed and and taken care of so yeah it’s a fun SP for for for the listeners benefit who doesn’t know how to get in into a project like this how

(40:59) did you get into it um well I would say I mean I’m gonna I’m G to uh I’ve got to credit Russell with that right I mean I essentially you know started working with him so I’d say find a coach or Mentor that um that you’re wanting to work with and and what you’re looking to specifically achieve through working with that person um and essentially he was able to connect me with people that were putting these types of projects and Deals together um and so I just sort of ran with it and now you anything that I do is buil on

(41:29) relationships right and so um you know and now now in a situation where it’s like you know in terms of acquiring projects and and properties um you know because I built up those relationships um I’m able to kind of continue to work with that group and um you know have to S of the stuff that they have going on so I think it’s all about people right it’s all about connecting with the right people right people is the key is the key word yeah connecting with the right people right um yeah and I think you know I like the turnkey model um I like

(42:00) the fact that you know through relationships I mean Russell’s been doing stepan Adon for 25 years he’s been working with a group for you know 20 years they’ve been working with builders for 10 years you know the same Builders and so to be able to kind of toop into that and have access to that without you know me having to go yes I could go hire a builder right I know people that you know hire a builder from ad mention but guess what if you’re not there who’s managing us right if you’re not on site and advention every day who’s managing

(42:26) your construction site right um I think that’s where sometimes for for me the appetite for risk is you know to what you said earlier you know I need to be able to sleep at night I need to be able to know that you know I do work with um private investors so I need to you know be able to feel comfortable with the information I’m sharing with them um and so it’s through those relationships that I can do that right because I’m getting updates on projects I’m getting you know video tours regular updates and I had to ad mention you know

(42:51) fairly regularly too um to check on things and and anytime I’ve you know popped there everything’s been exactly as what I was told right there hasn’t been any surprises but I think you do run the risk where you know if I just call up a builder right and I intend to go build a house on at slot you know am I going to be able to trust that everything’s taking along I I don’t know maybe but I feel like there’s more risk for me I think you can quantify risk based on your work experience yeah but but you know what like I know people that are doing that

(43:24) and and I also feel like there’s there’s just more more risk and and I like to kind of drisk you know any situation um as much as possible yeah drisk I think that language has been used more often in the last two years five last 10 yeah at the conference you were telling me about about the the return math like that’s that got you interested can you share about the Returns on your investment that make that made you interested in being an investor in Edmonton oh yeah yeah um okay so I don’t have anything open on my screen right

(43:53) now but essentially sort of kind of looking at the info um at the inso projects so we’ll start with those because those are kind of the smaller ones so sort of the six units um and I know a lot of people on on sort of the similar sites are doing eight um and you can do Eights on similar sites so if we’re talking six or eights you know we’ve all probably heard DHC mli select financing and um you know that’s where you can get up to and just de clear up to 95% loans to Value um you’re not always going to be guaranteed that

(44:22) you’re getting 95% um even if the building or the project does qualify because there is some underwriter discription that um plays into that but yeah essentially to be able to get into a project um and on some of the deals that I’m doing essentially it’s a 5% deposit and you can either structure it to do completion financing or construction financing so in the construction financing um you know you’re able to include a lot of your costs like your soft costs related to you know that project um and so you’re really into the deal you know for very

(44:54) little right um on the end of the day um so on on the first one I did it’s done as construction financing and I think I’ve got about a 90 $90,000 development management Fe that’s coming back on that um and so that’s going to be direct um pay back to to my ancestors um and so I don’t have the numbers on that to tell you exactly you know how much we we’ll be into that project for but you know it’s it’s going to be less than it’s it’s going to be less than 5% based on how the numbers are working out um and so that’s pretty incredible and the only

(45:28) reason I’m appra I would never say again I’ve seemen to many things on the appraisal side to know that this is not a good um situation but you know you hear 95% financing and it’s like oh God that just doesn’t sound like a good option but because there’s already equity on these projects right so for example if they’re being purchased around the 1.

(45:49) 67 range um but they’re appraising at 1.93 1.94 you know you’ve already got some good equity on these um in the deal so you’re not really financing at 95% if that makes sense you know what I mean like you’ve already got Equity there so that’s why the 95% financing you know in my mind is is totally different than if you’re doing a straight up purchase of a residential home you know for a million bucks and your mortgage is 950,000 plus your see Cs and you’re already overleveraged right at the beginning if you were to make de so um so yeah so that’s kind of what the breakdown is um

(46:21) on on like a for example and these aren’t subjective appraisals can can you talk to while you’re the perfect person ask how do they appraise these properties how do they appraise the after repair value is the lingo build value yeah well it’s completion value right so to be clear my yeah so for me as an a phaser I’ve got my CRA designation just to be clear for your listening so residential um and I never ended up getting my a so when I got into appraisal this is before the days that you actually needed a University degree I don’t have a

(46:51) University degree um and you could get into the anaer with just you know going through the program um but never did get my ACI because that would have involved getting a University degree and then and then getting um certification for commercial um but on these six plexes so it’s based all based on numbers it’s all based on the income right so um the appraiser that we work with in Edmonton essentially they know that we’re going for the CC financing and so they will kind of mirror what cc is looking for in their appraisal in terms of the numbers

(47:21) that they seeming to be wanting to use and how they want the project to be Quantified um so it’s all based on you know vacancy basically income and expenses right and um so I mean they’ll look at the rents and you know of course they ask us what do you think it’s going to rent for we give them our performance but they’re doing their homework to say okay is this actually going to rent for this what are the comparables um showing for rental and all of that from their database and so yeah I mean it’s it’s absolutely coming from a third party um

(47:48) appraiser just based on numbers right and what what the Market’s doing and and do they have comparable sales to compare to or people selling these um they do so they’re using primarily the income approach on it which is which is again one of the benefits of you know um doing commercial financing versus residential right so for residential everything’s based on comparables right um so your your house is only going to be worth you know what the house in the neighborhood sold for down the street or you know without

(48:18) knowing all the details around that um but on Commercial it’s based on the numbers right so it’s essentially a business right to become as business sustain itself based on the expenses and the income and um so these ones I mean I think the answer is yes right so they do take a look at um comparable sales but primarily um it’s based on the Inc and then there are like commercial buyers for these properties yeah Oh you mean on the flip side like if it’s a long-term Buy and Hold yeah because yeah well I mean investors I would say other investors

(48:54) are re or yeah I would for sure like I think a lot of people investing in Edmonton right now are investing in these types of six and eight unit infills for sure if you talk to like investor um like Edmonton investors this seem to kind of be a sweet spot Alberta yeah yeah I mean it does seem that way and I think for good reason though right like I feel like it’s like you know I don’t think people are necessarily getting caught up in the hype I think there’s a lot of Market fundamentals um that are really strong

(49:22) as to why um you know Alberto is having a moment right now which is a separate uh topic but yeah I think investor clients um you’ve also got the option depending on how you structure these um you can have them on one title or you can have them on two separate titles right so um and and with the CXC financing there is a 10-year Covenant if you are going for the M Source financing um but it is assumable right so if you were to sell the property assumable too yeah so you can actually yeah so um you are able to sell them within that you

(49:52) know in less than 10 years um if someone’s going to you know take that on right but yeah yeah yeah right so um so you’re not necessar like you can sell them within the 10year piece or timeline I should say Facebook profile oh yeah yeah yeah move around so that’s kind of the six units and then and then for the 10 units um those were done as straight up purchases and so for an example um you know the first one that that you saw when you were looking at I that was um not the one that was a drive with the one that was at framing stage um that

(50:30) was purchased in December for 2.82 two million and the appraisal came back before I remove conditions at 3.5 million so you know you’re you’re almost a $700,000 um difference between your purchase price and your appraise value so there’s some good Equity right in terms of um in terms of buying these projects right and and the builders you know they like to do these deals because they’re not not dealing with Realtors they’re not dealing with so they it’s a guaranteed sale right they’re kind of more in that build and sale model um and

(51:04) so essentially on those it’s like a 5% deposit and then nothing’s P till completion right so they’re funding the bills as well which is pretty incredible right so if you were to ask people I don’t know what it’s like in Ontario but if you were to ask people in Victoria like hey um if I give you you know 5% if I give you $150,000 do you want to go build this project for me and I’ll pay you when you’re done like they’re G to slam the door in your face right like they’re going to be like are you crazy um but in Edmonton it just it’s a

(51:30) different kind mentality there’s a lot of bigger con and I would say companies like my senses there’s companies and they’re just construction companies whereas here for example and I think it’s like just in Ontario in a lot of cases everyone wants to be a builder developer right they don’t just want to be a a builder right they don’t want to kind of share in that that win of like you know if they knew that the property is actually worth if they wouldn’t want to sell it you know um whereas in Edon fluence kind of just were were a home

(51:57) builder like they’ve already built their margins in so they’re already happy with the purchase price that you’re paying right they’ve made the money that they wanted to make on this deal so yeah there’s some really neat opportunities an interesting point some of the big players are just builders for example triell which is one of our biggest condo Builders here is just a builder they’re not really a developer they may be called a developer but they when they buy something they’re building it within like a few years right it’s

(52:23) not it’s not like you’re huge builders that you know who’ve owned the land for the last 30 years that’s like a that’s that’s a large scale developer and then we have the smaller folks today that are trying to do both yeah it’s not the easiest thing to do no and I think it depends on your business model right How They Se with things what their goals are but um but yeah there’s definitely been some attractive opportunities um in Edenton and I think I think it’s going to continue for the n a little bit for sure and my conversation with Russell it’s

(52:53) way easier sounds way easier to execute out in admon that it is pretty much anywhere else in the country anyone’s listening wants to challenge me on that I’m happy to hear it yeah well and I think it’s because the numbers work right like um the numbers make sense and I think you know the lenders we can see that people are moving to Edmonton right it’s one of the fastest population growth in the world happening right now and because the city is pro development right they they want to double their population in the next

(53:21) 20 years which is crazy right so going from one I think it’s 1.3 million to 2.6 million in 20 years is pretty wanted right so they’re building up infrastructure they want everything contained in inside the circle which is the Anthony H that goes around the city um to avoid Urban spra so they’ve got some pretty clear um goals that they want to hit and so I think it’s making it attractive for you know private investors to kind of come in um during this period in time and and create some some housing to support the city

(53:48) schools for the listener’s benefit can you explain why you can could you make this happen on Vancouver Island could you do the same type of investment I know the answer but I think for the best benefit they should hear it from you yeah um I’m gonna say no the answer is no you cannot do this on Vancouver Island or it’s not like Vancouver Island doesn’t need the housing no I think so yeah exactly so I think um it it’s all to do with and I might not be using the right teral but the the housing prices right so van of Island for example and

(54:19) like a lot of other markets are are appreciation markets right so Edmonton you know you’re going to get some appreciation but you’re going to get crash the numbers don’t work on them to a simple answer right so um what you’re going to get for rent you know I think the average house price is 1.4 million in Greater Victoria so you know that’s going to be averaged right and it’s never worked right so what was happening here is people would buy a house and to be able to cash flow if you’re an investor you would add you know one or

(54:44) two illegal sweets um and maybe maybe you’d Break Even I’m not condoning that to be clear but that was we would be what was happening for properties to just break even um and so a lot of developers here actually like a lot of build here is not happening so when you go if you drive around Vancouver Island or Victoria it feels like I’m going to say deadsville right from a from a construction perspective when you get off the plane in Edmonton every everywhere you turn it’s like Construction Construction Construction

(55:11) Construction it’s completely a different environment and it’s because the numbers work um and because the housing prices are so much more affordable um that’s why the numbers work yeah I don’t know if that makes sense but for the listeners benefit the average bace of a home in Edmonton area for last month was 440,000 ver you’re saying greater Victorious 1.

(55:36) 4 million yeah right and you can see here what you’ve got open ear is a 12% year increase right and then a detached is an average of 553,000 so still like 60% less than Victoria yeah and another thing that’s so interesting is is Alberta does have some of the highest they’ve got some of the most affordable housing prices but some of the highest incomes right so when you have a conversation and and perspective is everything right so if you have a conversation with someone in Victoria they’re like oh it’s expensive

(56:11) here if you have a conversation with someone in Edmonton they’re like I can’t believe how expensive it is here the housing prices are through the roof right but they could be making more money than someone in Victoria right and I think it’s just what people get used to like it’s you know the same thing like Toronto Vancouver um it’s what you get used to I don’t know if that makes sense but it’s like your housing prices are through the roof I mean what like it’s crazy right but that’s perception in advention right is that housing

(56:35) prices are crazy because they’re still the 20th most affordable city in Canada so I think that there’s just so much more room for prices to increase right like while we’re seeing rents come down for example in Vancouver and Toronto and Victoria which are like really expensive markets um I think rents in the last year in EV have gone up on average 17% that’s not the norm but that’s what’s happened in the last year right so um yeah it’s an interesting Market to dig into for anyone that’s you know considering it definitely interesting that I hear it

(57:05) all the time everyone thinks real estate prices are crazy no matter the context and I showed you my host in Texas which is a lot less than these prices yeah oh totally like hold on I’ve got something for you yeah it’s it’s fascinating right it really is fascinating of what what different perspectives are on different you know markets and situations and now you’re currently pursuing your mortgage broker license uh and I asked if I could ask you about specifically because there’s a lot of people out there looking to improve their cash flow

(57:40) situations their their active earnings can you can you elaborate while you’re getting your mortgage license yeah so um someone recently said so we were chatting and we’re Real Estate Investors we’re always chatting with active income and business and real estate investing and what we’re all up to and someone recently um said hey have you ever thought of getting your mortgage broker’s license and I was like what no like why would I do that you know I had never entered my mind um and I actually used to get ask that question

(58:07) quite a bit of why am I not a realtor why am I not a mortgage broker when I was an appraiser right people like why why are you an appraiser and not doing this that I hadn’t thought about in a long time and um I was like no I I haven’t why why would I get that and they’re like well think about the deals that you’re currently done in the last year you know how much have you paid in broker fees and I kind of did the math and they’re like that there’s a big chunk of your active income you know if if it’s something you want to look into

(58:32) um and then you know so I started kind of looking at the numbers and digging into it and processing it and really thinking about you know is this going to add value to you know my current um you know relationships and Partnerships like you know is that going to add value to what I’m currently working on and um you know I do work with some great broker Partners right now but I think um I think there’s definitely value of bringing things I say like inh house but having a bit more you know control over the process and being a little more

(58:59) intimate with the process um in terms of the investor relationships that I have so so yeah I just decided okay why not um and so I’m currently in the process of getting licensed I I just you know I’ve been away in Century so I’ve been back for a week well it’ll be a Week Tonight on the date that we’re recording this but um I as soon as I got back I registered for the course um in Ontario and I’ll be writing my exam this week and um you know licensing I think takes two to four weeks something like that but um but yeah and then my plan is to

(59:31) get licensed in you know once that’s established to get licensed in Al on DC as well um so yeah so I I was there when you had that conversation I wasn’t I wasn’t overhearing actually did over here some of it but just to show just to demonstrate to The Listener what an action take you you are that conversation was 2 and a half weeks ago right yeah and you’ve taken action on it yeah and I was was away in sanini for a week so I couldn’t I didn’t I decided not to take ason alls away but reasonable reasonable yes I gave myself

(1:00:03) a week um well way but yeah I came back and it was just yeah and I think too like I mean to be fair when I mean I was a real estate appraiser for 20 years so you know I’m a real estate investor so you know going through the course you know was not that challenging right because I’ve been in this world for a long time so for someone who’s new um you know it might take them a little bit longer which is totally fine I think they give you six months to complete the course you do it at your own pace um and then you can you can write the exam but

(1:00:31) yeah I’m excited I think it’s going to bring um even more value to to my partners right um you know with having that appraisal background now bringing the broker piece um into it and be being able to help other Real Estate Investors right like I think I’ve got sort of a an intimate knowledge of of you know with my own projects and and the appraisal backgrounds I think I bring a little bit of a different perspective um you know to the people that I’m working with so it translate U really nice be another another

(1:00:57) that yeah there nothing else you can just do your own deals and save a whole ton of money well exactly right I mean why not because I’m already intimate with my own deals anyways right so um and my understanding is there’s a disclosure requirment of course um but that’s not that’s not a barrier to doing your own stuff so be interesting to see how that plays out but yeah I’m excited cool now what’s next for you in your journey I know you have involvement with the with the mft what’s that stand for again uh mutual fund trust so yeah

(1:01:30) so I so currently we didn’t touch on this but we’ll touch on it if we have another minute um so I’ve also got a 94 unit apartment building that um we’re in the process of onboarding investors for now and and we will be submitting for our DP which is our development firm at any day and um so my my partners on that project own an mft which is a mutual fund trust and so we have partnered uh with their MF to allow investors to use uh registered funds so RPS tfsas um that L that type of thing um to invest in in real estate and in this 94

(1:02:05) unit kind of building so I would say that’s probably the biggest thing that I’m working on right now the other four projects that I have actively under construction are all really just kind of ticking along right um but this one um you know we’re actively working on getting all the pieces um dialed in and complete for that and it’s it’s F to offer a project where people can actually um invest their registered funds m um because think a lot of people a lot of the conversations that we’re having anyways are you know people are

(1:02:31) you know have to registered funds with you know one of the banks or somewhere and they don’t even open the mail right and when they do open the mail to read the statements they realize oh boy this is like not a very good return um and they love to continue to expand their real estate investing that don’t necessarily want to be active or maybe don’t have the cast you know kicking around um and so that’s been great to be able to offer that but I would say that’s my my next kind of biggest thing that I’m focusing on and then and then

(1:02:57) the bigger picture is to um sort of formalize I’m formalize going maybe a weird word but kind of just yeah I’d like to I’m I’m working on um creating a real estate investing s and um yeah not sure what that looks like exactly yet but that’s kind of part of a bigger Vision that I’m actively working on and um yeah calling in my bizy I’m going to say um of um yeah of of someone that I’m going to create with I don’t know who that is yet um but it is on the vision board and um yeah that’s kind of what I’m working on and among everything else

(1:03:34) super cool and with the mutual fund trust what is you’re offering investors is it Equity is it yes mortgages is it what is it no no no yeah so anything that we do is is equity so essentially um anyone who invests in the 94 unit apartment building is an owner of the building so you do get equity in in the building um and you know it’s it’s obviously the more that you invest the more Equity that you have so it depends on what your investment is on that particular project irn um it’s a $7,000 minimum investment

(1:04:06) um and that’s to keep us on side with Securities um commission rules and requirements um in terms of what the cital raises and the amount of investors that we can onboard um so yeah so it’s it’s equity in the building so you are an owner of the apartment building and um it’s a longer term hold for something like that is you know you’re kind of in that five to seven year um C window right when you add your construction uh timeline um the construction and then your your five your hold to tie in with your yourage how long do you think it’ll take

(1:04:38) to get built um it’s about a two-e construction period That’s not sound bad and this is a highrise no so it’s a low so it’s a lowrise four story uh building 94 units don’t see any of those onar perlex well land is land you well you know there’s no different Victoria Victoria land is crazy expensive yeah yeah so you’re going You’re Going vertical yeah yeah yeah no the land prices are are it’s a different world in in admington orone just put it that way in terms of uh you know prices and construction costs and and anything that

(1:05:19) um that I’m doing one the other things that I should touch on is any any project that I’m doing in on boarding inves for is you know there’s always going to be equity on on the buy and so you know on the 94 unit building for example I don’t have the numbers open in front I think it’s about $4 a half million dollar of equity um on the buy that’s available to sh Anders so um I mean it’s just kind of creating that and then what’s the exit how how are the um how’s the funds available to pay out investors yeah so that’ll either be on

(1:05:55) at the end of the fiveyear hold period that’ll either be on sale or on refinance so even though you can’t technically I’m going to use the word refinance it technically would be a sale like but it could if we were going to hang on to the project it could be a sale to a new ownership group so a call it to refinance you have to structure it as a sale um so we’ve got a couple options um there and I think given the location of the building um the fet of you know brand new construction um I think there’s going to be a lot of um

(1:06:24) you know possibilities not for someone that INSP and are the 94 units are the individual title like could you sell them off piece by piece um they are uh let me get this right because who’ve been working through this um they are individual well we’re not sorry we have’t made that decision yet um they we’ve not made that decision yet but I think they they are structured so that they could be sold off individually or if we don’t um do that at the beginning everything is going to be set so that we can do that basically just getting the Str plan done

(1:06:58) um but we’re reviewing sort of the tation um and different components as to what makes the most sense but um but the long and the short answer is yes that’s likely a possibility but again when you’re under the state financing you’ve got that 10year Covenant right to be able to get the financing so you wouldn’t be able to sell them all for 10 years individually individually individually yeah yeah not not the cleanest cut there has to be decision made yeah exactly it’s nice that you have the choice because all these things

(1:07:31) are difficult here in Ontario yeah yeah yeah yeah funny that we have different lingo as well across Canada you call it strata we call it condo oh yeah I didn’t really think about that but you’re right actually they essentially mean the same thing yeah we have Pondo boards you have what do you call it strata boards strata Council strata Council yeah You’ think it’ be the same we’re in the same country like why wouldn’t they just standardize it you know so we’re talking about the same thing different countries I get but provinces you’d

(1:08:04) think it would all be the same I’d never thought about that before but you’re so right there are different terminologies I’ll chat gbt with the differences later yeah yeah it wouldn’t find out let me know conceptually they seem the same the tax handling is always different as well but then you yeah you have layers complexity not the easiest yeah let me know what you decide because yeah as well all right how do you how you doing for time we’re at a time but how you doing for time I’m I’m I’m good you’re good I’m good yeah yeah CH gpg says I

(1:08:39) should ask you you you seem to have a strong work life balance especially with your passion for spending time your lake house we didn’t talk about your lake house that you bought no oh my God that’s a story for another time I the best manifestation story behind that that’s right go ahead how do you manage balancing your high-paced real estate career with personal time for family and hobbies like you mentioned you have teenagers how don’t bance the time I feel like it’s always been family first for me always like kids kids first and

(1:09:12) so it’s like in my calendar everything goes you know the school soccer games the non-school soccer games the dance recitals um it all just kind of goes into the calendar and and when when you are an entrepreneur in Earth I feel like you’ve got ultimate flexibility right like even when you have a lot of things on the go you’ve got control over your time which you don’t have when you’re in a 9 to5 right so some days it’s like this is happening I need to at 2 o’clock I’m done I got to go school pick up and and we’re off for the afternoon I’m not

(1:09:39) back till 6 and maybe I’ve got a couple things I’ve got to you know deal with that evening right that I need to off my desk um so I just kind of feel like for me every day is different like I don’t kind of jump into a into a specific routine um I was very regimented and routined for like a long time and um you know I just sort of thought wasn’t really working that well for me so I like the freedom to just go with the flow in a way um and Summers I mean Summers we live up at the lake um so we just basically spend two months up there