Powerhouse Conference: Kevin O’Leary, A-Rod, Dragons Michelle & Manjit — 1 Stage, 5,000 Attendees

✅ Understand why investors are shifting to U.S. markets

✅ Learn how to raise capital and structure bigger deals

✅ Hear what it takes to put 5,000 investors in a room with A-listers

Ever wonder what it takes to build Canada’s biggest investing conference?

My old friend Seth Ferguson, returns to the show, after losing all his rental properties to a nasty divorce along with his golf clubs, he started the Multifamily Conference in Covid in 2022 which was excellent, 2023 was headlined by Grant Cardone & Alex Rodriguez, 2024 Wolf of Wall Street Jordan Belfort and Robert Harjevic. Today, Seth takes us behind the scenes of how he scaled from a couple hundred person real estate event into a 5,000-attendee juggernaut, easily Canada’s largest Business & Investment event. With speakers like Kevin O’Leary, A-Rod, Dragons Dens: Michelle Romanow, and Manjit Minhas, and still another major speaker yet to be announced. Powerhouse is an apt name for the event. Same for the budget!

We dive into marketing, event growth, and how Seth landed some of the biggest names in business. For details and to register go to: https://powerhouseconference.com/

The event takes place May 23-25th in Toronto.

We also get into Seth’s own real estate portfolio and his shift away from Canadian rentals to focus exclusively on multifamily investments in landlord-friendly U.S. markets like Texas and Florida.

Seth and his team specialize in garden-style multifamily properties—low-rise, landscaped apartment communities that are common in the U.S. but virtually unheard of in Canada, where high-rise towers dominate. He shares what makes these assets so attractive, how they’re managed, and why he’s also drawn to build-to-rent communities and why he’s bullish in places like Florida and Texas. For details check out www.cpicapital.ca

To Listen:

** Transcript Auto-Generated**

(00:00) ever wonder what it takes to build Canada’s biggest business and investing conference welcome to the truth about real estate investing show My name’s Winto and my old friend Seth Ferguson returns to the show after losing all his rental properties to a nasty divorce along with the worst part He lost his golf clubs along along also in that divorce Then he went on to start the multif family conference in CO back in 2022 which was uh in my opinion was excellent Uh I had front row seats to it In 2023 uh the event was headed Levine

(00:30) by Grant Cardone and Alex Rodriguez 2024 Wolf of Wall Street Jordan Belffort and Robert Robert Hydravac of uh Shark Tank and Dragon Stand fame Uh today Seth takes us behind the scenes on how he scaled from a couple hundred person event which was headlined by Kevin Olir back in 2022 Again it was CO was still going on So Seth recounts the stress levels of trying to operate the the first big event uh just barely exiting COVID Anyways uh the plan is for this event in 2025 to be a 5,000 person attendee juggernaut but that will be easily

(01:09) Canada’s largest business and investment event with speakers like uh returning Kevin Lur Liry Alex Rodriguez Dragons Den Michelle Romano and Meni Maz along with a major major speaker that’s yet to be announced Powerhouse is an app name for the event So stay so and also same goes for the budget We dive into the marketing the event growth how Seth landed some of the biggest names in the business For details and to register go to powerhouseconference.

(01:37) com Again that’s powerhouseconference.com The event takes place over 3 days May 23rd to 20 May 25th in Toronto We’ll also get into Seth’s own real estate portfolio because this is a real estate investing show Uh of course we’re going to dig into why he shifted away from the Canadian rentals to focus almost exclusively on multif family investments in landlord friendly markets like Texas and Florida Seth and his team specialize in garden style multif family properties So that’s lowrise think like threetory at the most U so that’s lowrise landscaped uh

(02:07) apartment communities So these look more like resorts than they do what we’re what we’re used to in Canada of high-rise apartment buildings Uh these are more common uh these are more common in the US but virtually unheard of in Canada I personally can’t think of anyone I know personally who invests in garden style multif family in Canada Uh he shares what what makes these assets so attractive how they’re managed and why he’s also drawn to uh built to rent communities So that’s new construction uh purpose-built rentals uh also in

(02:37) these same markets in Texas and Florida Uh also why we’re going to talk about why he’s bullish in those markets as well For more details on Seth’s Investments go to www.cpic capital.ca At CPI those are letters CPI capital.ca And uh please enjoy the [Music] show But before we get to our guest I want to take a quick second to share something valuable with you If you’re serious about building wealth through real estate but struggling to find profitable investments in Canada I’ve got something that will help I’ve put

(03:14) together a comprehensive guide to US real estate investing for Canadians breaking down the best markets financing strategies tax considerations and landlord friendly states where Canadians are getting better cash flow and long-term appreciation It’s completely free You can grab your copy at www.truthofaboutreestateinvesting.

(03:31) ca Just look for it on the right side of the page Along with the guide you’ll also get our weekly newsletter that goes out to over 10,000 Canadians at no charge Since 2010 yes I’ve been sending it for every week since 2010 We send new podcast episodes as they were as a release so you never miss out on these expert insights invites to exclusive inerson and online events with top real estate minds actionable strategies to help you grow your portfolio and build wealth faster Again go to www.truthrealestinvesting.ca and

(04:01) download your free guide today Now please enjoy the show So Seth I I see all the ads in my in my uh social media uh feeds Um so what’s keeping you busy these days absolutely nothing You know nothing on my plate You know I’m not following you around the internet along with everybody else No absolutely nothing Yeah right I I have an idea what your advertising spend is Yeah it’s uh we we are spending a lot Um but it’s the same thing every year But yeah it’s uh you know it’s just Canada’s number one business and investing conference No big

(04:32) deal Yeah Probably biggest budget most attendees Yeah Like we’re this year will be uh about 5,000 people It’s big Okay So 5,000 expected What was the first year uh a thousand And that’s 2021 was 2022 almost Uh yeah that was coming of co So that was four years ago Um and then we did 2500 past couple years and then now we’re basically doubling in size Okay Yeah Crazy And the budget and the speaker profile Yeah Yeah Actually this year for speakers I think this is the best lineup we’ve ever had Um you know just to rip off a couple names So we’ve

(05:11) got Kevin Olri who spoke at the first event and he’s coming back He was excellent He was great We got really good positive comments We’ll talk about Kevin and the keyboard warriors in a little bit but uh yeah So Kevin Olirri is coming back A-Rod asked to come back Um we’ve got another speaker who has asked to come back who we haven’t officially announced yet Um we could release it and we’ll I’ll just hold on to this episode Say it’s okay No no no no We’ll we’ll make it a big surprise Okay Um and then um Michelle Romanau and

(05:43) Jeep from Dragon Stand Wait damn We have like three dragons That That’s right Yeah we’ve got Michael Hyatt uh who uh big tech guy He’s involved with U of um and he’s had a couple exits over a billion dollars Uh like really really smart guy He’s on um the like the Tomorrow’s Dragons show so he does lots of commentary with that Um who else do we have um yeah so anyways huge lineup Every day is rock solid speakers And your budget I’m imagine has gone up significantly Yeah the budget’s increased a little bit Yeah Okay hang on

(06:18) Let’s let’s go through journeys through time Who were who were your headline speakers the first year Yeah So Kevin Olirri was the the keynote in the first year Yeah Uh the next year A-Rod and Grant Cardone But you had other great speakers I think that first gentleman who had raised almost a billion Like that guy was really good The older gentleman Oh uh Joel Block Yeah Joel’s a great guy Yeah Yeah Yeah So um you know he helps people structure uh funds and syndications Really really smart guy A good friend of mine Uh Joe Fairless Uh

(06:46) so right now he’s doing deals with Blackstone now a massive multif family guy Um we’re we’re in like the billions and billions in terms of his his portfolio size with Ashcraftoft Uh he was in there the first year So yeah 100% We we have we’ve always had really good quality people But in terms of like the famous kind of celebrity speakers Kevin Olirri was the was the celebrity the first year second year A-Rod Grant Cardone Um and then and they’re really inexpensive right oh yeah Two for one deal Yeah Exactly They fly up on the

(07:17) same jet Um do they really or No no no no no Separate jets Trust me And it’s separate jets Um can you share how you know oh well because uh you know to keep a jet in the air is about8 to $10,000 US per hour Well how would you know that well I I don’t know how I would know You know maybe maybe uh that that fees included somewhere Um and then last year we had Robert Herjek who was excellent We had Jordan Belelffort who was really cool as a salesperson I thought that was really cool And uh Elena Cardone came up

(07:51) last year too So those were the big three last year and then this year it’s this is like the all-star team And and what’s different about the agenda are there more days yeah Yeah Yeah For for sure So um the past couple years we’ve run a Friday workshop session Uh so somebody could pick a couple different workshops a beginner or advanced workshop Um and then we would have the main stage for the Saturday Sunday This year we’ve changed it up Um and we’re going mainstage all three days And the reason is um crowd control Uh so we have

(08:29) a really hard time um fitting people in in places that aren’t the main stage area And with us doubling in size our breakout rooms they can’t really handle the capacity we would have So it’s far um better from um from both organizational but also in terms of the product people get Now I can put the best speakers on the main stage um like all three days I think it’s going to be more impactful for everybody Uh you know the the quality of speaker is definitely the the best we’ve ever had Um overall it’s just going to be a better

(09:04) experience for everybody right And I’m I’m still regret you telling me who the speaker unnamed speaker is Yeah we’ve got an unnamed speaker and then actually we have a couple unnamed speakers Um so you know right now on the website we’ve got some people listed but there are some more announcements to come for sure because I’m the worst criter Yeah Yeah I I’ll have to have you sign an NDA Uh but what I was trying to get to is like you still have some speakers that are really big Oh huge names Huge Huge Yeah And um now with our event you

(09:38) know we’re at the point where people will ask to come back Um which is pretty cool Um they’re like “Hey like I really like coming you know like Alex like he actually moved around something so he could come back.” Uh which is which is pretty neat I can see why he I saw A-Rod play and he I don’t know what it was but he he played extra good in front of the Blue Jays That’s why I still like Toronto Yeah Exactly Yeah Yeah So you know Alex I and quite honestly I thought Alex was excellent two years ago when he came A lot of

(10:10) people write him off as a baseball guy Oh he just made his money playing baseball Most people don’t realize he started investing in duplexes when he was broke in the minors You know he had no money and that was going to be his backup plan Um so I I think um you know a couple years ago when he came out he he changed a lot of minds and and he really gave people a true perspective on what he’s all about And now he’s built this worldass organization with A-Rod Corp Um and they’re doing some crazy deals Um but really you can just tell

(10:39) when you’re talking with him on stage um like he he’s got it dialed in He’s definitely an A player and you just can tell the sharpness of his eyes He knows what the he’s talking Can I say he knows what he’s talking about So so what’s the plan you have so you’re having a speaker return like is it uh what will he be talking about will he be building upon the previous or he’s got some new insights yeah Well obviously in the current environment we’ve had a lot of changes from two years ago What’s changed oh that’s all Nothing’s changed

(11:10) at all So you know on the Canadian side uh we’re going to be you know we’re heading we’re in an election cycle right now Uh so there’s going to be changes uh by the end of May whenever conferences on the US side We’ve had a president change Oh you know I never heard of him Well the other guy was sleeping and so I’m not really sure So um but yeah So so we’ve had a president change and you know foreign policy shift economic policy shift So one of the reasons why I wanted to bring this like all-star cast out to the conference is everybody has a

(11:42) different take on you know what they think is going to happen the strategies they’re employing in their businesses We’ve got people on stage that are in tech We’ve got people in on stage that are in real estate all sorts of different industries And all those industries are going to be impacted in a slightly different way Um so it’s more I want to give people in the audience I want to give them the information and the strategies and the applicable things that they can take away in real time like immediately and apply them to their

(12:13) business to help them because right now we’re in a period of uncertainty and we all know as investors the most amount of money is made in periods of uncertainty So how can we help everybody at the conference take advantage of the situation that’s presenting itself right now now you mentioned uh you have a couple dragons as well Yeah Do you what uh what what what did they uh do they have they already have their talks planned or did you like give them topics to choose from yeah Well I’ll I’ll let you in on a little secret Well you know

(12:43) this from your event Um nothing’s planned yet We’re still two months out So that’ll be done probably a week before because we want to keep it timely Yeah Um a and you know based on Yeah Because we’ll have a new We may have a new prime minister New prime minister We don’t even know what the platform is for the current prime minister Exactly So that there’s going to be a lot changing and then you know even on the economic with the whole tariff situation there’s going to be changes then Uh so I want this to be extremely timely Um and uh so

(13:13) yeah we’ll probably have those discussions the week before That’s kind of cool because like um you mentioned Michelle Romano and the other dragon uh man Yeah Yeah So they’re they’re used to having these conversations in real time with like their own investor partners and investors and whatnot Yeah So I’d be love to hearing that like hearing that inside the boardroom conversation that they have with their own clients and investors Yeah absolutely And we’re getting a lot of different perspectives obviously with uh Michelle with Clear

(13:40) Bank you know that there’s there’s that side of things Mane she’s in the beverage space So like just different insights and we’re going to understand how things are impacting them and then they can impart the the lessons they’ve learned and the strategies they’re adopting right now Um that that’s the big thing and the the thing I’ve learned as well over the years is you know you can learn a lot from somebody in a very different business or industry Um maybe you don’t see the maybe on the surface you’re like oh well that doesn’t make

(14:09) sense but then when you listen to it like you’re like hey you know I could actually do this in my business and and it just gives you a different perspective Yeah Like for example within Canadian real estate I see a lot of people working on real estate adjacent businesses because if you’re a local investor I think you know like where do you find cash flow exactly and then the previous avenue for cash flow is people refinancing and that’s really difficult these days So again like so again like local investors like on Canadian Ontario

(14:40) I I see I see a lot of them there are going into adjacent businesses to real estate So they kind of need like it’s kind of needed in this current environment uh to learn outside of real estate just just buying and holding whatever you got to crazy times people need to learn to pivot for for sure or they have to show up to one of your web classes So you also changed the name of the of the conference We did Yeah Actually there’s a really good reason why we did that So the past three years we’ve been the multif family conference So mainly

(15:11) focus on multif family real estate apartment buildings Um we do a whole bunch of audience uh data research surveys and we basically found that the majority of our audience was not buying apartment buildings Uh you know we had a lot of uh other types of real estate they were investing in We were attracting people who weren’t even in real estate who wanted to hear the speakers And so I I we basically came to the um the conclusion that we were actually turning away a lot of people who could benefit from the conference

(15:40) you know we get people emailing in calling into the office being like “Hey Seth two years I came I’ve been able to accomplish this much Thank you so much for what you’re doing.” And those are some pretty cool stories And I I just felt if we’re going to continue to grow the conference expand our impact you know why are we turning people away when you know we’re not only a small fraction of our audience is actually doing apartment buildings it just didn’t make sense So with powerhouse we’re changing the name so that way people aren’t

(16:08) turned off just by thinking it’s all about apartment buildings And the other thing some people didn’t even know what multif family meant A lot of people thought we were talking about multiple families living in the same house right like people who aren’t so familiar uh with real estate So powerhouse is uh is a new name Really excited about it Um and it it’s giving us a little bit more leeway So you know if somebody’s coming from uh from a real estate perspective you know we’re able you know we have Jordan Zimmerman coming in uh massive

(16:38) advertising guy You know he’s worked with Coca-Cola Honda he’s behind uh some Super Bowl ads like massive guy And uh so it doesn’t matter if you’re a real estate investor if you’re a tech startup it doesn’t matter like the stuff he’s going to give you about what’s working right now in the marketing space like you can apply that to any business you have Cuz I remember Kevin Lir’s talk from your first event Yeah Uh and how he was talking mostly about loss in his portfolio Yeah Which was from his uh commercial office He used to have AAA

(17:08) commercial office Yep For all the haters I’m sure they loved this That’s That’s right Just clip this We should Look at this loser Just got this loser coming to the show Sorry I’m actually I I think Kevin Lir’s content is quite good So back to the talk that he was giving and then uh and then him sharing about what prop what he considers proper uh portfolio allocation So obviously not all real estate and they talked quite a bit about crypto as well Yeah And at that time it was still pretty early and it seemed kind of worked out

(17:39) He was right He was right like Bitcoin is probably at least double versus what what it was when when he gave that talk Yeah Yeah Because that was uh like a month after the COVID lockdown Well the second lockdown’s lifted So yeah that that was three years ago basically And then um Yeah And then Kevin is a dynamic individual He doesn’t just do real estate No Very knowledgeable and super nice guy too Super nice guy Uh he just attracts a lot of hate from the keyboard people That’s all I don’t understand it You want to elaborate on

(18:13) that oh man Yeah So uh the first year uh that we ran the conference um we had Kevin Olri as the keynote guy and uh we had a lot of hate come in A lot of hate Um couldn’t see in the room Yeah Ticket Yeah Well but that’s that’s the thing So the keyboard warriors are not the people who would show up to an event like this Um and then this year I I would say the the hate has multiplied by a factor of 10 Well because you know like Kevin’s offering his opinions Um and he he has a certain view on some things that could

(18:48) be beneficial And uh I think I would call it the less the less astute uh people out there who live on the internet Um you know they they write things online and um that’s what they’d like to do Interesting Good Actually now that I remember like he ran for the leader of PC party so that’s probably why a lot of that hate was there Well PC and then you know he’s talked about an economic union between Canada and the US Um so you know there’s a lot of people who don’t understand um and you know the thing and this is goes for all internet

(19:22) haters right um you know when you actually check out who those people are generally they don’t have much going on in their life so that yeah so what else are you excited about at the conference how much more it cost than last year yeah so definitely spending a lot more a lot more money uh can you uh can you which areas are more cuz before we’re recording I asked about the venue food Yeah Yeah For sure It’s more of my own curiosity around how inflation’s going these days Yeah So so uh food and beverage obviously is impacted Um for

(19:55) sure Um now when you look at events you’ve got some fixed costs Your fixed costs are going to be the venue You know we take up you know 250 300,000 square feet um in the north building which is the most expensive venue in in Toronto Yeah you pay well I would say yeah you pay through the nose and it’s like Disneyland you know if you want to bring in a bottle of water they charge like six bucks for each bottle it’s ridiculous but anyways like that there’s pros and cons right so in that venue they have the size you can basically do

(20:28) anything you want in terms of rigging no restrictions worldclass venue you know it’s good but you pay for it you pay for what you get um so that’s a fixed cost uh the variable costs with running events like this are um you know speaker fees You can choose to bring on more expensive speakers less speakers that type of thing Um and then also um you know marketing cost You know I basically follow people around the internet for months leading up to the conference So for the next 60 days I’m sorry Irwin but you’re going to see my face every day Um

(21:00) so that’s obviously a a variable cost too But the the big changes with uh COVID or not COVID but uh with uh inflation um I I would say food and beverage has been one overall Um you know increase in I guess like your typical speaker fee would be another one Um and then you know wages staffing like all of that costs a pretty penny as well Just high level it sounds like you’re like at least 10% higher on everything over the year Uh yeah Well so we’re basically doubling in size uh for this year So obviously ad spend’s basically doubled

(21:36) like all of that type of stuff Venue doesn’t really change but venue has gone up a a decent chunk just with the way things have been in the economy over the past year Sounds like people should own a hard assets I think they should Yeah Or speakers Yeah Yeah Well well for like we’re we’re going back to the scene tower this year again So last year we did a um a black tie party at the Art Gallery of Ontario Everybody loved it So the ladies had their nice dresses the guys had the tuxes That’s a nice venue Yeah Yeah It was really cool Um but this

(22:06) year we’re going back to CN Tower which we were at two years ago Uh so we’re doing black tie um in CN Tower So that’s uh So general admission gets gets black tie to Tower No no no So you got to buy like a VIP ticket to get into the black tie Oh for sure Yeah Well there’s capacity issues and all of that So no Can I fit 5,000 people up there no I definitely not Definitely not Um but uh but yeah so like our top ticket um is VIP or act well actually I should correct myself So we’ve actually added a new ticket type for this year uh called

(22:39) the powerhouse ticket So what we’re doing is they’re getting everything in terms of VIP So they’re getting the Q&A with all the speakers Is it on the website oh yeah Yeah We we can scroll down if you want I don’t scroll down Oh look at all those beautiful people Look at all those beautiful people Oh here we go So the powerhouse ticket um we’re basically adding two extra days of mastermind So it’s a fiveday event But get this So in those two days Michelle Romanau is sticking around to run um mastermind sessions Man Jeet

(23:11) sticking around and Michael Hyatt So if you’re a high highlevel business owner and you want like a small group with some really high quality people and talking about business at a high level the powerhouse ticket Yeah Yeah Yeah It’s pretty cool Yeah You You’ve never had this before no No This is brand new Well because like we take audience feedback pretty seriously and uh we have Oh yeah People want Oh yeah Naturally especially when you’re have a big event people always want smaller groups For sure Yeah And and so they’re like “Hey

(23:41) like I love these speakers.” VIP we do the Q&A but they’re like I want more So we’ve added on the two extra days so the Monday and the Tuesday right after the conference small group mastermind Um and uh yeah it’s it’s going to be really really cool And this and quite honestly the speakers are really excited about it because it’s it’s small group like they can be a lot more engaging a lot of a lot more back and forth with it It’s going to be a lot of fun And and then the VIP Yeah So VIP um you know CN tower like all of that stuff um plus Q&As’s

(24:13) with the speakers So you know let’s say Kevin Olirri gets off the main stage he goes right to the VIP room we do Q&A with the VIPs Same with same thing with Alex Rodriguez Same thing with Jordan Zimmerman Um same thing with another big speaker we haven’t announced yet Um and that’s actually been really popular um over the years where somebody gets off the main stage we do more private Q&A It’s it’s a different setting It’s a little bit more intimate You get different answers than what you would get on the main stage Um so it’s a lot

(24:42) of fun I remember previous years there were a lot of photo ops as well Are there photo ops well for sure Yeah So um I think uh with Alex this year we’re going to do some photo ops for the VIPs um as well So basically like the VIPs when I go to events I always like when I went to your your conference for example I always buy the most expensive ticket because you meet the coolest people Um and um and basically our VIP We want to give the best access we can So hey you get access to the speakers You get top-notch experiences you wouldn’t

(25:12) experience on your own Renting out the CN Tower We’ve got some other cool things we haven’t even announced yet So it’s going to be a fun time CN Tower So you’re on one of the upper levels Yeah we’ll rent out the observation deck Yeah How many people in the in the powerhouse uh Oh about a 100 Okay A lot Yeah But it’s a small it’s it’s small compared to the to the 5,000 people It’s top notch Yeah top-notch What uh so you mentioned you did survey um surveys of your past attendees and whatnot Yeah What are people looking for what were their

(25:44) challenges oh I’ll give you all the stats So um 42% and this is specific to real estate right so if somebody’s a real estate investor 42% of our audience their number one challenge is raising capital And and so when you look at um when you look at content and and how we drive things um es and it doesn’t matter if you’re raising money for real estate raising money for a startup whatever to expand your business Um the fundamentals don’t really change Um so a lot of our content will gear towards that Um number

(26:18) two challenge for real estate investors is deal flow You know how to find deals that pencil out that type of thing Um and then number three is structuring So hey you know I’m raising money from people How do I put this deal together you know I want to launch my first fund How do I do that i want to launch my first syndication How do I do that so those are the top three On the business side uh number one challenge is lead generation getting attention for the business Number two is conversion So taking that interest and converting it

(26:47) into paying customers Then number three is business funding So how do I tap into sources because I think Robert HJC uh mentioned this at last year’s conference He’s like he’s the only guy he knows who has launched a tech a successful tech business using uh credit cards and banks because like using banks is almost impossible especially here in Canada very restrictive Um so we we won’t definitely want to tap into some alternate funding sources how you know Michelle like she’s invested over $2 billion into uh businesses and startups

(27:21) you know like I’m like she’s going to be sharing you know hey exactly if you got this idea if you need to grow these are the avenues you probably don’t even know about that are available to you what’s so back to real estate question what is this interest in local real estate versus foreign yeah so about se um I think it’s like 73% % or 72% of our audience they’re either already investing in the US or they’re interested in investing in the US That’s a lot Yeah it is a lot That’s way higher than my list Yeah So it’s uh Yeah it

(27:59) it’s very interesting And so and that’s why you know with us on the real estate content you know we’ve got Canadian investors but we also have US investors because it’s a huge interest for our audience Huge And obviously with CPI and everything we’re focused exclusively in the States and you you’ve got stuff too Um but yeah it’s a it’s a huge point of interest Yeah huge point of interest Speaking of huge point of interest all this like buy Canada stuff Do you have anyone talking to Canadian real estate yeah actually uh we’ve got a couple

(28:27) people think that’s that’s patriotic Oh Oh man Uh yeah So we actually have a couple panels this year Uh the panels actually we get really good feedback on the panels Uh so we’ve got a couple people on there talking specifically about Canadian real estate and what they’re doing right now in the Canadian market to win Yeah It’s actually funny A friend of mine where and I were talking like everybody hates landlords Why don’t be landlords to Americans especially Texan Stick it to them Oh man But you know like I I have in in terms of like

(28:57) hate about that stuff especially with the multif family conference there’s some really batshit crazy people at like I was getting death threats I was getting people who were threatening to like murder my family It just crazy sick stuff Um so yeah like people are ridiculous Just ridiculous Is this on Facebook yeah Like like they would send DM messages in to like the Facebook page and you know like it is what it is But yeah just like some really messed up people Yeah it’s unfortunate and that’s the that’s the downside of being in

(29:29) front of everybody Yeah Right I can’t I couldn’t imagine what your speakers get like a Kevin Olri Oh for sure Well we kind of we kind of laugh Oh no But like what does he get directly oh Oh yeah Way worse than you got For sure Right But but at some point like when you start getting the hate you know that’s a sign you’re actually starting to get some traction Interesting Were any of your speakers get overwhelmingly positive feedback man like uh oh I love that you got this person Um you know what everybody like we get complaints about

(29:58) everybody literally everybody So you know like you you can’t please everybody And uh so you know like Petra he’s got haters Oh man Yes Michelle literally everybody And she has haters Everybody Um but the thing like for me um from like the organizer standpoint I want to make sure number one I invite these people in because I want to hang out with them and I want to talk to them because I want to know what they have to say Um and I also want to make sure I’m getting uh different perspectives from different industries

(30:31) So for instance Michelle uh you know a Canadian like she’s got her uh uh clear co now and then you know Manet another Canadian um you know Kevin Oly you know Canadian perspective um as well but he’s crossborder And then we have other people like Alex right alex Rodriguez we got Jordan Zimmerman Um you know I want to put the most well-rounded lineup on stage Uh because number one I’m interested in it but number two um you know it it’s showing that the audience is interested in it too And that’s why we get so many people out Adam can you

(31:08) scroll down to just the the the announced speakers i feel like I’m on Joe Rogan right now We got the TV screen now Yeah we try to be like that It’s good looking people Yeah Uh next row down I think we’ve talked about these people Yeah we we got a couple question marks Yeah I’m fascinating what the what man’s thinking about the because I like alcohol for example like the younger the younger generation doesn’t drink I know Yeah 100% You can’t blame I don’t blame them talking about food and be prices Yeah Yeah Boost

(31:35) prices are nuts Yeah Well like I I don’t I don’t drink either right but um yeah we got Michelle Hilly Wikenheiser Jordan Zimmerman I love I watch so much women’s hockey Yeah Hilly Wikenheiser And then so uh yeah Jordan Zimmerman Michael High and then we’ve got uh a bunch that I haven’t even announced yet So yeah it’s it’s uh it’s pretty cool It’s pretty cool A-Rod’s changed his picture though from a couple years ago So who should come to this conference yeah so this conference is a perfect fit You know if you’re a business owner

(32:12) right seven figure eight figure business owner If you have a startup idea perfect fit If you’re a real estate investor if you’re a lender a developer anybody in business who’s looking to attract more customers or investors do a better job at converting them into revenue and scaling their business in wealth That’s who should come Pretty much everyone Yeah Yeah We h we have like you know last year for example we’ll have somebody you know who’s just starting out and then we’ll have somebody with a billion and a half

(32:43) dollars of assets under management and everything in between And and that’s the cool thing Um and I can tell you like you know the guys on on my uh my ticket sales team they love it because you know they’re calling uh people who have requested more information and um you know they somebody could pick up the phone they could be brand new or they could be running a very successful business So it’s fun for them too They get to talk with a whole bunch of different people Now tell me about what uh I remember you doing a lot of uh South USA uh multif

(33:16) family properties Yeah for sure Yeah What’s Give me an update on that How’s things Yeah Yeah We we actually have a deal right now in Texas that we’re in San Antonio that we’re wrapping up Nice Yeah Yeah Yeah Yeah So uh so that that’s wrapping up Um but yeah we’re very very bullish on the Florida and Texan markets for sure Um so we’ve got a couple others in the works that right now that we haven’t announced but we’re we’re almost there Tell me tell me about uh for for the people that didn’t listen to previous episodes for example like what

(33:45) is it you’re looking for for real estate investing because when we first met I believe most of your properties were they local in Milton oh Oh yeah Well those were the ones that disappeared So they’re still there Yeah Yeah Yeah Um but uh but yeah so so I’m a partner with a company called CPI Capital So we focus exclusively on US real estate uh specifically you know Florida Texas What’s wrong with here the home buy Canadian It it Well you you don’t you want Ontario Canada tenants uh no I do not Um you know it’s just you know we we

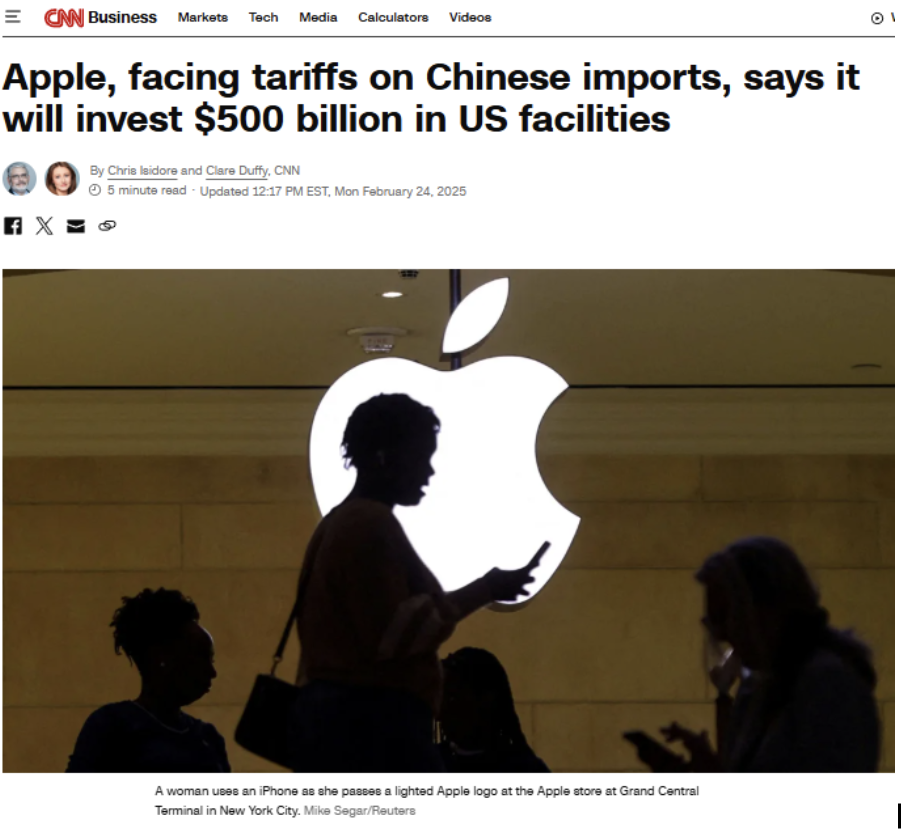

(34:19) look for uh some specific things in markets You know you just look at the GDP of Texas right and you look at the Canadian GDP I you you’ve gone through this stuff before like the entire Texan market uh exceeds the total GDP of the entire country here It helps that they’re willing to access their oil But yeah oh for drill baby drill right and then uh you’ve got government policy in place too Um and and there’s just the long-term uh market drivers that we’re that we’re looking for There’s just growth Um and then the government policy

(34:51) I can’t understate it It does play a role in it as well So we’re pretty bullish on um on the Florida markets Uh there’s a couple that we really focus on Same thing in Texas So you know we’re we’re uh we’re growing the portfolio We’re having some fun eating some barbecue at the same time Yes I remember someone was telling me I forget it’ll bother me now Someone was telling me about how Texas uh employees of the state are actually like doing basically doing business development going to other companies in different states Oh

(35:21) yeah And telling them like “Hey come to Texas the lands that you can get the land for cheap at this value There’s no state tax No Well that that’s the thing So and this is where you know so for just to clarify for the listener like no state taxes are equivalent of saying there’s no provincial tax Yeah Exactly Which is like half your tax Yeah Yeah So so you look at policy from you know a federal level a state level and then a municipal level Um at the municipal level there are some cities who are very aggressive in targeting and going after

(35:51) you know uh companies to move in outside investment and some of them do a really good job at it Really good job And then there’s other cities who who don’t Um we avoid those ones Oh for for sure But yeah like there are entire departments whose only job it is is to provide relevant statistics and information to possible investors and companies and present a business case as to why that person should leave California Yeah And move their company right well anywhere where don’t know a better way to say it Anywhere that’s pro union and high taxes

(36:22) Oh for sure 100% Like why would you if you’re looking to invest generally you’re probably going to look where it’s more businessfriendly and lower tax well Erin you’re telling me that you can’t tax your way into economic su success right i’m a business guy so I’m like like show me the history of where that you that were that successful Yeah Oh no We just have a homeless problem Everybody’s on the streets and there’s poo everywhere Oh we’ll just raise taxes Yeah Yeah But I digress Uh so uh which markets in Texas and Florida you

(36:57) interested in yeah Yeah So the deal right now is in San Antonio Um this this is actually a build to rent um community Yeah So like 62 units Um we have a good relationship with the builder who just built the exact same project just down the street So it’s a exact carbon copy So the van the advantage to that is we know exactly what the costs are exactly what the timelines look like exactly what the properties are selling for renting for Uh it’s a carbon copy So we’re going into that with a high degree of uh confidence and the the numbers are

(37:30) actually really really good Is there more information available on it anywhere yeah for for sure If somebody’s interested they just have to go to sethfers.org/invest /invest and then you can fill out a a quick little like calendar thing and then you can talk with my team Yeah for sure I always think that people should uh like for example when I started investing in real estate I looked at a hundred houses Yeah I was licensed so I could do it on my own not bother a realtor go to open houses and whatnot And then only then

(37:56) did I feel I knew what the top 20% looked like and then I was only interested in owning the top 20% for that for that segment I was trying to target for Yeah For uh my tenant profile Uh and no different than this Like this is a build to rent Um can you elaborate more is it houses is it high yeah Yeah Good question And I should probably explain what build to rent means if somebody’s listening and they’re not quite sure It’s not really a Canadian thing No one really builds to rent here Yeah Yeah That is Yeah Well there’s

(38:23) there’s a whole thing like here people will convert an apartment into condos right in the US they’ll take condos and convert them into apartments So it’s just the the economics at play Built to rent in a nutshell uh think of a single family home that you would typically rent out It’s not very scalable There’s a lot of inefficiencies And then you take apartment buildings on the other hand very efficient but it’s like apartment buildings It’s it’s there’s no home There’s no uh backyard or anything What build to rent does if if the

(38:52) demographic has good income they generally want a yard Exactly Right Families as well Yeah So what build to rent does is um you know a number of years ago a couple of the big big firms said hey well why don’t we just have single family homes where we can get higher rents and have the tenants stay for longer on average but why don’t we just do this at scale so um sorry just sorry to interrupt for the listeners benefit pretty much all the largest rates on Wall Street all do built to rent huge massive amount of money all of

(39:22) them all the household names America homes for rent lenar yeah uh uh tric Icon uh Blackstone they all do it Everybody right so so basically you know in our case you we’re building over 60 uh units on this site They’re built to our specifications We decide what we’re doing because we’re basically gearing it for rental This entire community is being built to rent out Um but the benefit is in terms of financing in terms of operation it operates just like an apartment building So you’re getting the efficiencies of scale that come with

(39:55) multif family but you’re also getting the higher uh average rents and the stickiness of the tenants at the same time So it’s a good middle ground Um this is our first build to rent project that that we’re doing Uh really excited about it We’ve got a great partner in terms of the builder Um but like generally speaking we’re a multif family value ad uh firm But yeah like super excited So this from the outside looking in does it look like just any another any other subdivision yeah for for sure It’s um because again like most most

(40:22) Canadians have no concept of what built to rent what what it looks like in the states like you’re building a basically a 64 home subdivision Yeah Yeah And and the only purpose is to rent it out And you know anybody who’s done single family homes they’ll know if they’re buying a resale home and they’re going to rent it out There’s probably things in that home that have been done for the homeowner in mind not necessarily to maximize rental value So the materials you’re going to use you’re probably going to want to use a sturdier floor

(40:48) like that type of thing And a lot of homeowners they’ll often overimprove their property but for rentals like are you maximizing the ROI so at the end of the day we want to provide the absolute best living uh situation and um and comfort for the tenants We want to make it affordable accessible and when we have full control from the ground up we can basically do whatever we want It makes it a lot easier Mhm And just as a sound like a broken record real estate’s hyper local because the question I always get from investors is “Oh why

(41:19) don’t you just build apartment buildings why why are you doing houses?” Because it always like end of the day it’s what the customer wants and will make you the most money Yeah And in certain markets it’s detached houses for for sure Yeah Single family detached houses Yeah You have to have a handle on what tenants are looking for For instance you can compare two markets One market the expectation is you have a built-in washer and dryer Another market that’s not even an expectation Some markets they’ll expect you know granite you know

(41:47) stone countertops Other people just typical countertops are fine You have to understand well what your demographic is who’s moving in Is it families is it single professionals with a dog is it uh couples who is it that’s going to help guide you on you know what types of amenities you’re going to offer do you need a gym do you need a dog park all of that type of stuff for sure I was actually reading I’ve repeated this before I was reading the quarterly analyst call notes for America Homes for Rent which is a top five RE Yeah Right

(42:18) Huge Uh huge Yeah and and the anal and on the analyst call and someone literally asked why don’t you build multif family or at least some density like town houses and the answer was we found in our experience if anything with density even town homes they said they had higher vacancy more rental concessions meaning you have to give back to the tenant and uh and so so that’s lower valuations if your rents are lower it’s worth less right this is just business so they decide to build what is in highest demand and that is

(42:49) detached homes Yeah 100 100% Right And I think and again it’s market dependent Yeah Oh yeah For sure And it’s also firm dependent right it’s like what types of skill sets uh does does the uh does the partnership or the ownership look like uh what do they bring to the table you know if if somebody’s got a great uh track record building and that’s what they know and they can uh and they have an inside edge on the rest of the market build If somebody’s a great manager of an asset and that they’re they excel at the

(43:18) management side well buy something already existing and run it You know with with us we’re fortunate where we’ve got you know really strong uh people on the development construction side We have really strong people on the management side So you know we we’re we’re fortunate that that um that you know our company skill sets can you know run a build to rent uh project but also do multif family really really well right and when you say multif family is most of it vertical like 30 story No no no So so we like the garden style Um so

(43:50) what I mean by garden style is you’ll see two or threetory uh properties You got lots of green space You’ll have the pool Obviously we’re not dealing with snow in here Can we bring it up on your website oh yeah Yeah for for sure Yeah you can go to cpic capital.ca Oh we’re plugging websites now Oh this is like “Hey Jamie pull up that clip like on Rogan.

(44:14) ” Yeah sure Was that what they look like yeah Yeah So this is garden style So um if you scroll down this Yeah Yeah Yeah Well it’s Florida right man this is way prettier than stuff Looks like an Ontario Oh Uh yeah If you go um here go track record There’s going to be some other photos and stuff Maybe the internet’s kind of running slow For listener we actually uh we do broadcast post these videos on YouTube as well So those who are following on YouTube can see what we’re talking about but if you go to cap uh cpic capital.ca

(45:02) uh there’s a we’ve got all the pictures all that stuff But yeah it’s like the reason I personally like garden style properties is um number one you don’t feel like you’re living in like this concrete tower You’ve got grass you’ve got pools you’ve got like dog you have green space If you got kids they can run around You’ve got playgrounds It’s not you’re not just not in that vertical now Downtown Toronto it’s all buildings right uh but the property uh the areas we’re looking at it’s uh you know like we’re we’ve got one in Tampa right great

(45:34) market Uh oh here we go I think it was just uh loading slow with the internet If you click on one there you go You can click on that one here Atlas There we go I remember uh something that Grant said at the long time ago Grant Cardone he was saying how if you show nicer properties it’s easier to raise capital Oh yeah for sure Because I remember when when I remember when he first showed me his stuff I’m like “This isn’t actually your stuff It’s just like marketing real stuff right?” He goes “No no these are actual properties.” Yeah Like “Oh this

(46:05) is this is pretty good looking nice looking stuff.” Well when you’re selling anything um you know like you have to have a little bit of sex appeal And you know if somebody you know if the that doesn’t exist in Ontario multif family No No No I’m sure everyone’s grateful you can’t scratch and sniff though No And so with this property atlas like this is a 70s vintage right so really Yeah Yeah But this is what I mean 70s This is what we do right we take an older looking thing and and we uh we freshen it up and add some beautiful uh

(46:34) stuff to it Right Wait So both inside and the common areas like your like that interlocking looks new Yeah Yeah So so we’re changing the exterior There’s some other stuff we’re uh we’re adding right now um to the exterior Uh cleaning up modernizing it in-unit renovations Great Yeah for sure So what kind of like let’s let’s get more detailed like what kind of what kind of renovations provide you ROI yeah So um when we’re looking to go in we’re not looking to do like heavy heavy heavy lifts So we’re not we’re not

(47:03) dividing one unit into two basement But but what we’re looking to do is we’re looking at coming in uh you know flooring uh the the boxes in the kitchen uh cupboard doors uh you know vanities toilets lighting paint that type of thing on the inside Okay So nothing crazy Not nothing crazy Pretty light But it it’s also looking Yeah Is that what the Is that what the main room looks like yeah Yeah This one’s a obviously a class A property Wait was that what the Was that what it looked like when you bought it yeah Yeah This is this is like

(47:35) a trophy frontier Is that what it called yeah So so talking about um you know for instance with uh grant and that stuff like Yeah This is a a class A asset Yeah But yeah so so when you’re looking at and each type of property is going to have a different business plan So with the one we were looking at before Atlas uh that one is called what’s is what’s called value ad So we’re taking an asset that we feel is underperforming in the marketplace We’re doing either physical renovations or we’re improving the operational efficiency of the of the

(48:07) property and then we’re going to drive rents and then improve it Interesting So for the listeners benefit it almost looks like a vacation resort but the property look really nice The finishing on the inside modern Well you’re in Florida You have a shared pool Yeah You’re in Florida like an outdoor pool not like an indoor pool No no no Well you don’t have to deal with snow So uh Yeah Like but this is what you get So for me if I’m buying a piece of real estate do I want to deal with snow most of the time no Like here you can swim

(48:42) There’s nothing like this in Canada No No So but this this these are great examples of garden uh garden style assets Do you have an Instagram too oh yeah Just go to Seth Ferguson official And you have pictures of these on there too uh yeah If you scroll like we put a lot of different content on the Seth Ferguson official This is uh I had no idea Oh yeah I thought you I thought you just did highrises No no no Oh no No We don’t do highrises No But you can see when you start looking at the uh the garden style it’s got a nice feel You

(49:13) see grass you know you’ve got all sorts of amenities It’s a lot of fun Yeah And and I have a I have a friend who’s like exiting his all his Ontario stuff because he’s having um even his own staff or the the tenant uh property manager relationship’s the worst it’s ever been He was telling his own staff feels uncomfortable with the the tone that tenants have Gotcha And you can like it’s it’s so like we’ve been on this affordability issue forever and now it seems like we’re close to the breaking point Yeah So people are on

(49:43) their last dollar and Yeah Yeah Yeah And I I think what’s happened is we’ve had decades of mismanagement of it and uh it’s not getting any better versus your tenants are they live in paradise Well are you happy yeah Yeah So so you know we provide housing to regular people So you’ve got doctors you got uh nurses you got firefighters police officers like just regular people you know So that’s what we’re doing We’re providing a high quality place to live um at uh like affordable fair prices What What’s the typical unit a

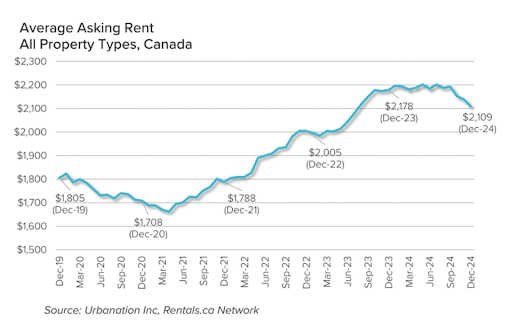

(50:20) two-bedroom like what is it yeah two two bed uh one bath Um well depending on the asset right so let’s start with the Florida one Yeah Yeah So so if you just click on that there So we have a mix of uh two-bedroom units Um and obviously have a couple different uh layouts and styles And how much is to rent a two-bedroom uh right now uh we’re we’re just under $2,000 for some units So like it’s it’s affordable Yeah One bedrooms in Toronto Yeah This is this is what I mean right this is what I mean right so we’ve got you know some two bedrooms

(50:52) some three bedrooms Um you know depending on the asset sometimes you have some bachelors in there as well Um but like here how much is the bachelor oh like compared to here it’s dirt cheap right it it’s insane And sorry what city did you say this one’s in uh this one’s in Tampa Tampa’s a nice city Oh yeah It’s great Yeah Yeah We were down there drove around had some great barbecue It was fun So um but but yeah like it’s it’s just a very different feel Um and uh yeah like so basically our business plan is we acquire properties where we

(51:24) feel we have an advantage in the marketplace we’ll acquire them and deploy that advantage So I have this theory I don’t want to be tested I have this theory If there was a union between Canada and US just like the European Union has where they’re able to travel across border work and live wherever how many Canadians would leave uh I would say a lot And that would devastate our local real estate It would Yeah it would A lot of people Yeah Well we’re already like losing our smartest people to the states like Edmonton Well yeah but but

(51:57) but we have we definitely have the brain drain Um and yeah if you remove that you remove the border basically People are free to go wherever Yeah I I think well what why you just look at the size of the marketplace in Canada you know it’s like we are just a drop in the bucket compared uh to the economic juggernaut which is the United States But most Canadians don’t appreciate I mean that’s not the word Again I didn’t know much of this stuff until I started doing my diligence But like for example San Antonio has a Toyota plant where they

(52:26) make the Tacoma and the Toyota That’s right Yeah Right And then when I was driving around Georgia I was saying to Cherry like “I thought Americans bought American It’s all Toyota Tundras out here.” Yeah And like and I had no idea where it was made Like “Oh it’s made in San Antonio.

(52:41) ” Yeah So my point is take an automotive employee in Ontario Say it’s Cambridge Your average detach is over 800,000 You can go live in San Antonio My house is a lot nicer than your $800,000 house in Cambridge My 2400 foot house fourbedroom two and a half bath I paid $265 in San Antonio Crazy right how do you not see people leaving yeah Well well you just So Google Vancouver real estate and you look up like a $1.

(53:10) 2 million place and then you look up in San Antonio $1.2 million place Oh my god Huge difference Huge You’ll you’re buying a castle Yeah Like for a million American you probably get 4,000 square foot Yeah There’s some nice places Yeah And then you know then we can talk about advantages if you’re a Florida resident you know like all of that type of stuff No state tax Oh yeah So you know I I just think you know when when we’re looking in a general overview and this will definitely be a topic at the conference this year but you know how do

(53:42) we give our businesses and investors in Canada an edge because it’s competition right every country’s competing We are competing for investment dollars just like the US is and I feel at this moment that the US has an advantage in a number of different areas So how do we make our country competitive right that’s what has to get tackled at the federal and the provincial level Some nice things though I like the fact that we don’t have many shootings up here True So I always So people people always ask “Oh when are you moving?” The thing is you

(54:13) and I made a lot of good decisions We bought real estate early on so we can afford to be here For sure For sure And then if as long as you if you exclude housing I find cost of living here is cheaper than than most places in the States Well yeah And then you get into the the health care thing if you don’t want to pay for private healthcare and all like like there there’s there’s definitely um like other factors at play but I think just from a business investment standpoint you know just changes to our tax code you know how the

(54:39) government even approaches investment you know how do we incentivize people um I think even put more simply I think it makes for sense for everyone to we’ve always talked about multiple streams of income having one of them in US dollars probably makes a lot of sense for sure you know and I’m happy to have that argument with any financial planner who thinks that’s a bad idea 100% 100% And and with us you know like we have a lot of Canadian investors that invest with us and we have a lot of US investors We’re basically split down the middle Oh

(55:08) wow Um and but the advantage with us is you know we’re Canadian so we understand what it takes to move money across the border in the most tax efficient way So we’ve structured it for Canadians but yeah we’ve got a ton of Canadian investors where you know like they actually want to put their money to work in the US Mhm Um you know they just see it as you know just a better investment for them It aligns with their goals and they see the US as being very strong So you know like there’s investment deals in Canada too But you know for us in our

(55:38) company you know we’re looking at states You don’t offer trips do you people nice properties Yeah Come swim in our pool Uh and it’s all you’re all long-term rental No short-term No Yeah No we don’t uh do short-term So um Yeah Like for instance with with Atlas there that’s going to be a five-year hold G give or take Like we’ll see what Nobody has a crystal ball but four or five years we’ll probably be looking at exiting We acquired that one uh last well middle of the year last year let’s say Why the decision not to do

(56:10) short-term i asked because it’s a very popular topic that keeps coming up in my feed in my surveys It it is Yeah Well short-term I I think um a couple things uh to break it down Number one uh the long-term rental uh market is proven So you know when we’re raising millions and tens of millions of dollars you know our business plan like it’s rock solid So uh we want to put that money to work Um short-term rentals depending on where you’re at uh legislation is changing Uh so there’s a number of people in number

(56:42) of different cities where they acquired you know short-term rentals STRs and now you know local government has a shift and now you know they’re so um and I think at scale you know I know some operators have experimented having um you know long-term with a couple short-term units in there just to keep the velocity of people coming in and out Um you know that’s just not something we’re looking at That’s not our that’s not our thing because generally neighbors don’t like them No No And like we’d rather get a family in for a couple

(57:13) years right provide them a an affordable safe place to live that’s high quality rather than having people come in for a bender on the weekend and then they leave Right Right Yeah Because you still have density here Like some of these are row houses Yeah for sure Yeah Absolutely But yeah that that’s just not our thing Other people I know are being successful at it Our thing is like that’s our bread and butter Very cool Very cool Anything else I should be asking well I I don’t know Where can you buy a ticket to the

(57:39) conference i thought we recovered that Oh did we yeah Well they got to go to power It’s been showing in the background No they got to go to powerhouseconference.com And then when’s the conference may uh 23 24 25 But if you get the 5day with the two-day bonus mastermind that’s we include the 26th and 27th and those are like the very small group Yeah That that’s the mastermind So Michelle Mete Michael are sticking around They’re really pumped for that Really pumped right yeah Yeah Yeah And then I think the question you should ask

(58:10) too is like if somebody’s listening right now and they haven’t subscribed why not they should hit the They should hit the subscribe button right now I’m already getting your stuff Oh yeah No no I mean I mean for your show Oh yeah they should subscribe I like We have a cap on 17 listeners Okay Handle more capacity than that Yeah Yeah What What do you see for business going forward what do you see for real estate and business going forward we are in interesting times this uh late March 2025 We we are um I think there’s

(58:43) definitely a lot of fear in the marketplace right now Tons of fear Yeah And especially on uh the the money financing side a lot of people are sitting on money right now Um I don’t have a crystal ball but I think if people are able to position themselves the right way over the next you know like 12 18 months um once we pop out the other side and things kind of loosen up I think we’re going to see some pretty incredible growth I think I don’t know Um but I I know with us and what we’re doing we’re making some pretty big big

(59:15) moves on our end Uh because we want to be ready to rock and roll when things kind of turn around Yeah I have more questions about Florida because uh people Oh yeah People still ask about like hurricane risk and whatnot You’re in Tampa Yeah Yeah Well we actually got hit by a hurricane Uh so uh Alice we got hit by a hurricane and um so one of our buildings on S because there’s multiple buildings right um so uh we lost a roof So what we think happened was we think a a tornado in the hurricane kind of hit Um so the benefit is we were going to

(59:47) replace the roof anyway and the hurricane just did it for us So it was part of the business Yeah Exactly Exactly So um but but yeah like um what we do is we obviously look for flood planes Uh we make sure our insurance is there We look at the history of the property So like this property has been around It’s seen a lot of weather Um so we look at okay well what’s the history um of what’s happened in the past how well has it weathered things are we in the right location mo once we answer all those questions we don’t have concerns

(1:00:18) you know like we work with really good insurance people We work with really good um you know inspectors We’re we’re solid Yeah Is there a difference in your multif family insurance versus like the the retail insurance that regular everyday people get oh for Yeah Yeah For for sure Um the you know one of the things we try and do every site we walk um where we’re very serious about the property is we’ll bring our insurance guy out with us because he’s going to look at it through a different lens And so you know like anybody who’s walked

(1:00:49) property before you know like you want to have your contractor there Um you’ll want to have your insurance guy depending sometimes the lender comes out and we’ll walk it as well and our team has some pretty diverse backgrounds in terms of real estate and everybody picks up on different things in the in the building So you know with insurance uh we’re looking at uh you know construction uh we’re looking you know we’ll walk and see uh you know some warping So for instance uh let’s say it’s vinyl siding and you’re in Florida

(1:01:19) in the heat like you know if it’s not installed properly you’ll get warping Well why is that if if if it’s woodframe construction you know is there warping in in the framing there and you can generally see that But those are things the insurance guys is going to be looking at too He’s going to be looking at um you know are the uh garages placed under the property versus you know somewhere else Like all of that impacts it because under it could flood for for sure Yeah And so many vehicles getting flooded Yeah Yeah And um and so I I

(1:01:48) think you know the big difference from putting insurance on a single family home versus apartment building is just you’re multiplying it by a scale of like 100 200 different units And you know you’ve got different uh building codes you have to worry about like uh you know like fire like all of that type of stuff So and what other markets you looking for in the states any any just anywhere in Florida and Texas well no So like we’re we’re pretty bullish on Tampa Um you know Atlas was our first asset there So we’d like to acquire a couple more

(1:02:20) We’re hunting very aggressively in Tampa And stay the same thing A class No So so that that’s a class class Uh that’s like a C plus B minus asset Now obviously we’re we’re moving it up Yeah Oh okay So when you acquired it it was a lower class and you’ve since Yeah Like we’re doing our our work on it uh right now Um but like it’s a good-look asset right so something to be proud of Yeah No no absolutely Um so so this is our bread like I said it’s our bread and butter We can we can acquire an asset like this do

(1:02:53) the renovations we can change the management of the asset because we’re we’re very strong on the management side So we basically to take a look at the property as a business and say okay this is how the business is operating right now These are all the efficiencies we can find we can actually save on these expenses or invest more heavily in different areas and get this result out on the other end Um and and that’s why our investors invest with us because we’ve got the track record of of of doing that So but yeah these properties

(1:03:22) are fun Like they’re fun Um they’re stable Uh they produce uh cash flow which doesn’t really exist here in Canada American dollars too Yeah In USD Um and so you know we’re able to pay our investors monthly distributions right so I get this a lot so I’ll ask you as well Does the currency bother you no no not not Well right now you’re getting a a 40% uh you know bonus right now um when you convert into Canadian Um but but no um definitely not And a lot of the investors um even right now where the where the uh the exchange rate isn’t like great they

(1:04:00) it’s a long-term play They’re like “Hey you know even though all my money is in Canadian it makes sense just to do it once Now my money is in USD and then away they go for the next 20 years Right I did the math with the assuming a 30% down just again I worked with chap GPT on this I just needed 2.6% price appreciation to cover my effects loss Yeah For sure For my worst case Like it’s not a lot I think a lot of people who are just starting at thinking about crossber investing um you know it’s one thing that pops up They just like it

(1:04:31) it’s one of those like kind of scary jitter things Buy one It’s a big deal Yeah you’re going to buy multiple like you know like stock investors talking about uh uh about DCA um just average cost bas Oh yeah yeah yeah yeah just average cost basing will work out for for sure right and we’re at the point now where we have like investors investing in multiple deals right so so they’re basically asking risk yeah um so yeah and and I think you know if if somebody’s if somebody’s worried about you know the forex I appreci appreciate it But you

(1:05:07) know you have to look at well what economy are you investing in there’s other reasons why you would want to move your your money across the border Same reason why you’re across the border right like that there’s there’s solid business decisions and reasons why The the the the saying I the thing I say is what financial planner in the world would say own all your income and all your assets in one country yeah Exactly Right Exactly If they if they encourage it they’re selling you something Yeah Yeah 100% Right Especially when your

(1:05:34) next door neighbor they’re like an economic juggernaut right the only one Yes And may be the only one ever Yeah Money from all over the world is looking to go there And even if China catches up do you want to own a piece of property now exactly That the people will take it away from Yeah Seth thanks so much for doing this One last time where can people get more information on the powerhouse conference oh uh powerhouseconference.

(1:06:01) com Not.ca no.com Here we go Yeah you imag I imagine you’ll draw like quite a few Americans for this conference Oh that’s probably a bad word Americans in the room Yeah Well we actually get people from Europe Middle East Africa UK Uh it it’s pretty crazy um to see how far people actually travel for this It’s It’s pretty cool especially after you announce your your secret your your final big ticket See more people cross the board Yeah that’s probably another week away And uh yeah it’ll be cool Because my American American friends are like

(1:06:32) “Everything’s like 40% off here with our money.” Yeah Yeah So like as a Canadian wouldn’t you like to say that too yeah Wow With my US money I’m getting like 40 I’m saving 40% here Oh 100% 100% So yeah for sure All right Looking forward to this I can’t And then for me like it’s always great for me to see all my friends there It’s like a It’s like a high school reunion for me Oh for sure Well people I like better than high school Yeah Well Well you’re you’re a superstar Everybody listen I mean 17 people listen

(1:06:58) to your podcast so Yeah Hopefully six or seven of them will be there And hope Yeah Hopefully all 17 listeners are there Love to see it Yeah Irwin does uh you know free uh free photos He’ll autograph anything you want any body part you want He’ll sign up Thanks again All right Thanks All right friends That wraps up another episode of the Truth About Real Estate Investing Show for Canadians Hope you got as much out of this one as I did Remember that whether you’re just starting out or a seasoned investor there’s always something new to learn

(1:07:26) And it’s always about building that practical knowledge base that gets you closer to financial freedom If you found value today please do us a favor and leave us a review or a rating share this episode with a friend or better yet join our community of real estate investors who are taking action and making moves And hey if there’s a topic you want us to cover or have uh there’s a certain guest you’d like us to have on the show drop me a line My DMs are open on social media Reply to this email Let this have arrived on I’m not hard to find Uh you

(1:07:52) know we’re all about getting you the unfiltered truth to help you on your journey Thanks again for tuning in and we’ll see you in the next episode Until then stay smart stay curious and keep building that future Catch you later

HELP US OUT!

BEFORE YOU GO…

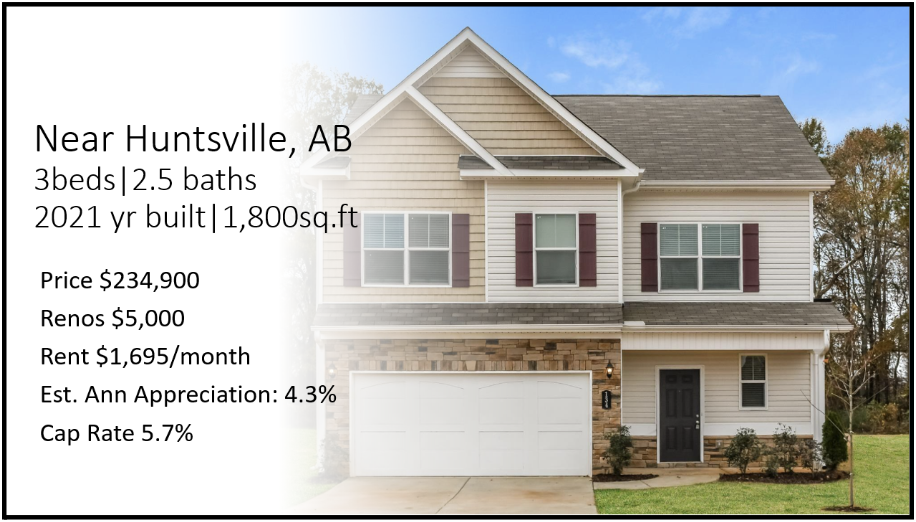

Before you go, if you’re interested in what kind of properties I am looking at in the landlord friendly states of the USA please go to iwin.sharesfr.com for what I consider the best investment for most Canadians, most of the time.

I’ve been investing in Ontario since 2005 and while it’s been a great, great run. I started out buying properties in the 100,000s and now it’s $800,000 to $1,000,000. How much higher can it go? I don’t know

To me, the remaining potential for appreciation does not match the risk hence I’m advising my clients to look to where one can find rental properties that are affordable range of $150,000 to $350,000 US$, with rents that range from $1,400 to 2,600/month plus utilities. As many Canadians recognize, these numbers will be positive cash flow and are night and day compared to anything locally. Plus the landlord has all of the rights, no rent control, and income is US dollars which are better than Canadian dollars.

If you don’t believe me, US dollars are better than Canadian dollars, go ask 100 non-Canadians which currency they prefer to be paid in.

So to regain control of your retirement planning. Go to iwin.sharesfr.com and check out what great cash flow properties are available in the USA.

The best part is, my US investments will be much more passive compared to by local investments as I’m hiring an asset manager called SHARE to hand hold me through the entire process. As their client and shareholder, Share will source me quality income properties, help me with legal structure and taxes, they manage the property manager and insurance provider while passing down to me preferred rates so I save both time and money.

Share will even tell me when to strategically refinance or sell. SHARE can even support investors all over the country for proper diversification hence my plan is to own in Tennessee, Georgia, and Texas. Share is like my joint venture partner but I only have to pay them fees while I keep 100% ownership and control.

If your goal in investing is to increase cash flow, I don’t know of a better strategy for most Canadians most of the time. One last time that’s iwin.sharesfr.com to see what boring, cash flowing real estate investing can look like on your path towards financial peace.

This is how I’m going to make real estate investing great again for my family and hope you choose the same. Till next time!

Sponsored by:

This episode is brought to you by me! We don’t have sponsors for this show. I only share with you services owned by my wife Cherry and me. Real estate investing is a staple in my life and allowed me to build wealth and, more importantly, achieve financial peace about the future, knowing our retirement is taken care of and my kids will be able to afford a home when they grow up. If you, too, are interested in my systematic strategy to implement the #1 investment strategy, the same one pretty much all my guests are doing themselves, then go visit www.infinitywealth.ca/events and register for our next event.

Till next time, just do it because I believe in you.

Erwin

W: erwinszeto.com

FB: https://www.facebook.com/erwin.szeto

IG: https://www.instagram.com/erwinszeto/