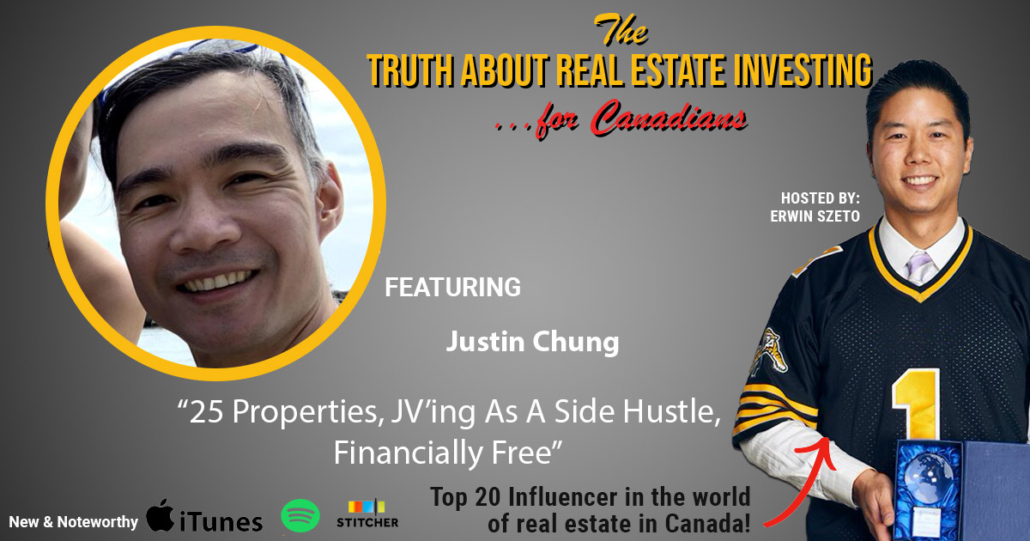

25 Properties, JV’ing As A Side Hustle, Financially Free With Justin Chung

Greetings, Wealth Hackers!

This episode is brought to you by Cherry and I’s Wealth Hacker Conference, the all-day, in-person only, no Zoom option conference, this coming November 12th, 2022.

It’s been three years since we hosted over 1,500 investors and entrepreneurs at the conference of the year headlined by Grant Cardone.

This year, our keynote speaker Jesse Itzler will share his secrets on building a life resume to be proud of. Think of it as when your time on this planet is up, you look back and are proud of your accomplishments and relationships with those most important to you.

We first learnt of Jesse when Cherry and I attended the 10X Growth Conference in Miami, and Jesse gave a fantastic talk about some of the wild stuff he’s done. A Jewish guy from New York who wrote an Emmy rap song, a trend spotter co-founding the Uber of private jet sharing and later sold to Warren Buffet’s Netjets. He spotted the trend in energy drinks, partnered on Zico coconut Water, and later sold it to Coke.

He courted and married Sara Blakely, founder and billionairess of Spanx. Together they have four kids, and they are a family to be admired in the experiences they share as Jesse is highly present in his kids’ lives.

Jesse is a New York Times bestselling author of one of my favourite books, “Living With A SEAL,” that SEAL being the incredible David Goggins and the story of David training Jesse, a middle-aged man, father of young kids, vegan, marathon runner. The story is insane, hilarious, inspiring, and educational.

I can’t recommend this book enough, the audiobook is even better as Jesse reads it himself, and even better is to see Jesse speak live on November 12, 2022.

CLICK HERE TO REGISTER FOR WEALTH HACKER CONFERENCE 2022!

25 Properties, JV’ing As A Side Hustle, Financially Free With Justin Chung

On to this week’s show!

We have a veteran investor who’s been investing for over a decade and has accumulated 25 properties, including several in Joint Venture (JV for short) with friends and family.

Justin Chung is one of our long-time clients, and time in the real estate investment market has served him and his family well, as the properties we coached him to invest in have allowed Justin to join our exclusive 7 Figure Club.

Owning a million dollars of real estate isn’t too hard these days; earning a million dollars or more in return is significant, and Justin has done that!

In today’s episode, Justin shares how he got started; we dig into the numbers of some of his properties, what motivated him to invest, and start a podcast for parents to teach their kids about money.

Please enjoy the show

This episode is brought to you by me! We don’t have sponsors for this show, I only share with you services owned by my wife Cherry and I. Real estate investing is a staple in my life and allowed me to build wealth and more importantly, achieve financial peace about the future knowing our retirement is taken care of and my kids will be able to afford a home when they grow up. If you too are interested in my systematic strategy to implement the #1 investment strategy, the same one pretty much all my guests are doing themselves, then go visit www.infinitywealth.ca/events and register for our next FREE Online Training Class. We will be back in person once legally allowed to do so but for now we are 100% virtual.

No need for you to reinvent the wheel, we have our system down pat. Again that’s www.infinitywealth.ca/events and register for the FREE Online Training Class.

This episode is also brought to you www.stockhackeracademy.ca where everyday real estate investors learn the best practices in stock investing to earn cash flow in about 15-30 mins per day from their mobile phones. After real estate, Stock Hacking is the next best hustle as you’ve heard from many past guests on this show. Among our students last year, 31 trades were shared with them. 30 were profitable for an over 96% success rate and 12% return on capital. I will be giving free demonstrations online, very similar to the one I gave my kid cousin, a full time musician and he just made 50% return in 2021. Past of course does not predict the future but if you’d like a free demonstration go to www.stockhackeracademy.ca in the top right, click FREE Demo. At the demonstration I’ll have special bonuses. We do not advertise publicly for all my favourite listeners and I only have two more demos to give in the next few weeks.

Don’t delay www.stockhackeracademy.ca, what I consider the future of side hustles with real estate so unaffordable for many.

We’re hiring!

Just a friendly reminder that we are hiring more investment Realtors who want a full-time challenge to help our clients, regular everyday people, mostly from the GTA, invest in the top investment towns west of the GTA.

This is for driven folks who want to multiply their current incomes.

APPLY HERE: https://www.infinitywealth.ca/hiring

To Listen:

Audio Transcript

Erwin

Hello everyone welcome to another episode The Truth About Real Estate investing Show. My name is Erwin Szeto and this episode is brought to you by Cherry and I’s wealth hacker conference the all day in person no zoom option conference this November 12 2022 as well as this year. It’s been three years in the making since we hosted over 1500 investors and entrepreneurs to the conference of the year headlined by Grant Cardone back in 2019. This year our keynote speaker is to see us sir, and he will be sharing his secrets on how to build a life resume to be proud of think of it is when your time on this planet is up. You look back, are you proud of the accomplishments and relationships that are most important to you? We’ve learned about Jesse Itzler and I actually attended the 10x growth conference in Miami. We were actually there to scout it with Grant Cardone before we hired him for our collarbone conference. And Jesse was one of the speakers that day, he gave a fantastic talk about a lot of wild stuff he’s done. He’s a Jewish guy from New York. He’s written Emmy award winning rap song. He’s been a successful transporter, and that’s how he’s made all his hundreds of millions of dollars in funding businesses. For example, one of them was he’s co founder and basically the Uber of private jets private jet sharing, and he later sold that company to Warren Buffett’s net jets. He also spotted a trend in energy drinks being more naturalised so he partnered with Zico, coconut water, if you’re a Costco shopper like Guy, you’ve probably hadn’t been bought it before. This company is eco water. He later sold it to Coca Cola. He’s courted and married Sara Blakely, Jessie and I have something in common that we have very famous spouses. Sara Blakely being the founder and billionaires of Spanx. Together, they have four kids, and they are a family to be admired in terms of the experiences that they share. And as Jesse is highly present in his kids lives, he has a lot of freedom in his life. Thanks to his business ventures and investments in music great parent. Jesse’s also happens to be in New York Times bestselling author of one of my favourite books, living with a seal. That seal happened to be the incredible David Goggins and the story of David living with and trading Jesse for 31 days. Jesse being a middle aged band, father of young kids, he’s a vegan and a marathon runner. The story is absolutely insane. I won’t want to give away too much, but I personally found the book hilarious, inspiring and educational. Again, one of my favourite books ever, I can’t recommend it enough. My opinion, my experience, the audio book is even better, because Jesse reads the book himself. And even better to see Jessie speak in live and in person on November 12 2022.

Erwin

On to this week’s show, we have a veteran investor with us who has been investing for over a decade and has accumulated 25 properties, including several joint venture JV for short joint venture with friends and family. Justin is one of our longtime clients. And as time in real estate, you know, that term, time in the markets more important than timing the market? Well, Justin done quite well, again, he’s been investing for over 10 years, and that type of served as well. He’s invested largely in cash flowing properties in places like Edmonton, Alberta, Waterloo, Ontario, and Hamilton, Ontario. My business my team and I, we helped him out in Hamilton, of course, and those Hamilton properties alone have allowed Justin to join our exclusive seven figure club. Now with seven figure Club. Well, there’s stages to being an investor. Owning a million dollars in real estate isn’t too hard these days, earning a million dollars in return million dollars or more is pretty significant. And Justin has done that, along with many more clients. On today’s episode Justin’s shares how he got started, we dig into the numbers of some of his properties, including the first his first property student rental of Waterloo. What motivated him to invest what got that fire going, and what got him was to start a podcast for parents to teach kids about money. Justin will also be part of a panel of joint venture experts on June Saturday 18th that the morning event starts at 9am to 12pm. At our next iWIN real estate meetup live and in person only, there will be no online option. There’ll be no recording either. Justin will be joined by longtime friend of Iwin, Jules McKenzie who has done over 50 joint venture properties in his three years as a police officer. Also Gillian Irving, an expert in joint ventures, student rentals and mortgage professional from Lend city mortgages will round down in our panel. So there’s a link to register in the show notes. And for those of you on our email list, you’ll get that as well. You’re likely already getting emails to register for the event. Again, link is available in the show notes that you want to attend. For non clients. It’s only like 20 bucks, and that all the profits go to charity. So yeah, hope to see you there. June 18. And more importantly, November 12, for the wealth hacker conference, wealth hacker.ca. For details, please enjoy the show.

Erwin

Hey, Justin

Justin

Erwin, how you doing?

Erwin

I’m excellent. What’s keeping you busy these days?

Justin

Well, I would say my podcast is keeping busy so I was on launched that back in on April the 12th. It’s podcast, it’s called Money dad podcast, and it’s dedicated to helping parents raise money smart kids. So I’ve released eight episodes now. And that’s that’s keeping me busy.

Erwin

Right. I’m going to share with where we’re recording it. So let’s share it now where she hosting. Spirit of math has a money education partner. So we actually heard them privately in case you want to bring on one. Okay to join us. I think it’s in the summer. But yeah, but we got half price because we provide the facility. Yeah, we’ll talk about it after. Yeah. So our kids are doing it and a bunch of other kids are doing it from the office. Cool. We get nothing for just sharing. What am I trying to do? Me want to sit in? Maybe? Yeah, cool. Yeah, that’s cool. The podcast?

Justin

Yeah, it’s one of those things where I started it, I thought about, I’ve been thinking about it for a while in terms of starting it, and it took your finger for a while. Yeah. For me, it’s like, I’ve always wanted to, I mean, for me, financial education is so important, right? Like, I think back to when I was a kid, and I didn’t necessarily get any formal financial education. But my dad, you know, talked about, we talked about money all the time, in terms of a lot of times the lack of it, or how to hustle for it. And so that’s sort of ingrained in me from the time that I was young. And what I found was, you know, as I was thinking about how I can serve, or better help people today, I thought, okay, what can I talk about? And what do I want to do. And so starting a podcast, helping parents raise money, smart kids, so that they have a better shot, or their financial future just seemed to resonate with me. And I think that’s something like right now, there’s just not a lot of resources, I think, that are dedicated to helping kids be more financially literate. And so I just want to put something out there and be a resource to people to help further their education.

Erwin

I just finished reading the psychology of money. And I brought up a good point, it’s American, so like, whatever they’re called down on their 401 K, I meant to look it up. So I don’t even know how old RSPs are, for example, but they’re not that old. They’ve only haven’t been around that long. So savings hasn’t really been something that it’s been around for multiple generations, right? Yes. So it’s a really it’s a newer subject. Yeah. Like your experience is very similar to many of my clients. And many people who are listening to this was that maybe their parents knew a little bit about money, but likely the generation before, like, knew even less around savings and investing.

Justin

Well, if you think about the generation before our parents, that was I guess, the Great Depression, and back then were, you know, it was they saw a lot of their savings go away. It’s like money was scarce. I mean, it’s it was scarce, probably for a lot of people. So I would say like, you know, our parents generation, like my parents were immigrants coming into the country, they came to Canada with like, nothing, right, like very little education. Like my mom, I think my mom finished, or she Yeah, she was in high school. I think she finished high school. My dad was, I think he almost fell or he finished elementary school. So they didn’t really have a lot of education itself. But they had the desire. And I give him a lot of credit, like being able to like pick up and go to another country and start from scratch, basically, not speak the language. Yeah, not Well, yeah. I mean, they spoke the language like my, my mom, her primary language is Chinese, Cantonese. She spoke some English. And then my dad, he spoke English. He was so he was from Jamaica, and came to Canada. And you know, in search of a better life, like he, his dad was basically the owner of a general store in Jamaica. And that’s what my dad helped him run. And so my dad told me stories of, you know, when they were sleeping at night, they would lock up the shop, and there will be people that would be breaking in to the store to try to, you know, get things and he was like, You know what, I don’t want to live like this. I don’t want to live here. And so he met my mom, and they decided to come to Canada. I think it was my mom’s aunt or someone that lived in Montreal. And so that’s where we ultimately ended up settling. That’s where I was born. And then we we moved around to Toronto and other places growing up, but um, yeah, I think it was one of those things where I just saw how hard my parents worked. And especially my dad, like, he didn’t have a steady job. You know, he was a realtor, residential, real estate realtor, and he would, you know, he would take me with him and my brother, while he was on business, taking a look at houses and previewing them. And he did that he did a wholesaling business for a while, like so importing, you know, whatever, dry goods and then delivering them to people. He was a big talker, he was hustling, like, he was basically trying to figure out a way to put food on the table for the family. And so my mom was helping take care of my brother and I and, and then later on, she, you know, she ended up working like, I think she worked at a travel agency for a little bit or a retail store. But, you know, it was really up to my dad to sort of, you know, he’s the main breadwinner and just bring make money to survive, really.

Erwin

Their survival was the thing. It wasn’t about saving.

Justin

It wasn’t a savings investment. It was really about surviving. So it definitely was not about investing. It wasn’t until actually probably when he was a little bit when I was a little bit older. That’s when he started to, I think focus on investing where we were more grown up and he would, he would hone in on me and say, Look, you gotta get an investment property, you gotta get investment property. And so at the time, I think I was I wasn’t necessarily that receptive to it. I didn’t really brush it off, but I wasn’t keen on it. And it wasn’t until Oh, so the year before I got married, so I proposed to my wife or girlfriend now wife, wife, and it was like, Okay, there’s gonna be this big to me, in my mind, like this big wedding expense coming up. So I’m like, okay, you know what that motivated me to say, before I spend all this money on a wedding, I need to put money into an investment property. And so that was when it clicked in like, Okay, I should get an investment property and divert some resources to it, I didn’t even necessarily have money at the time. But it focused my attention to getting an investment property. And so I ended up buying a student rental property in Waterloo, off market. And I bought Yeah, so I bought it, you know, and I borrowed money from my dad, my dad lent me $40,000 to use as the down payment, charge me, you know, interest rate market rate of interest on it. And I managed properly myself for the year. And what happened for me was like in terms of when it all clicked, and in terms of real estate like and what you could do with it, and how you can use it as a wealth creation vehicle, was in that the end of that first year, I ended up, refinancing it and buying a second student rental property from the same person that I bought, the first one, he was actually a university professor who was looking to retire. And so I ended up reaching back out to him again, off market and saying, Look, I’m interested in buying more property, you know, are you still interested in potentially selling some of your other ones that you’re looking to get rid of before you retire? And he, he said yes. And you know, we negotiated the deal. But again, I didn’t even have a down payment, I broke the mortgage refinance, didn’t pull the additional proceeds from the first student rental and use it to buy the second one. And so for me, like, that’s when the light bulb clicked on for me, and it was like, Oh, you can actually buy real estate, without any of your own cash, you can add and grow your grow your portfolio and your net worth that way. So that was, yeah, that’s, that’s when it started. For me.

Erwin

That’s pretty cool. Did your parents really invest in property before?

Justin

You know what my parents owned, when we live, there’s a time where he lived in Etobicoke, near Humber College. And actually, we ended up renting a room in our basement out to a person from who went to Humber College. And so that was part of I mean, that, you know, they earned some rental income that way, they also had a rental property. I mean, this is back in the 80s, though, when the interest rates are so high, and I think they actually lost money on that deal, to be honest with you. So they bought the property, I think they ended up taking, yeah, they bought it, they were renting it for a while, and then they ended up selling it. And when they sold it, there was a VTB on it, that they had to take back vendor take back mortgage. So I don’t know if that necessarily that deal was profitable for them. But I know always like my dad, especially like from high school onward. He was always, you know, I think he just harped on getting an investment property, getting investment property. And I should have done it. In hindsight, I wanted to do it when I was in university, like it was crazy, because I would see, you’d rent for whatever, X amount per room with your friends. And I remember hearing about one landlord who owned a number of properties on a certain street in Waterloo. And I was like, he must have had, like, he must have so many different properties here. But it never clicked into me that, oh, maybe I should try to get a property and then live in it with my friends while I was in university. Because then I mean, whatever. In hindsight, everyone’s like, Oh, I wish I bought more.

Erwin

Right. But most people are listening. So they don’t see me rolling my eyes. But sorry, how long ago was this first property you bought?

Justin

So the first property that bought in terms of a rental property was 2007.

Erwin

Okay, so good time to buy. Okay, so I always harp on that folks are going to listen and learn from someone they should learn from someone who has what you want. Right. So you have a sizable portfolio. Can you share about that?

Justin

Yeah. So yeah, I have, I mean, so between myself and other joint venture partners that I’ve brought on, you know, I have an ownership interest in 25, mainly single family residential properties, some student rentals, some single family, some small, like Maltese. And I’ve been doing it, you know, so I started actually, the first one I bought was not even a rental was actually my own condo that I bought after I graduated from university. So that was back in 2002. That was pre construction. 2002 And then I, you know, it took them two years to build it, and, and I moved in 2004 So I’ve been investing in real estate since 2004. And just, you know, in the beginning, it was more like buying a property a year. So, you know, my first rental was 2007 and then I bought another one 2008 That same one from that same professor, and then I bought another one 2009 And then it wasn’t until I guess, 2011 when I met you actually, as well, but I joined rain, which is a great, great group at the time in terms of the Real Estate Investment Network and, and it was really a way to For me to like level up, and I wanted to get more focused on real estate, and I wanted to be around people who were doing what I wanted to do in terms of investing in growing their portfolio. And so that’s when I joined rain. In 2011. I met you. And that’s when it sort of took off. Like I think I bought, yeah, so I bought another one. It was a single family and Hamilton in 2011. And then what happened was, so my mom, she passed away, basically, in 2012, January of 2012. And up until that point, I guess, you know, so it’s really not until you lose someone that you really realise, like how precious like life is and how short and how not guaranteed it is. And so, when she died, it was really like it hit me hard. And that basically, like I was angry at the fact that, you know, she she passed, and the fact that I wasn’t able to spend as much time with her as I wanted to while she was in the hospital. So she had an illness. And she had to have surgery to basically remove some stuff in her spine, which ended up which they got out, but in a paralysing her from the waist down. So it was tough, it was hard, it was really tough time. And then when she passed, it sort of basically unleashed all this fuel in me that I said, Okay, you know, what, I’m not guaranteed to have you know, a life long into the future, who knows, when my time is up, I want to make sure that I get to a point where I’m, you know, I can make a decision in terms of my time, and I don’t have to like work, I can basically build a real estate portfolio that generates, you know, cash flow and passive income and, and do all the things that we love about real estate in terms of appreciation, so that I can get to a point where I don’t need to work, if I don’t want to, and then I can spend the time the way I want to do it. And so that really hurt, I would say her passing just provided the fuel to grow my portfolio from that point on. So I bought a bunch of property in 2012 and 2013 a lot in Hamilton, you know, with your help and, and then I started to move out to Alberta and bought a bunch there as well, again, not just with myself, but for myself and other joint venture partners who had brought on, you know, a lot of family and friends that I just, you know, they saw what I was doing, they were interested in what I was doing, and they wanted to get involved in the real estate market. And so, you know, I thought, Okay, I’m doing this, I enjoy real estate, love buying real estate, and so I ended up buying as well for them as well, in conjunction with myself, so

Erwin

I laughingly enjoy buying because I showed you some scary stuff. Here,

Justin

I remember there was stuff we would see. I was it was I mean, I loved the the West harbour area. Hamilton near the GO train station, and you know, Jane Street North and all the great things happening around the harbour as well. And I, there’s some stuff that you took me through, I remember there’s one on John Street 100 of you remember, but it was like, The floors were uneven, like it was tilted. So that it was like a bowling alley pretty much. But it was one of those places where, you know, there was a lot of work to be done, or it was a fixer upper.

Erwin

There were lots of those in the area. There were lots of most.

Justin

Like I bought, you know, so the first property that you helped me buy.

Erwin

Okay, this is do this is whiteboard it. I do want to actually, can we start with the first the first Waterloo Student rental? All right, so we’re doing this for the first time, I’m going to whiteboard. Right? I want the lesson listeners to know, I think numbers are good. I think it’s just healthy that I keep telling people, everything’s relative. Right? But if you have no data, no context, and you don’t even know relative to what Yeah, right. And also just a bit of a history lesson. Okay, so we’re talking…

Justin

And I would say like, yeah, so we can go through these numbers. And, you know, a lot of people are gonna listen, say, Oh, I can’t get those numbers these days, obviously, because I bought 15 years ago. But the main thing for me was, you know, in today’s context, you can look at today’s numbers, they’re gonna be a lot higher than obviously 10 or 15 years ago, but you can still make the numbers work in terms of positive cash flow. So you know, so we can definitely go through these numbers. They’re gonna they’re gonna sound like ridiculous, because they’re so low in terms of how much I bought it for but, but this is what that’s about real estate. But keep that in mind for like today’s dollars. It still works.

Erwin

All right. Waterloo, and you’ve lived in Toronto.

Justin

I lived in Toronto.

Erwin

You drove closer an hour? Yeah.

Justin

Yeah, it’s been a little over an hour hour and yeah, or 15 minutes or 15. Yeah, that’s important. Yeah. And the reason why so I started off when I was, you know, so again, before I bought that first one, I was super motivated to buy something and I started looking initially in Toronto, but what I found was, so at the time, Toronto was IX, quote, unquote, X Red zip. And I couldn’t make the numbers work. So I decided okay, you know what? I know Waterloo I lived there for four years while I was in school. So invest in what’s new. Yeah. And so I ended up buying a student rentals. And this is back in 2007. I bought it for, I think it was like 240,000. Something like that.

Erwin

What do you think it’s worth today? You can ask me that because I don’t.

Justin

Well, you know what happened? I so I ended up selling that one. Back in 20. Oh, it must have been 2016. I think 2016 2017 Where what happened was sort of the where the location was, it was on a major street close to university, like within a walking distance to both Waterloo and Laurier. And the person who approached me about buying it was a developer who had been basically assembling land part like land parcels because he wants to build a big guy. Yeah. So I ended up sitting down at a coffee shop with him. And we negotiated or hammered out a deal. Yeah, so I sold it. I’ve sold it, but I sold it for basically, at the time, I wanted more than a million dollars. So I sold it for like, 1.1 2017. Yeah, because for me, it was like I knew at the time that…

Erwin

We didn’t even talk about this. This was 1.1. Yeah. This is appropriately.

Justin

So he I knew at the time that so he had already picked up other properties. And it was actually the planner. So the city planner that got in touch with me saying, oh, like basically there’s this planning application going through. And you know, you may want to think about selling because this developer basically is looking for land. And I know he needed it because if he didn’t get it, he would have had to build an underground underground parking. Oh, love is really expensive, which is super expensive at the time. Yeah. So. So for me, it was like, Okay, I knew that, you know, in terms of leverage I had, and I saw I had in my mind what I wanted, in terms of a price and he met that price. So you know, back when I bought it for 240. Like I put down I put down $48,000.

Erwin

And then renovations?

Justin

Renovations wise, I didn’t have to do much. It was like it was basically a five bedroom student rental property. There was no upfront renovations. I inherited the tenants. And then, you know, over the years, I remember spending some money to renovate. You know, do some put some new flooring in the kitchen. I mean, think I did work in a bathroom really like in terms of a major renovation at the time. It was it was more money necessarily. Yeah, it was maintenance. Okay.

Erwin

And what did you rent it for?

Justin

Well, back then. I mean, this is probably I probably rent it was like, I don’t know how to save 400 a month. 350 a month. Okay, back. five bedrooms.

Erwin

So four times 400, 2 grand. So it’s two grand rent, and then curiosity market rent today.

Justin

Well, so I still Yeah, I own other rental properties, still rentals in Waterloo. And I would say like the last one that I rented. So I bought a place last year off market as well. And I rented it for 620 room. That’s really good. Yeah.

Erwin

Even with all the competition.

Justin

Yeah. You know what I found? I found that. So in Waterloo for exam, for example, there was a lot of people building these multiplexes. And so there’s the big ones. Big ones. Yeah. Big ones. Huge high rise. High Rise.

Erwin

Yeah, like 30 Storey, how big are they?

Justin

I don’t really, I’d say like 15 stories, maybe 10-15 stories. So big water supply? Yeah, lots of supply. And there was a time where I was like, oh, you know what, like, are people going to want to be in houses. But what I found was that a lot of people that live students, they actually still love houses, they want houses, because if you live in these big multiplexes, you know you’re sharing your space really with like, a tonne of other people, you don’t really get there smaller as well, like in terms of the size. So you don’t really get as far as the bedrooms are smaller the bedrooms, and even the units themselves, right, the units are still probably again, for five people, but the units are smaller than on the backyard. Really. It’s just really not a space that they can call home home. So I found that the demand for houses was still quite strong, even when all these most

Erwin

of them are very strong. Yep. Fascinating. All right. What do you think you cashfloat When you originally there’s a fantastic rents for this purchase price?

Justin

Yeah. So what did I cashflow? I couldn’t I mean, it’s been a while and I sold it.

Erwin

Ballpark. So 100 bucksa month, or just how much trouble 100 bucks a month? Maybe.

Justin

It’s probably more than that. It’s probably one that based on like, and that’s one of the reasons why I decided to just do rentals as well, because of the better cash flow. And I mean, yes, you know, a lot of people are gonna say, Well, this, it’s definitely more maintenance. And it can be in terms of like, more wear and tear on the property right? Students are not going to necessarily take care of their property, as well as let’s say, a family or a couple or whatever. But, and what I’ve learned over the years is that I think it’s super important to obviously screen and make sure that you put in a group that you think is going to be responsible. And so I would say, I’ve gotten better at that. We Yeah, like at the time. I mean, you have there probably was more maintenance wise, like it was like five guys living in this house. So we probably cashed a lot about three to 500 a month.

Erwin

What do you think it’s worth today? If it still existed, and it wasn’t a development property?

Justin

Today, in today’s dollars, I would say, like, so I have another five bedroom student rental, not too far from it. And I think the value on that one’s about, you know, I’d say like, 657 Easy,

Erwin

And you’re dealing with rental licencing, or you’re not?

Justin

Yeah, and Waterloo, thereis a rental licencing programme that kicked in, I can’t remember how long ago but yeah, there is. So it’s basically, you need to go through a couple of different hoops every year to get that renewed. It’s not that big of a deal. You know, there’s it’s to me, it’s like it’s a it’s a cost of doing business, the city. I mean, they don’t even it’s funny, like they don’t even it used to be before the current licencing requirements, you would have to get a whole bunch of other things done, including, let’s say, your so yeah, and this sorry, as part of the current rental licencing requirements, they you know, they want you to do so like your gas fueled appliances, they want you to get that check your furnace and your I guess your hot water tank, fair. Fair, fair. Obviously, they want to make sure that are you attest to doing smoke detector checks every year, which I do things like that. So it’s it’s really to me it’s it’s a way for the municipality, I guess to control the lace, like what housing is going in, but I just see it as its cost of doing business.

Erwin

It’s coming to Hamilton. And already through the pandemic, a lot of people already sold law landlords already sold or they rented out to families. And then you know how families are they don’t they stay there, they lease the renting under a year or two year old rent, they’re probably stay, I don’t know how long, they’re gonna stay for a while. And then what I’m seeing in Hamilton is that’s causing a lot of pressure, because the demand is back to pre pandemic level supply is way down of housing. And then licencing is being rolled out in Hamilton around the student areas, and they’ll cause more landlords to sell. So that like, I’ll be the only game in town, not the only but yeah, and then I maybe I can see 620 rents per room, which would be like more than a 10% increase substitute students.

Justin

But it’s still relatively cheap compared to what even some of the condos or multiplexes around the university are charging, like, on the newer stuff they’re getting, they’re easily, you know, charging 750 $800 a room. And a lot of that I think is tailored towards, let’s say international students that are coming in, and you know, and, and they have like international parents, they’ve got money, they’re sending their kids to school, or whatever. But so I would say like, you know, I’ve been trying to keep it as close to there as possible. But at the same time, there’s a bit of a gap, because it’s not as luxurious, let’s say as, as a high res.

Erwin

So if you’re a cashier three to 500, a month before, you would increase by 1100 or so. Based if you kept the house yeah, if I kept the cash flow would be ridiculous. Yeah. Right. And then just some quick math, you know, assume you sold it today for market value. Let’s use 650. Let’s be conservative, I like being conservative with all my numbers, you paid 240 for it. That’s a gain of a capital gain of 410. You only put down 48,000. Yeah, that’s eight and a half times on your money. Eight and a half times return on your money. Nothing was a good idea to buy this one. Alright, so let’s do another one. Let’s talk about a Hamilton property share. Which one do you want to REIN or…

Justin

Do you wanna talk about? Awesome? Sure. Or yeah, why don’t we talk about showing the auto railway if you want.

Erwin

I like them all, but just kind of funny because you and I met at rain. And then we went looking for properties. And actually, I don’t even know how we came to the decision that we would look at West Harbour.

Justin

Well, you know what I remember. So when we started looking together, you were showing me stuff on the mountain. And then I mean, in hindsight, that would have probably been goodbye as well, because of, well, they’re all good. They’re all good. But I mean, at the time, I It’s funny, like I wanted, I didn’t even at the time. I wasn’t necessarily convinced that, you know, suburbs family. Yeah, the suburbs was the way to go. So I was more focused on downtown. That’s why we decided to look downtown where like the West harbour area. And there’s a lot of different things that were

Erwin

Very up and coming is very up and coming. Had a long way to go though. Leslie fair.

Justin

Gentrifying

Erwin

Gentrifying, which means it was pretty ghetto.

Justin

It was like it was like you can see there’s pockets of like, I don’t know is yeah, there’s good. There’s good and bad area. But you could tell us on the rise. We’re talking to 2011 this is 2011

Erwin

And this is Hamilton West Harbour. Yeah, that’s So for those who don’t know what, Hamilton West harbour, we’re just northwest of downtown along the shoreline, which probably want to talk about to talk about railway or race Street.

Justin

Sure. Yeah. Yeah. So let’s talk about Ray,

Erwin

Because that is the first one I helped you with. Yes. The very first one. So let’s let’s paint a picture. It was a power sale. Yes, it was a power of sale. That means so for the listeners benefit, the bank is selling it. Yeah. So someone failed on a mortgage. The bank is selling it. We don’t see those many. We don’t see that much these days. With such a strong economy and housing prices so strong. So yeah, in the house was rough. I swear there were bugs during the inspection.

Justin

I don’t remember the bugs. I wouldn’t be surprised. I remember in the basement, there was some water. There are some water issues in terms of like getting up the drywall and so we had to replace you know, rip that out. But it was rough. Like it needed some work. So I bought it for around 150. Yeah, it was about 1/5 the 156. And then I had to spend Kohut about 25,000 to get it ready. So I think part of it was doing some electrical work. I think it had some knob and tube. It was doing some work on the kitchen. It was doing some work in the basement where like, basically created like, put it down your flooring, framed out the bedroom, I think.

Erwin

In the basement, I believe so. Yeah. You haven’t been back in a while. I don’t know. downpayment 20%. Yeah, that’s been 20%. Now what were you thinking? Like, how did this compare to the other stuff you bought? Because this was not like a condition property at all. And I know what 25,000 doesn’t sound like much today. We were joking before we were recording. That’s a kitchen as a rental kitchen. Not even nice kitchen. Right? Well, this rental today would be a while ago. Electrical alone is usually around 10,000 In these days alone. Yeah. And you’d have flooring pulling out or five. You put up some walls pulling over five. Did you do some bathrooms and kitchens this whole nother place neither work.

Justin

You know what the main the main bathroom, which was on the second floor? needed? You know, it was okay. It was not bad. I didn’t have to do I didn’t have to do too much in there in the main bathroom. In the basement bathroom. It was it was in the basement bathroom. It was I had to do a little bit of work. Not much again.

Erwin

Your two bathrooms not common for this area.

Justin

Not very common. No. I mean, the basement bathroom was wasn’t the greatest. But it was a bit it was a second bathroom. Which again, was not very common. Like I’ve got which is a big bonus, which is huge bonus.

Erwin

And then what’s your rent for? What do you remember your original run?

Justin

I don’t remember the rent

Erwin

- I’m gonna guess. 1300?

Justin

Yeah, I would say the original rent. I can’t remember. Like it’s up to call it 1700. Now. Oh, which is still in the market?

Erwin

What do you think market is?

Justin

I don’t know. I just know it’s under market.

Erwin

It’s over two, three, markets should be over too great. For the listeners benefit because because the rental housing markets cooled with interest rates going up the rental markets heating up. So yeah, so that’s current rent. And you could probably get three $400 more. How long’s the tenant been there?

Justin

There was a turnover, probably in the last like five years.

Erwin

Five Year Old rent. Right. And we think it’s worth today.

Justin

I think it’s probably worth about two we talked about this, I think before, but I think it’s probably worth about at least probably similar. Probably similar. Yeah. 650.

Erwin

That’s just that’s similar. It’s not even similar. Very similar last year. Waterloo property. Yeah, 650 in the spring and target and a lot more. Yeah. But you’re not going to cry if you sell for 650. And so sorry, I’m laughing because I look at these numbers. So you have a 650. You paid 156. You also paid for a Renault? 25,000. Right. So you return on your. So we add together? Sorry, 650, less 156. That’s almost four. That’s almost 500,000. All right. I don’t need to go much further to notice there’s a rocking investment. Add together your Reno plus your down payment is 56,000. Your return is 8.8 times.

Justin

Well, you know, and that’s the thing. Like I think that’s the beauty of real estate, right? Like, what if you think about how, if you imagine, you know, house prices, at least doubling over a 10 year period, let’s say so, it’s not a matter of necessarily trying to time the market of Oh, like, it’s really, you know, yeah, that’s the phrase, right? It’s not timing the market. It’s time in the market. So putting your money to work for you, so that you can allow allow the market to do what it’s done. And you know, if you think about what’s happened recently, over the last couple years, I mean, it’s kind of it’s stupid, it’s unsustainable, how much prices have gone up, and things are going to correct a bit. But that’s okay. I mean, if you hold it for the long term, and for me, it’s like, it’s always been a long term hold. Like, I wasn’t necessarily interested in flipping houses.

Erwin

Thats a lot of work. It’s this is already a lot of work. Yeah, yeah.

Justin

It’s a lot of work. And I would say like, for me, it’s like, it’s so hard to buy. Right? All right. So why am I selling? You’re never gonna find this again? No, you’re not. And I think even today, like even the stuff, you know, I get, like, if you’re trying to create income, that you you flip, so I get that if you need the income. But for me, it’s like at the time, like I, you know, I was working full time job, I didn’t necessarily need to liquidate or sell these properties to get cash flow. But it’s there when I went in. If I ever want to sell I can I can sell it. And whenever lock in the gains.

Erwin

What do you think your parents would think about all these properties we got now?

Justin

I think they would probably I mean, I think my dad, would, I think you’d be happy. Obviously, I think he feel he was a big influence in it. And when he was in terms of developing that mindset to getting property and building it, so I think they’d be I’d be happy to see it. They probably they probably think like, Well, okay, like, how are you doing all this? But But I think they’d be happy.

Erwin

Or we probably want to invest some more money with you. Oh, another property? I was talking about Balsom.

Justin

Sure. Yeah. So that one is

Erwin

This is the truth about real estate investing its not all sunshine and rainbows.

Justin

Like anything, these are the types of properties where it can scare a lot of people away. So this property is a triplex that they helped me buy it so we bought it in and I bought it with a partner, JV partner, so a friend or family or family. Yep. So I bought that it was a we bought that in 2012 for

Erwin

Legal Triplex.

Justin

We got legal while legal nonconforming trademark before we try blogs. Bar for 243,000. Oh, no, this is not in the West Harbour. This is away from us harbour but

Erwin

This is east. Lower city east end. Yeah.

Justin

And so I spent about 35,000. To do but do a bunch of work.

Erwin

It was a triplex. Yeah. Three kitchens, three bathrooms. Yeah.

Justin

And so I think I mean, I don’t know if we necessarily want to run through all the numbers, but like, the this is a property I would say, was probably in terms of terms of like horror stories of like, what could go wrong? This was one of them. So, you know, when I bought it, it was it’s fine, it’s good. But there’s a period of time where probably about five years after I bought it, I thought about selling it, because there’s so many different things going on at the property at will. And it sort of all hit at once. That it’s like, I just thought that this property is just a big headache. But so what happened was, you know, in 2017, and I had a property manager, you know, manage managing these properties and Hamilton

Erwin

Over all your property history. Yeah. Even your Waterloo ones?

Justin

Waterloo ones I still I still take on myself. But at Hamilton yet, there’s an I’ve got a fantastic property manager and Hamilton who deals with that now. But what happened was in 2017, I had another previous property manager. So this particular property, like there’s so much stuff going on, like where what happened was, I think the tenant in the first ground floor unit, stopped paying rent, we had to evict them, they ended up and I and that took a while to do that. While we were trying to do that the and so this is a tenant actually where they had like, so we found that after the fact once they were eventually evicted, they had like 15 cats in the place. So we you know, whatever, department manager to call him like SPCA, there’s so much like crap and junk left at the property. It’s funny, I was looking back at some pictures that were sent to me from my property manager. And it was like, this place is like it was their hoarders. hoarder. They had a tonne of cats, right. Was this inherited tenants or? No, these are tenants that were put in? Oh, crap. So I would say, you know that.

Erwin

Sorry, how long were they there for?

Justin

How long were the tenancy for in terms of before we got them out?

Erwin

Yeah. Or even before they started causing problems.

Justin

I mean, it’s been a while but like they were there for? It’s been too long, but it probably like a number of months before they start causing problems.

Erwin

Okay, so you can didn’t have much notice that they were hoarders and cat people.

Justin

And then what happened was, once we got them out, there was so apparently, there were these unauthorised occupants that were also living in the place at the time with so they were not with them. They were not on the lease. And so again, it was a process of trying to get those people out even though they were not on board. He’s, no one is paying rent, obviously. Then when we eventually got those people out, there were some squatters that broke into the place, and damaged windows and damaged things. And they started living there for a while as well. The same people are, this is a new group, I can’t remember it was the same people like the same unauthorised people or if it was just I think people who just broke in a garden. So that was all going on in the ground floor.

Erwin

This is the east side of the lower city.

Justin

The second, there’s a period of time where I think what happened was the unit became vacant. I don’t know if it was issues with the ground floor because people were not getting along, or they decide to move out. I can’t remember, but…

Erwin

They were dog people not cat people.

Justin

Maybe. And so that was vacant, and there was a bedbug issue. So there was a bedbug issue that was trying to, you know, that we’re trying to get resolved. So while the you know, this is all going on the ground floor, the second floor was vacant as well. And there was only one other tenant living on the attic, I guess, the third floor. So that was all going on, we eventually did get rid of the you know, the people on the ground floor. And then there had to be some work done to renovate the place to get it up into like, cleared all the junk, renovate the kitchen, kitchen, in the bathroom, as well. And what happened was through the towards the end of that year, I got sued at the same property because what happened was there was some sort of incident where I guess someone fell off like this, the staircase, the exterior staircase, and they got injured. But what happened was I got served this, whatever Statement of Claim, but it was for an incident that happened like two years prior to that. And so they sued me. And so like all this was happening around the same time. And so what happened was I eventually ended up terminating the property manager and took over the property, basically, during the Christmas holidays in 2017. Get over yourself, I took it over myself home, because I wanted to really deal with it myself and just see I mean, so I’m not I’m not a person that is scared away from kind of this stuff. Like, I just see this as it’s an opportunity to grow. And so I was I took it over with the whole intent to just try to stabilise the property myself, before transitioning it to another property manager who like my current current property manager, who takes great care of it now.

Erwin

So who’s your current pm? Just the first name because we don’t share.

Justin

The current one is the same one. I think it’s a former police officer.

Erwin

Yeah, let’s stop there. Because we don’t want anything to get out. We save it for ourselves and for our clients. Right, we need to prioritise. Yeah.

Justin

So yeah, so to stabilise the property, wash, you know, so what happened was I ended up finding a tenant to rent out the second floor, they were actually an issue. So I even though I screwed up, did everything like that, but they ended up moving out, I think within six months after the fact because they eventually stopped paying, but my current property manager dealt with all that. Anyways, so that was I would say like, stuff like this happens when you buy rental properties and and things can go wrong. It’s not all unicorns and rainbows like people think, oh, yeah, like, you see, like great appreciation or great cash flow? Well, that’s the good part of it, there can be the bad parts of it. And so there was a period of time where I thought about selling. I’m glad I didn’t, because I look at the value of the property today. And the fact that, you know, has great tenants in place today. And it’s very stable property. But it made me realise like, I think until you go through it, there’s that inclination people get the urge to like when things start to go wrong. Like your first instinct could be to Oh, my God, like, I want to exit get rid of this, right? Because you kind of want to get rid of the pain. It’s painful, like you’re not bringing it in come the property, you’re still carrying it with a mortgage, you’re still having to deal with issues in terms of like, whatever can pop up. And yeah, so but ultimately ended up staying the course and resisted my urge to sell. And yeah, thankfully I did.

Erwin

I remember you telling me you’re getting sued and stuff. We talked about this, right? And I’m imagining I made the introduction to yes to the property manager. Yeah. Yep. Got it. So as soon as the game ahead, should we sell the property? Should it be listed? Or should we be listing it it would be all sunshine and rainbows? Because at the ask, what is it rented for now? What is your rent paid to 43 you rent out for 35,000 And then so what are the current rents?

Justin

Yeah, current rents today our current say are three $300.

Erwin

How old is that rent?

Justin

That is Yeah, so what’s which pay for Good lord? Yeah, so I would say the know the person on the third floor. So they are way under market moving original. They’re the original

Erwin

Your inherited them? Oh, who’ve been there forever.

Justin

Yeah. They’re just what they gave notice to their move again. Oh, no way. And so I’m going to be spending some money to renovate the place.

Erwin

Like 35,000 to the original budget. I laugh because the inflation on renovations is just insane. Right? What was the attic paying?

Justin

What were they paying? So it was a bachelor suite they’re paying is like six or $700?

Erwin

Oh my god would charge for a bedroom. And then what do you think that market will be after that?

Justin

I think it’ll be about 1400. Or sorry, no, you don’t know. It’s a bit less than that. It’s a bachelor suites not very large. I think I’m expecting 12 1200.

Erwin

Double. Are you glad you didn’t sell? Yeah. Yeah. I don’t remember that. The conversation we had at a time. But usually my conversation is not not to sell. Right. Tenants are temporary. Even though it feels like it’s forever. The property is nearly forever. It’ll burn down at some point. Nothing lasts forever. But it’s sold break. It’s century home and last for a while. Yeah. Hello, lieutenants. It’ll likely outlive us.

Justin

Yeah, yeah, I think that’s the thing like and especially for me anyway, like, my mindset is always been more long term in terms of real estate investing. So I was able to see past those current troubles, but I’ll admit, like, there was times where I was just like, I just want to throw in the towel and just get rid of it. I just want to get rid of this problem.

Erwin

What do you think this house is worth? Now? Let’s legal nonconforming triplex.

Justin

I think it’s probably about 650s. That’s it. Although we did talk about this, like a few months ago, maybe a little bit more.

Erwin

Maybe a little more duplexes, sulphur, a million these days, legal duplexes. But this is the centre, it’s a fair amount of income. Yeah, but Yeah, but you’re in no hurry to sell. So you’re onto it for a while.

Justin

Yeah. And that’s the thing, like I think, you know, especially with the market where it’s going, yeah, there’s a bit of softening. But now, but it’s going to, in the long term, the long term fundamentals of the market are strong, right? There’s still tonnes of immigration into, you know, not only Canada, but into the GTA area. And people need a place to live in, they’re not building enough supply. They’re not, there’s not enough homes to support the amount of the people population growing in the immigration coming into the country. And so I just think like, that just bodes well for the long term fundamentals of the market in the GTA. And so yeah, expected to continue to grow with belly.

Erwin

And you’re not just like a regular Kool Aid drinker, like your work actually gives you access to a lot of data, does it not? In terms of like, what the community economy is like?

Justin

Yeah, like we? Yeah, I’d say we see a lot of, I would say data, I would say data in terms of rents, like we see strengthening of rents across the country, like, in different provinces. You know, there’s some pockets that were things are not as strong.

Erwin

Can you share that where that’s not strong?

Justin

Yeah. So I would say like parts of, you know, let’s say Edmonton downtown is not as strong but like, so I have property out in Alberta, myself, where in suburbs, like things are going really well, like, we’ve been able to

Erwin

Sorry summarise with which city? Oh, sorry. Sorry, sorry. I cut you off. Sorry.

Justin

Yeah, it debited. So what we’re seeing is that, I mean, I would say in the Alberta economy can go up and down. I mean, it’s, it’s still tied to resources, oil and gas. And what we’re seeing is that in, let’s say, in Calgary, things are very strong there. And we know that there’s typically a lag 12 to 18 month lag between what we see in Calgary to what we see in Edmonton, but at the same time, we’re seeing, you know, some growth in Edmonton suburbs, in terms of rents, like on some my properties, while on properties, where we’ve been able to on renewals, increase the rents by, you know, between 50 and 75 bucks. And we haven’t seen that years, like it’s been relatively flat. So it’s a nice thing to see. And the good thing about, let’s say, Alberta, in general, is that, in contrast, Ontario, Alberta doesn’t have rent control. So you can rent, raise the rents, you know, to anything you want, basically, once every 12 months. Whereas the material you’re capped at your read guideline, increase, The urge is puny,

Erwin

Just need the government to maintain because before we’re recording, we’re talking about New Brunswick, for example, where their government implemented rent control for the first time for 12 months, and then my money is they’re gonna extend it. That’s, that’s what that’s how I bet.

Justin

Well, I think, I think in general, like a lot of, I mean, a lot of governments are succumbing. But like, there’s a lot of pressure, I think, you know, you think about all the headlines these days in terms of real estate, like how housing is unaffordable, and a lot of people a lot of politicians think that the way to solve that is to on the demand side, not necessarily the supply side, they’re not really to me, in my mind, like addressing real issues on the supply side fast enough. You know, they make all these promises, but, you know, in reality, it’s not happening. And so you know, One easy way to appease to your voters is to say, oh, yeah, we’re gonna put in rent control, because we’re going to keep a cap on what we can, you know what landlords can raise their rents for. But in the end that ends up happening, like hurting your supply side, because then you’re not even, you know, let’s say even developers are not even as motivated, they still have to make their numbers work, they still have to make their performance work. And so by putting that in place, you are artificially suppressing the returns and therefore causing supply, like to decrease to decrease like you’re not adding to new supply. So it’s just shorts.

Erwin

Because at a minimum landlords want spend on maintenance, they’re gonna look to work, they can cut costs, if they can’t raise rents. So because the Yeah, inflation is not real, right?

Justin

Yeah. It’s only like six or 7%, right?

Erwin

Walmart, Walmart, in their earnings report, they reported that their food costs, Walmart’s looking, you know, even like, largest retailer in the world, I believe, at least in the States for sure. Like their food costs are up 10%. Right.

Justin

Yeah. And I wouldn’t be surprised to see, like, in terms of food inflation, like you’re gonna see that continue, because I think I mean, what’s happening with, let’s say, in Ukraine and Russia, that’s gonna create an issue with, you know, the fact that I think Ukraine is a huge exporter of let’s say, wheat and other other commodities. So that’s going to work its way through the system. The thing gas prices like so gas prices are at I have an electric car. So I don’t even feel that pain. But it’s, you know, gas prices are through the roof. And that’s going to feed its way through the system in terms of, you know, it’s it costs more for trucks to transport goods across the country. So that’s going to work its way through this.

Erwin

Our very farming equipment. It’s an everything. And then in India, recently, they stopped exporting their own meat. So I will work its way through this system. Can you tell us more about the Edmonton properties? What year did you buy?

Justin

Yeah, so I started I bought basically, some of those I mentioned properties in 2012 and 2013. That’s when the bulk of it happened. Oh, you’re busy. Beaver. I told you. Yeah. 2012 is basically, you know, after my mom passed, it was just it unleashed the theory.

Erwin

What did you buy? What kind of properties were these?

Justin

You know, what I found? So my strategy in Edmonton was really, it was different than it wasn’t Hamilton, let’s say. So in Edmonton and surrounding areas. Basically, what I did was I went to pick up newer properties, not necessarily the ones that are older, like in Hamilton. Yeah, there’s century homes, there’s a lot more in terms of maintenance. So in Edmonton and Leduc, and other surrounding areas, what I did was I wanted, like, cookie cutter, like starter homes, so that were newer, that basically were built within the last, you know, five to 10 years. So very, not as much maintenance from that perspective. So at the time, yes, I would have bought a lot of them, basically, they were like 2017 to 2020 10, like year builds, or sorry, 2007 to 2010 year builds, then they would be the semi detached homes that I would pick up for less than 300,000. And that I would, right, I mean, this was before the oil crash, but I would rent for anywhere from, you know, 1600 to 1900. That was sort of the feel of how they were one. That’s that’s how I did it. I just said, Okay, I bought the first one. And I remember so the first one, I ended up flying out to visit Edmonton on civic, it was a civic holiday weekend. And so I ended up meeting up with a realtor who helped me in buying a lot of these places out there. But I met with a number of Realtors at the time, met with a number of property managers, so I could try to get comfortable with the market and the rents and you know, the areas to go the neighbourhoods that I want to be in. And, you know, I bought, I think I ended up putting up offer pretty much not too long after that visit, and then ended up just buying more from there. Because that was pretty much I wanted to replicate a system that I felt comfortable with. And so it was like, okay, semi detached, less than $300,000 rent for you know, 1600 to $1,900 it cash flow well. So the cash flow is probably anywhere from 100 to 300 hours after you know, your operating expenses and after your financing. And, again, yeah, I did this either on my own or with JV partners.

Erwin

And then fast forward today. What would be semies be worth and what’s the rent today?

Justin

So the thing is, I would say a lot of these semis haven’t even appreciated too much from the time that I bought them. Oh, so the good thing in Ontario is that we’ve seen like all this run up in prices, and the values just take off in Alberta or Edmonton. Let’s say I’d say you know, we went through when I bought 2012 2013 It was like pre oil crash.

Erwin

So you’re bought just before a previous crash though. I bought before a financial crisis you bought before starting the financial crisis.

Justin

But I would say like knowing the lead up to the oil when oil was like 100 dollars barrel like prices were had gone up. And then I bought, and then they kind of came down after the oil crash. And then I think they were working with its way back up. And then the pandemic hit. And then it’s, you know, it came back down. And then now so I would say like they’re not, you know, what I would estimate these places to be? They’re not even more they’re marginally up from what I bought them for. So maybe they’re high, two hundreds to low three, hundreds, nothing.

Erwin

So almost even, it’s almost enough. So after with all this inflation.

Justin

Yeah, which so that’s, I would say in terms of, I wish things took off there the way it did hear. So that’s the one thing I would say in Alberta. It hasn’t been like from, you know, the reality is like, appreciation has not been the way it has in Ontario. And so even though cash was good mortgage pay downs, good. Depreciation hasn’t been there. But that’s fine. Again, because I’m not looking to sell these, or I’m looking to hold these long term. And even if it doesn’t, even if it doesn’t appreciate, it’s fine. At the end of the day.

Erwin

Do you know if builders are selling for around the same price now?

Justin

I don’t that I don’t know. I don’t know. I would I would think you know, it’d be one of those. It’s funny because like, I find inadvertent like when a ver like just these new like subdivision just pop up like anything like they’re like mushrooms, they’re just all around the Ring Road area. And it’s always because it almost doesn’t seem as though like in the GTA here, we’re kind of land constrained in that we’ve got the greenbelt and protected areas. In evident. It’s just, it just proliferates like it just there’s more housing that just grows and grows. And there’s nothing to really constrain it interesting, which is maybe one of the reasons why.

Erwin

They had to still do infrastructure, infrastructure restraints. Yeah, they do. But it’s just roads, hospitals, schools. sewer.

Justin

But we just haven’t seen I don’t think that like you look at it just doesn’t have doesn’t seem to have the same land constraints that maybe would support or higher growth,

Erwin

But just kind of magic product magic here in the GTA, or Golden Horseshoe. Yeah, we’re also the lake on the west side we can’t build on Right. Right. Those are fascinating stuff. Justin, thank you for being so open. Anything I’m leaving out that you want to that we want to cover? Oh, yes. To talk about the R word. We’ve had discussions around not needing to work anymore.

Justin

Well, I think you know what, for me, it’s always been one of those things where, like, yes, starting 10-15 years ago, my view has always been, I want to build a real estate portfolio that generates, you know, passive income. And we all know that real estate,

Erwin

Not completely, not necessarily passive, but it was a great story to show it’s not.

Justin

It’s not, but at the same time is generating cash flow, or an appreciation, appreciating in value. So that my whole thing was like I want to be able to at a point in time, be able to be financially free that I can make the decision of if I want to continue working or not. And so, you know, I can’t see myself like in terms of like attritional retirement, where it’s like, oh, you’re gonna sit around and do nothing all day, and, you know, the lounge on a beach or whatever. But I’ve always made sure that my long term mindset was okay, I want to get to a point where I can make that decision. And, and I have the freedom and choice to make that decision. And think that’s ultimately where I see. I mean, even the young people today, it’s funny, like, I’ve talked to a number of young people where recently, like, they’re looking to get their, their first investment properties, right. And I say to them, like, you just have to get started with one. And even though prices are like where they are today, compared to where they were, like, 1015 years ago, you can’t even look at that, that’s, it’s all relative, right? If you can make the numbers work today, you get it, and then you, you know, 10 years from now, you’re gonna look back, you’re gonna be like, Oh, I wish I bought more or that was cheap at the time. So it’s ultimately trying to put yourself in a position where you can have full control over your time, which is our most valuable resource. Like, it doesn’t matter. Like, you know, everyone’s hung up on like chasing dollars or money. Time is your most valuable resource. And you can’t get that back. So, you know, in terms of the R word, I think it’s really getting myself to position which I think I’m, I am in where I can choose to continue doing what I do. And as long as I love what I’m doing, I’m gonna keep doing it. And that’s ultimately what you should be doing, like people. I’ve always found, like, you meet people where they’re in their jobs or roles where they don’t enjoy what they’re doing, and they’re doing it. You know, if you’re working somewhere where you’re not enjoying what you’re doing, like why do something that you love to do, and find if you have to make sacrifices along the way where you’re not necessarily enjoying what you’re doing. Make sure you get like hard assets or income producing assets where you can generate, you know, that additional stream of income and build that up so that one day you can, you know, walk away from that job that you don’t like or whatever so, but as long as I continue to love, you know, to love what I’m doing, I’m gonna keep doing it and and ultimately that’s That’s my goal

Erwin

in your corporate job. How’s, Are you working from home more now?

Justin

It’s a hybrid model. Yeah. So I’m working from home three days a week and working in the office twice a week. And what was it before the pandemic? pre pre pandemic? is full time in the office?

Erwin

Oh, yeah. So you actually have way more freedom than you had before?

Justin

Yeah, I would say in terms of light, and I love it. Like, I love the fact I think the hybrid model is the way things are gonna go for a lot of different industries. I mean, it’s not gonna work for everything, but the flexibility, I think, it’s funny pre pandemic, you know, the expectation was, like, you know, it has to be in the offence, like, that’s where it’s all done, the pandemic forced people to pivot immediately. And, or for a moment, it still works, like, and so I think, you know, more and more businesses are going to continue using this hybrid model want to, you know, retain their people and, or to, to attract their people, because I think a lot of people are going to be expecting, you know, these hybrid type of arrangements. And I think it makes sense. Like, I love you know, there’s times of the office where yeah, there’s absolutely a need to have like face to face conversations and, and be the office I think, there’s definitely a place for that. But there’s also definitely a place to, you know, it’s okay to work from home, you can still get you know, all you need to get done at home. And this thing is you can I love the fact that you know, I’m home for there’s no commute that I can be home for dinner with my kids and, and family. It’s nice. It’s nice.

Erwin

Yeah, you can almost argue work is life is better than ever. There is a virus out there that’s trying to kill us all. But I’m joking, and it’s not trying to kill us off kills doesn’t feel that many people these days. But yeah, even your triplex you were probably talking about eight times return on your money, maybe worth all the trouble. Now after I got past it, yeah. At the time. Justin, thanks so much for doing this. Any final words? where can folks on the podcast?

Justin

Yeah, so I would encourage parents who are listening who are looking for a resource to raise money, smart kids, they can go to money, dad, podcast.com. And they can find me there. Basically, the podcast is really meant to help you have those conversations with your kids, I bring on different guests every week, whether they’re educators, authors, small business owners, people that are that are out there really trying to have conversations about money with their kids. So whether that’s normalising conversations, I think a lot of people are not necessarily having enough conversations with their kids about it, whether or not it’s because money is still a taboo subject in the home, or they don’t feel comfortable talking about money with their kids. It’s one of those things where, you know, the sooner that you have those conversations, the better. So I think first level is really having or developing that financial literacy amongst kids. And the best time to start is when they’re young, right? Like, there’s a tonne of adults and people that are just getting to it once they graduate, or once they’re starting to work or whatever. And to be I mean, I think that’s good. But I think the better option is to start them when they’re young, when they have time on their hands when they you know, learn the power of compound interest and what you can do in terms of records of time and time to mark its time in the market. Right. And so I think the other thing is, like, even just from a compounding perspective, if you teach kids early about whether that’s, let’s say investing, they that changes also their outlook on consumption, like if they think about, okay, I can invest my money and earn a return on my money, then the, you know, maybe consumption or having the toys and all this stuff is not that dissimilar that important to that, right. So I think building habits at an early ages is super important. And you know, that’s one thing that I’m trying to do with my kids. And one thing that I’m just trying to help other parents do for their kids as well. So So yeah, so people can look me up on money, dad, podcast.com. And, you know, encourage everyone to subscribe to the podcast, spread the word talk, you know, if you like you enjoy the episodes, talk to your friends and share with them and just get the word out. I think, you know, people, kids will be in a better place and set up for a better financial future by having those conversations and learning about money.

Erwin

Amazing. Probably stop it there. Thank you, Justin. Thanks for coming on the show. For coming out.

Justin

Thanks for having me. And yeah, it’s fun.

Erwin

Before you go if you’re interested in learning more about an alternative means of cash flowing like hundreds of other real estate investors have already, then sign up for my newsletter and you’ll learn of the next free demonstration webinar I’ll be delivering on the subject of stock hacking. It’s much improved demonstration over the one that I gave to my cousin chubby at Thanksgiving dinner in 2019. He now averages 1% cash flow per week, and he’s a musician by trade. As a real estate investor myself, I got into real estate for the cash flow, but with the rising costs to operate a rental business, it’s just not the same as it was five to 10 years ago when I started there were forget the cash flow reduces your risk. The more you have, the more lumps you can absorb. And if you have none are limited cash flow you’re going to be paying out your pocket like I did on a recent basement flood at my student rental in St. Catharines. Ontario. If you’re interested in learning more about secure for free for my newsletter at www dot truth about real estate investing.ca Enter your name and email address on the right side. We’ll include in the newsletter when we announce our next free stock hacker demonstration. Find out for yourself but so many real estate investors are doing to diversify and increase our cash flow. And if you can’t tell I love teaching and sharing this stuff.

To Follow Justin:

Podcast: https://moneydadpodcast.com/

HELP US OUT!

UPCOMING EVENTS

BEFORE YOU GO…

If you’re interested in being a successful real estate investor like those who have been featured on this podcast and our hundreds of successful clients please let us know.

It is our honour to give back and educate others on how we build cash flowing real estate portfolios using all the best practices shared on this podcast, from the lessons of our hundreds of clients and of course our own experience in owning investment real estate.

If you didn’t know already, we pride ourselves on being the best of the best real estate coaches, having the best property managers, contractors, handy people, cleaners, lawyers, accountants, everyone you need on your power team and we’re happy to share them with our clients to ensure your success.

New investor or seasoned veteran investor, we can help anyone by providing our award winning coaching services and this isn’t all talk.

We have been awarded Realtor of the Year to Investors in 2015 by the Real Estate Investment Network, 2016 by the Canadian Real Estate Wealth Magazine and again in 2017 because no one told the judges no one is supposed to win the award twice but on merit, our peers deemed us as the best. In 2018, we again won the same award by the Real Estate Investment Network.

Hopefully being the most decorated team of Realtors in Ontario will make you consider us for your first or next real estate investment. Even if you don’t invest in our areas, there’s a good chance I know who would be ideal for you.

I’ve been around for a while, some Realtors are talented at servicing investors there are many with great ethics. The intersection of the two, talent and ethics is limited to a handful in each city or town.

Only work with the best is what my father always taught me. If you’re interested, drop us an email at iwin@infinitywealth.ca.

I hope to meet you at one of our meetups soon.

Again that’s iwin@infinitywealth.ca

Sponsored by:

Infinity Wealth Investment Network – would you like to know how our investors returned 341.8% on positive cash flowing real estate over the last five years? On average, that was 68.4% per year.

Just imagine what winning in real estate could do for you.

If you would like to know how we did it, ask us how by calling 289-288-5019 or email us at iwin@infinitywealth.ca.

Don’t delay, the top markets we focus in are trending upward in price, so you can pay today’s price or tomorrow’s price.

Till next time, just do it because I believe in you.

Erwin

Hamilton, St. Catharines and Toronto Land Development, Real Estate Investor, and soon to be builder.

W: erwinszeto.com

FB: https://www.facebook.com/erwin.szeto

IG: https://www.instagram.com/erwinszeto/

Leave a Reply

Want to join the discussion?Feel free to contribute!